1srelluc

Diamond Member

- Nov 21, 2021

- 45,546

- 64,963

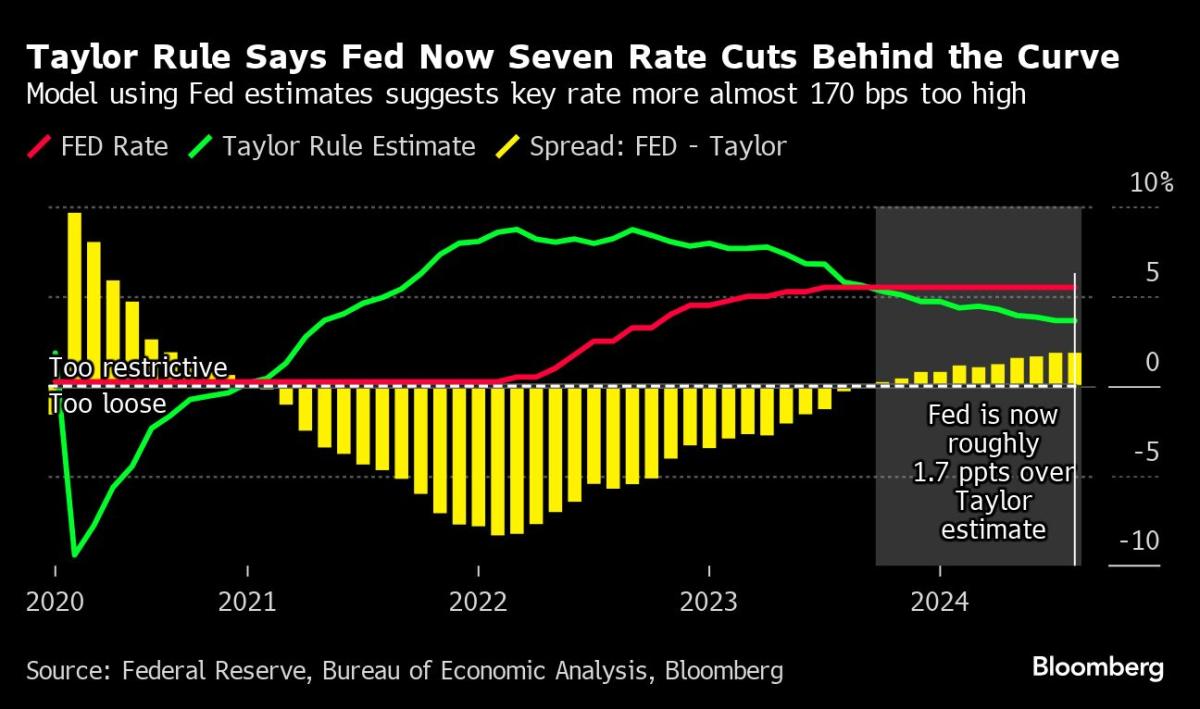

Treasuries Surge as Traders Bet on Emergency Fed Rate Cut

(Bloomberg) -- Bond traders are piling into bets that the US economy is on the verge of deteriorating so quickly that the Federal Reserve will need to start easing monetary policy aggressively — potentially before their next scheduled meeting — to head off a recession.Most Read from...

Bond traders are piling into bets that the US economy is on the verge of deteriorating so quickly that the Federal Reserve will need to start easing monetary policy aggressively potentially before their next scheduled meeting to head off a recession.

Previous worries about the risk of elevated inflation have virtually disappeared, swiftly giving way to speculation that growth will stall unless the central bank starts pulling interest rates down from a more than two-decade high. Traders now see a roughly 60% chance of an emergency quarter-point cut within one week.

That is fueling one of the biggest bond-market rallies since fears of a banking crisis flared in March 2023. The advance has been so strong that the policy sensitive two-year Treasury yield tumbled last week by half a percentage point to less than 3.9%. It hasn’t been that far below the Fed’s benchmark rate — now around 5.3% — since the global financial crisis or the aftermath of the dot-com crash.

Well you can certainly depend on the fed to always be lastest with the leastest.....Manipulate faster!!!

But, but, but I bought on the dip.

The decision making "algorithm" at the fed must look like this....The chicken always knows.