Lesh

Diamond Member

- Dec 21, 2016

- 81,490

- 40,804

- 2,615

Freedman? The guy who admitted he got it all wrong in the crash of 2007-2008?Nope, absolute facts.

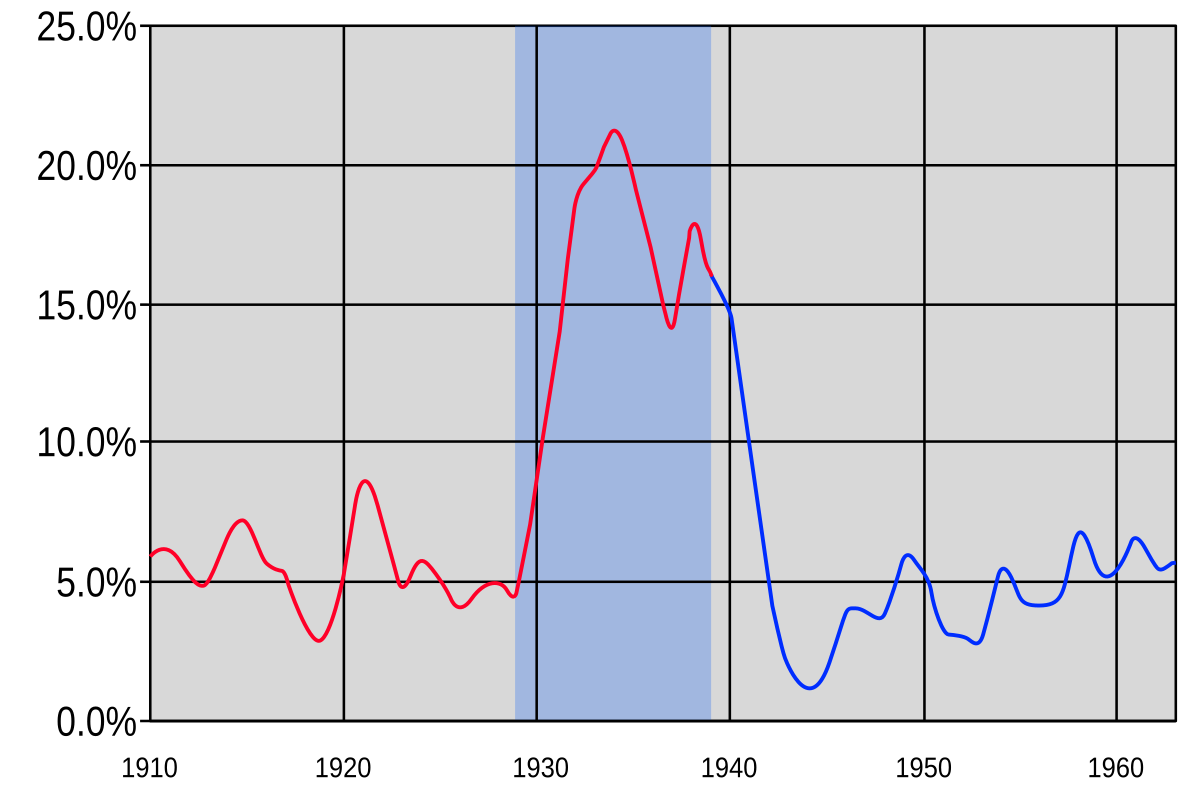

Only massive factory orders for defense goods c.1940 got the economy going.

The Fed was tight money policy throughout the 1930s.

Yes, many economists believe that the tight monetary policy pursued by the Federal Reserve in the 1930s, particularly after the 1929 stock market crash, exacerbated the Great Depression by allowing the money supply to shrink and failing to act as a lender of last resort.

Here's a more detailed explanation:

- Initial Tightening:

In the wake of the 1929 stock market crash, the Fed, instead of injecting liquidity into the system, allowed the money supply to decline, which led to a contraction of the economy.

downturn.

- Failure to Act as Lender of Last Resort:

The Fed's charter mandates it to be a lender of last resort, meaning it should provide liquidity to banks facing distress. However, during the Great Depression, the Fed failed to fulfill this role, leading to a collapse of the banking system and a further contraction of the money supply.

- Consequences of Tight Money:

The tight monetary policy led to a sharp drop in prices, output, and a rise in unemployment, further deepening the economic crisis.

- Milton Friedman and Anna J. Schwartz's Argument:

Economists Friedman and Schwartz argued that monetary factors were a major cause of the Great Depression, pointing to the Fed's policy mistakes as a key factor in the

FDR got us out of the Depression. His policies began a positive trend that continued until he listened to conservatives in 1937 which caused a Recession within a Depression.

The numbers were trending positive right up until then