Independent thinker

Diamond Member

- Oct 15, 2015

- 22,670

- 18,629

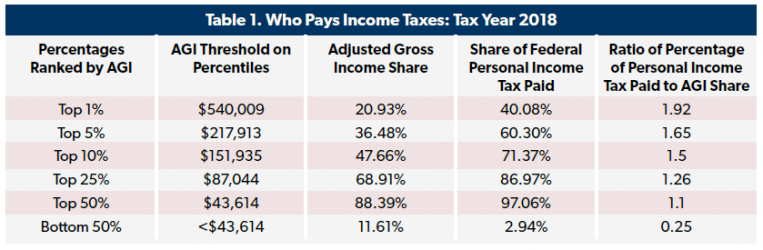

And yet you refuse to acknowledge that the Trump tax cuts benefitted the poorer more when you talk about difference in tax rates before and after the tax cut. You only want to talk about tax rate percentages when it benefits you and then with this article you say percentages don't matter. By the way, if you want to talk about zeros, then there were more poor who paid zero federal taxes under the Trump tax cuts than before.Percentages matter. 100% of nothing is still nothing. If the rich get 80% of the income but pay only 20% of the taxes, that means that those who receive less, are being taxed more.