excalibur

Diamond Member

- Mar 19, 2015

- 21,206

- 41,022

- 2,290

Bad economic policies of Biden-Harris catching up. Reality is ringing a bell.

Stagflation seems baked in. But maybe worse.

www.zerohedge.com

www.zerohedge.com

Stagflation seems baked in. But maybe worse.

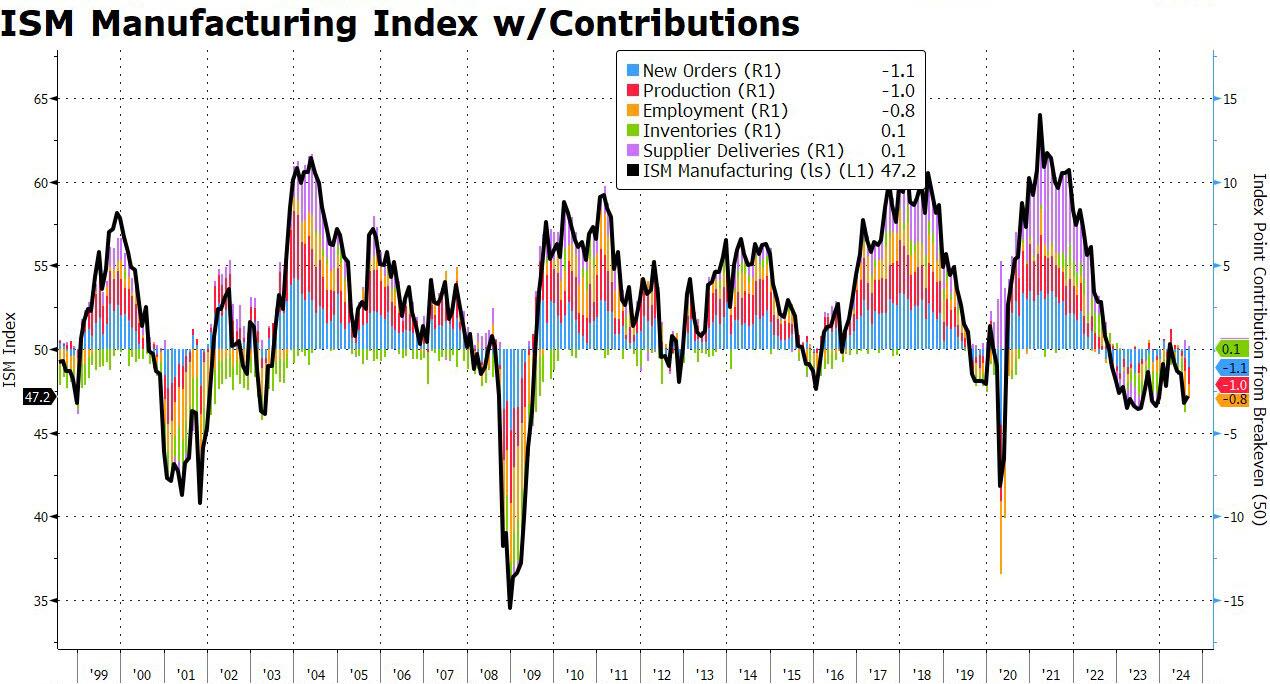

Ahead of Friday's payrolls report, there were rising expectations that the economic rebound observed in the past two weeks - and following the dismal July jobs report - would persists. Alas, those hopes were promptly crushed moments ago when shortly after a dismal US Manufacturing PMI report, which printed in its final iteration at 47.9, below the prelim print of 48.0 and below the 48.1 estimate, the more closely watched Manufacturing ISM report came in even uglier, printing at the 5th consecutive contractionary level of 47.2, which while a modest rebound from the 2024 low of 46.8 hit last month, missed estimates of a 47.5 print. And while the two surveys have frequently diverged in the past, there is clear agreement between the two since the early summer: the US manufacturing sector is imploding, and the economic contraction is accelerating.

The contraction was broad based, with the index posting declines in the all important New Orders, Production, and Employment.

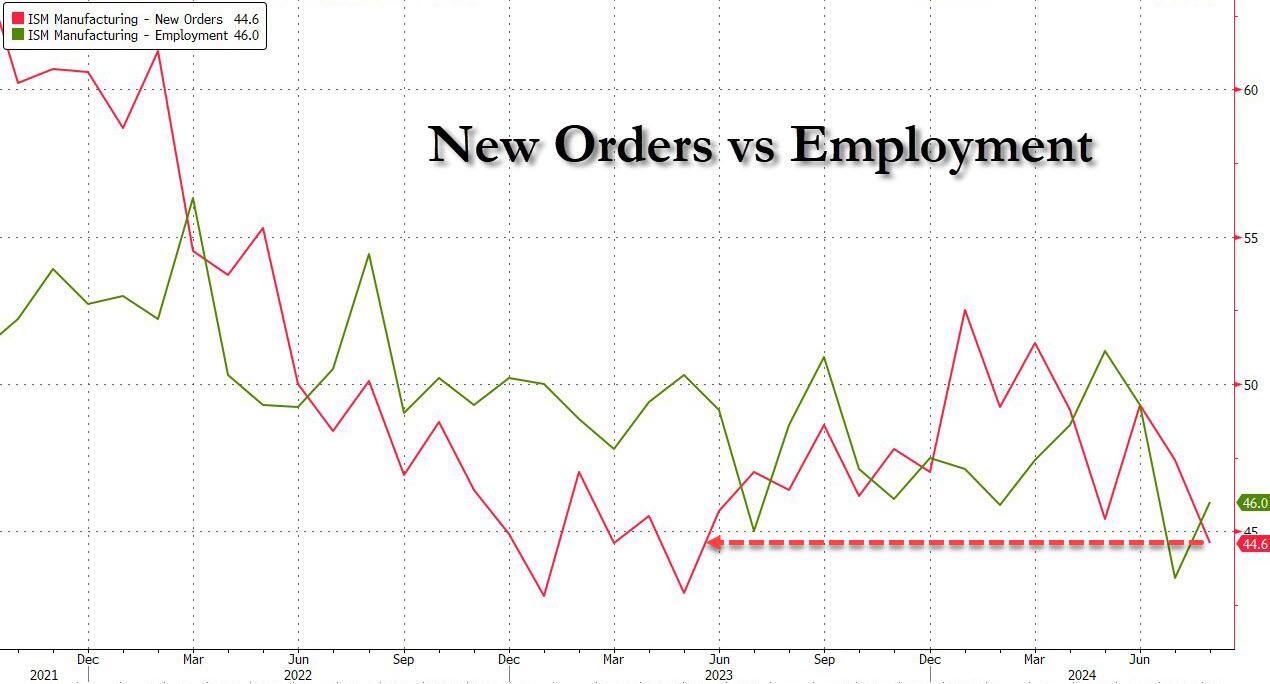

While the Employment subindex did post a modest rebound - while still stuck deep in contraction - which suggests that Friday's jobs report will come stronger than expected, the bad news is that new orders declined at their fastest rate since June 2023.

And while most output subindexes remain deep in contraction territory, one continues to rise: the one that should not be doing that: we are talking of course about prices paid which rose again, from 52.9 to 54.0, beating estimates of 54.0, and resuming its ascent since the start of 2023. In fact, compared to an 8-month lagging CPI print, one can be assured that we have seen the lowest CPI prints for this cycle.

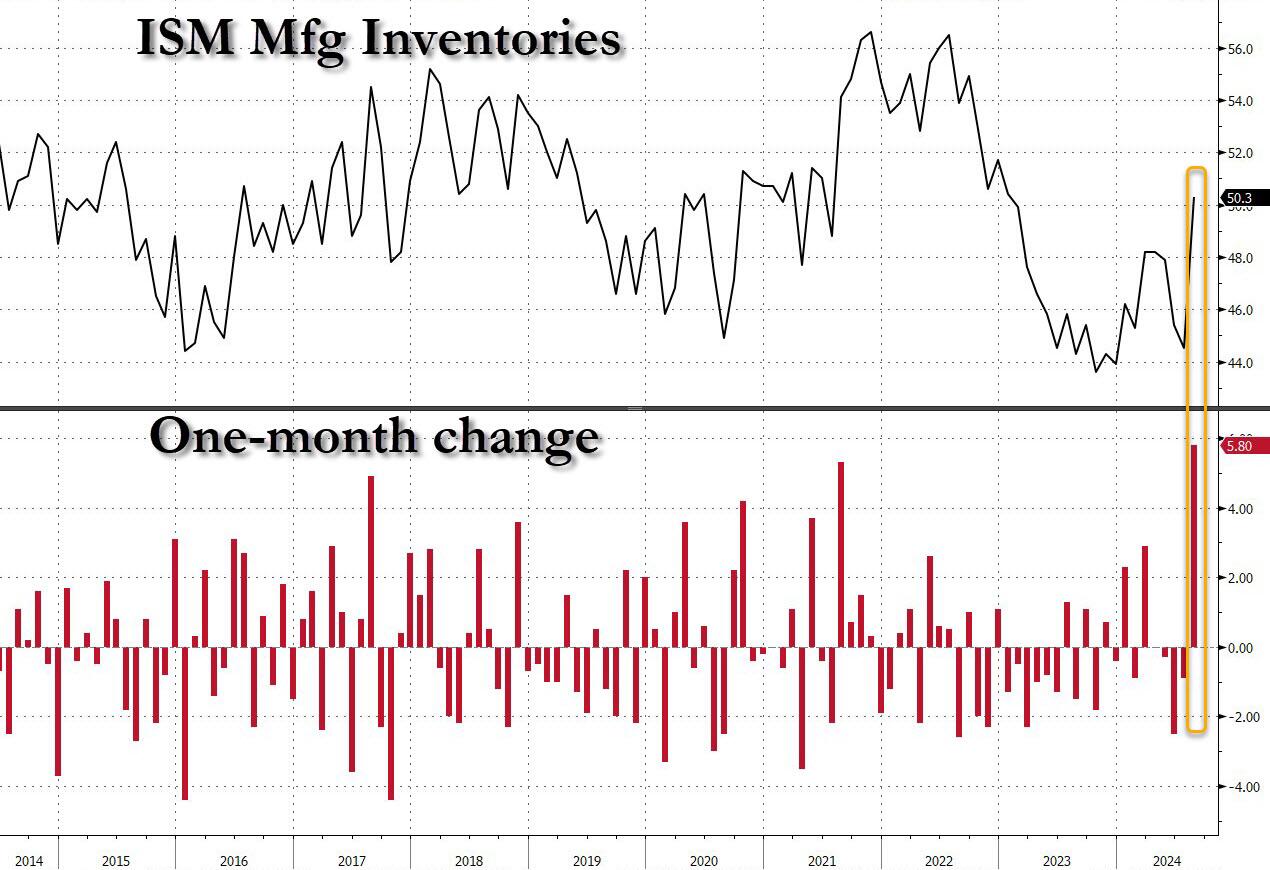

Adding insult to injury, the closely watched ISM New Orders/ Inventory ratio suddenly plunged back to recession levels...

... because inventories unexpectedly soared the most last month (back over 50 from 44.5) in the past decade as end-demand suddenly disappears...

...

US Manufacturing ISM Signals Accelerating Stagflation As PMI Turns Downright Apocalyptic | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero