joaquinmiller

Diamond Member

- Oct 12, 2013

- 6,807

- 7,208

- 2,055

It won't be the party that has claimed, incorrectly, that tax cuts pay for themselves.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

No, there aren't. You may tax the rich into Canada but that won't solve the problem.America will save Social Security and Medicare. There are many options available.

Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

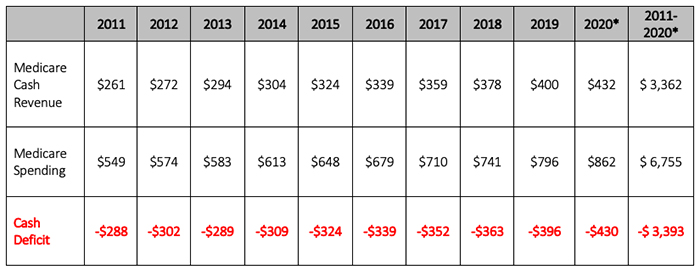

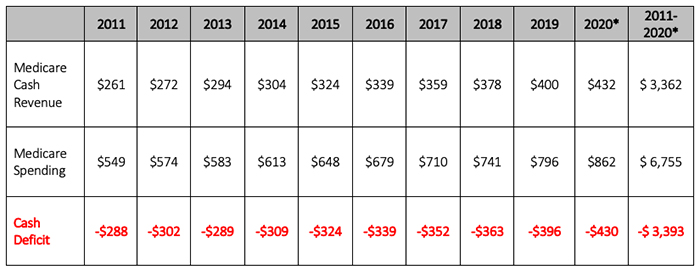

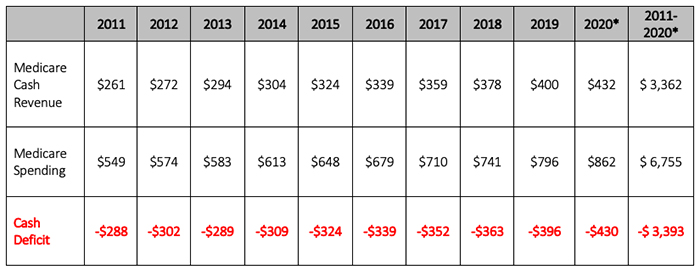

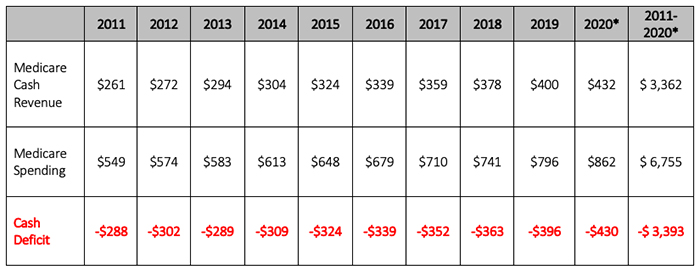

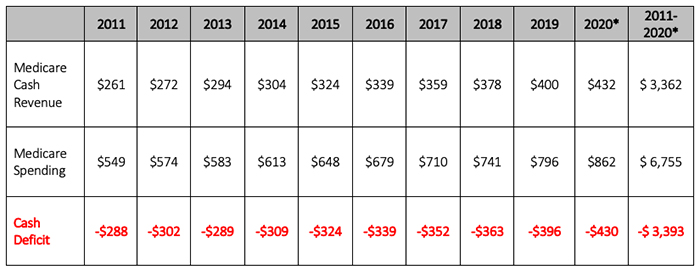

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

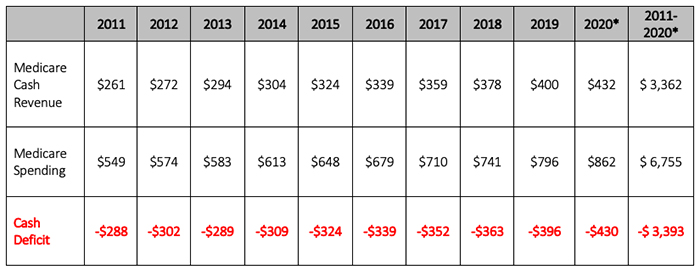

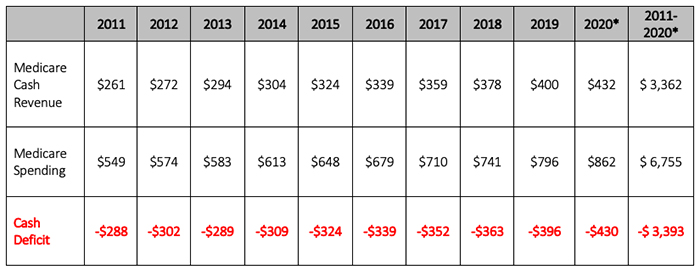

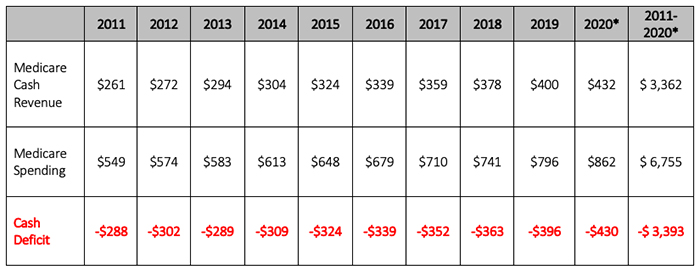

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

There are many "fixes" for SS and Medicare.No, there aren't. You may tax the rich into Canada but that won't solve the problem.America will save Social Security and Medicare. There are many options available.

Tunnel vision from boomers is hilarious

Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

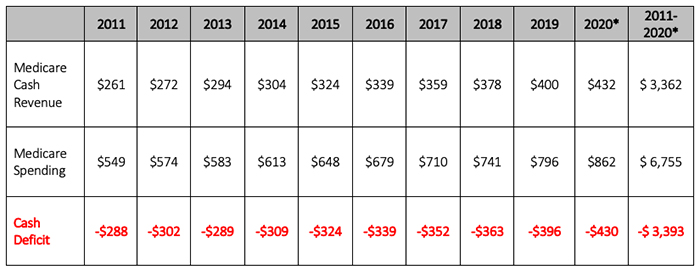

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

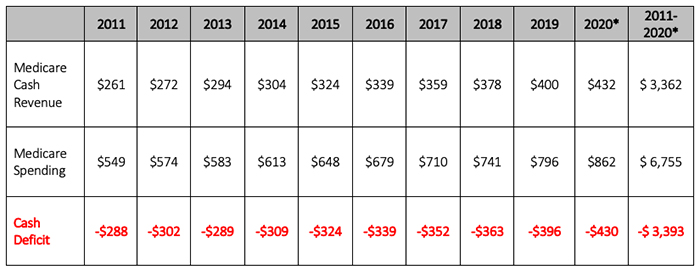

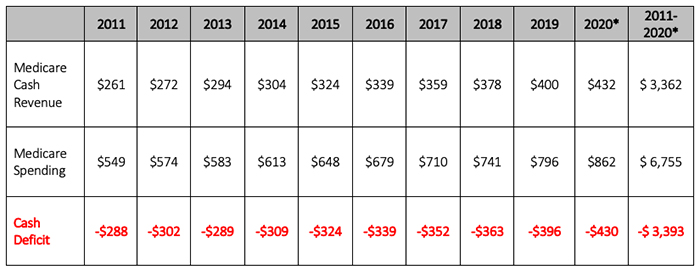

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

I agree with most of what you are saying. However I disagree with a VAT tax. A vat tax is a hidden tax that most won't realize is there. What we really need to do is wake people up to this deficit and debt of ours. A consumption tax on the other hand is that wakeup call. We have one where I live. It's listed on every receipt with your purchases. It's like Rush Limbaugh said so many times about payroll taxes. He said payroll taxes are deducted because you only look at your take home pay. If they didn't take any taxes out, and you had to write the IRS a check every quarter, you would see how upset people would get paying those very same taxes they pay now. A wakeup call.

My other problem is that nearly half of the people in our country pay no income tax period. So nearly one half is paying the bill for the other half. Then when the Democrats start yelping about free college, paid time off, reparations, Medicare for all, the people that don't have to pay for it are supportive of their ideas.

They go out in the street and ask people if they'd like cleaner air and cleaner water? Well duh! How do you think they're going to reply? Now if we had a consumption tax, and every time we did any major spending, that tax went up, you'd get quite a different result from that question.

Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

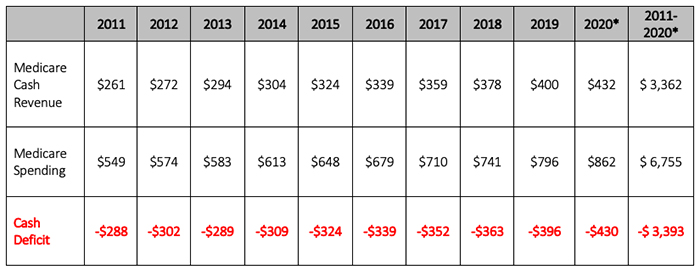

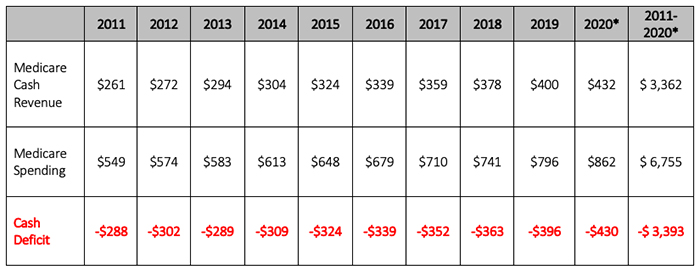

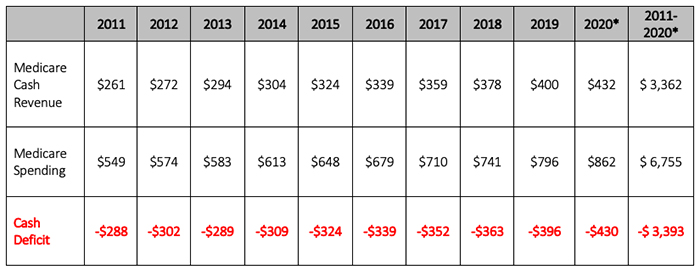

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

I agree with most of what you are saying. However I disagree with a VAT tax. A vat tax is a hidden tax that most won't realize is there. What we really need to do is wake people up to this deficit and debt of ours. A consumption tax on the other hand is that wakeup call. We have one where I live. It's listed on every receipt with your purchases. It's like Rush Limbaugh said so many times about payroll taxes. He said payroll taxes are deducted because you only look at your take home pay. If they didn't take any taxes out, and you had to write the IRS a check every quarter, you would see how upset people would get paying those very same taxes they pay now. A wakeup call.

My other problem is that nearly half of the people in our country pay no income tax period. So nearly one half is paying the bill for the other half. Then when the Democrats start yelping about free college, paid time off, reparations, Medicare for all, the people that don't have to pay for it are supportive of their ideas.

They go out in the street and ask people if they'd like cleaner air and cleaner water? Well duh! How do you think they're going to reply? Now if we had a consumption tax, and every time we did any major spending, that tax went up, you'd get quite a different result from that question.

Agree the VAT/Sales tax needs to show up on receipts. I'm not going to start the "income inequality" debate. I'm okay with a progressive tax rate, but I do agree that the "free" stuff is not going to happen.

You would have people not right out those checks every quarter.Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

I agree with most of what you are saying. However I disagree with a VAT tax. A vat tax is a hidden tax that most won't realize is there. What we really need to do is wake people up to this deficit and debt of ours. A consumption tax on the other hand is that wakeup call. We have one where I live. It's listed on every receipt with your purchases. It's like Rush Limbaugh said so many times about payroll taxes. He said payroll taxes are deducted because you only look at your take home pay. If they didn't take any taxes out, and you had to write the IRS a check every quarter, you would see how upset people would get paying those very same taxes they pay now. A wakeup call.

My other problem is that nearly half of the people in our country pay no income tax period. So nearly one half is paying the bill for the other half. Then when the Democrats start yelping about free college, paid time off, reparations, Medicare for all, the people that don't have to pay for it are supportive of their ideas.

They go out in the street and ask people if they'd like cleaner air and cleaner water? Well duh! How do you think they're going to reply? Now if we had a consumption tax, and every time we did any major spending, that tax went up, you'd get quite a different result from that question.

In other words, we are not the government.We are the government. But it doesn't work if there's a Federal Reserve gatekeeper as head of the Treasury Department.It would become a black hole for money the minute the government took it over.

View attachment 329471

View attachment 329473

A VAT is a hidden tax, which is precisely thugs such as you like it.That is literally the moral code of a thug:Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

Your proposed cuts added together are about $400b. So you're about $600b short of a Balanced Budget.

Someone needs to pay the fucking bills. Who should that be?

A VAT is paid by everyone, as an example.

All we need to do is restrain the growth of government, but every year washington gives out more benefits and increases spending faster than the rate of economic growth.Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

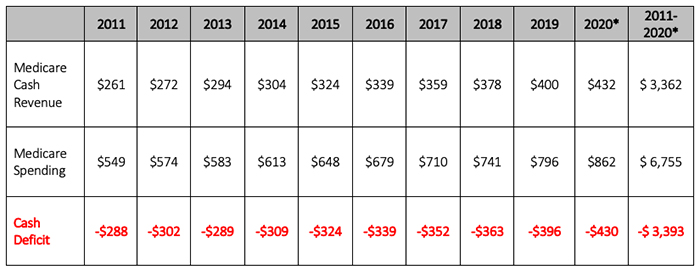

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

I agree with most of what you are saying. However I disagree with a VAT tax. A vat tax is a hidden tax that most won't realize is there. What we really need to do is wake people up to this deficit and debt of ours. A consumption tax on the other hand is that wakeup call. We have one where I live. It's listed on every receipt with your purchases. It's like Rush Limbaugh said so many times about payroll taxes. He said payroll taxes are deducted because you only look at your take home pay. If they didn't take any taxes out, and you had to write the IRS a check every quarter, you would see how upset people would get paying those very same taxes they pay now. A wakeup call.

My other problem is that nearly half of the people in our country pay no income tax period. So nearly one half is paying the bill for the other half. Then when the Democrats start yelping about free college, paid time off, reparations, Medicare for all, the people that don't have to pay for it are supportive of their ideas.

They go out in the street and ask people if they'd like cleaner air and cleaner water? Well duh! How do you think they're going to reply? Now if we had a consumption tax, and every time we did any major spending, that tax went up, you'd get quite a different result from that question.

Agree the VAT/Sales tax needs to show up on receipts. I'm not going to start the "income inequality" debate. I'm okay with a progressive tax rate, but I do agree that the "free" stuff is not going to happen.

But the free stuff is supported by those that don't have to pay for it. When you're talking about nearly half the country paying no income tax at all, then of course they support free stuff for them.

When you rob Peter to pay Paul, the Paul's of your society generally have no objection. So we institute a progressive consumption tax. By progressive, I mean if we want more things, then our consumption tax increases each time.

If we did that, then people would not be looking for ways to be taxed more, they would be looking at ways to decrease the deficit/ debt so they can start paying less. It would totally weaken the Democrat strategy, because every single presidential election, the Democrats run on more free stuff they can give the public.

A VAT is a hidden tax, which is precisely thugs such as you like it.That is literally the moral code of a thug:Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

Your proposed cuts added together are about $400b. So you're about $600b short of a Balanced Budget.

Someone needs to pay the fucking bills. Who should that be?

A VAT is paid by everyone, as an example.

All we need to do is restrain the growth of government, but every year washington gives out more benefits and increases spending faster than the rate of economic growth.Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

I agree with most of what you are saying. However I disagree with a VAT tax. A vat tax is a hidden tax that most won't realize is there. What we really need to do is wake people up to this deficit and debt of ours. A consumption tax on the other hand is that wakeup call. We have one where I live. It's listed on every receipt with your purchases. It's like Rush Limbaugh said so many times about payroll taxes. He said payroll taxes are deducted because you only look at your take home pay. If they didn't take any taxes out, and you had to write the IRS a check every quarter, you would see how upset people would get paying those very same taxes they pay now. A wakeup call.

My other problem is that nearly half of the people in our country pay no income tax period. So nearly one half is paying the bill for the other half. Then when the Democrats start yelping about free college, paid time off, reparations, Medicare for all, the people that don't have to pay for it are supportive of their ideas.

They go out in the street and ask people if they'd like cleaner air and cleaner water? Well duh! How do you think they're going to reply? Now if we had a consumption tax, and every time we did any major spending, that tax went up, you'd get quite a different result from that question.

Agree the VAT/Sales tax needs to show up on receipts. I'm not going to start the "income inequality" debate. I'm okay with a progressive tax rate, but I do agree that the "free" stuff is not going to happen.

But the free stuff is supported by those that don't have to pay for it. When you're talking about nearly half the country paying no income tax at all, then of course they support free stuff for them.

When you rob Peter to pay Paul, the Paul's of your society generally have no objection. So we institute a progressive consumption tax. By progressive, I mean if we want more things, then our consumption tax increases each time.

If we did that, then people would not be looking for ways to be taxed more, they would be looking at ways to decrease the deficit/ debt so they can start paying less. It would totally weaken the Democrat strategy, because every single presidential election, the Democrats run on more free stuff they can give the public.

You would have people not right out those checks every quarter.Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

I agree with most of what you are saying. However I disagree with a VAT tax. A vat tax is a hidden tax that most won't realize is there. What we really need to do is wake people up to this deficit and debt of ours. A consumption tax on the other hand is that wakeup call. We have one where I live. It's listed on every receipt with your purchases. It's like Rush Limbaugh said so many times about payroll taxes. He said payroll taxes are deducted because you only look at your take home pay. If they didn't take any taxes out, and you had to write the IRS a check every quarter, you would see how upset people would get paying those very same taxes they pay now. A wakeup call.

My other problem is that nearly half of the people in our country pay no income tax period. So nearly one half is paying the bill for the other half. Then when the Democrats start yelping about free college, paid time off, reparations, Medicare for all, the people that don't have to pay for it are supportive of their ideas.

They go out in the street and ask people if they'd like cleaner air and cleaner water? Well duh! How do you think they're going to reply? Now if we had a consumption tax, and every time we did any major spending, that tax went up, you'd get quite a different result from that question.

VAT can never be shown on a receipt. Under a VAT, a product is taxed at every stage of it's production and sale to the customer. How would you show this on a receipt? The final seller wouldn't even know the actual amount.A VAT is a hidden tax, which is precisely thugs such as you like it.That is literally the moral code of a thug:Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

Your proposed cuts added together are about $400b. So you're about $600b short of a Balanced Budget.

Someone needs to pay the fucking bills. Who should that be?

A VAT is paid by everyone, as an example.

I'm fine having the tax shown on the receipt. Call it a VAT, a sales tax, or a consumption tax. We need to raise revenue.

VAT can never be shown on a receipt. Under a VAT, a product is taxed at every stage of it's production and sale to the customer. How would you show this on a receipt? The final seller wouldn't even know the actual amount.A VAT is a hidden tax, which is precisely thugs such as you like it.That is literally the moral code of a thug:Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

Your proposed cuts added together are about $400b. So you're about $600b short of a Balanced Budget.

Someone needs to pay the fucking bills. Who should that be?

A VAT is paid by everyone, as an example.

I'm fine having the tax shown on the receipt. Call it a VAT, a sales tax, or a consumption tax. We need to raise revenue.

The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

You would have people not right out those checks every quarter.Poor examples of class envy. We need to pay the bills or disaster will happen, look at Greece and Venezuela.Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

I'm sure you have more than other people too. Does that mean government should have the right take it from you to give to somebody else? If you have eight beautiful hedges in front of your home, would it not be proper for government to take four of your hedges, and give them to the person down the street that has none? Or perhaps you have four video game systems in your household. Would it not be only fair for government to take two of those systems, and give them to somebody that has none?

The wealthy pay most of the bills already. How about we all pay, like with a federal consumption tax until this debt we incurred is paid off completely? Then everybody has a dog in the race.

Then look at China.

A VAT (value added tax) aka a Fed sales tax hits everyone at the same rate.

The top rate needs to go up.

Add a tax on financial transactions

Raise the gas tax (it hasn't been raised in ages)

We also need to implement "fixes" for SS & Medicare.

We are in deep shit with all of the new COVID borrowing. We need to start paying down the Debt, not just the interest.

I agree with most of what you are saying. However I disagree with a VAT tax. A vat tax is a hidden tax that most won't realize is there. What we really need to do is wake people up to this deficit and debt of ours. A consumption tax on the other hand is that wakeup call. We have one where I live. It's listed on every receipt with your purchases. It's like Rush Limbaugh said so many times about payroll taxes. He said payroll taxes are deducted because you only look at your take home pay. If they didn't take any taxes out, and you had to write the IRS a check every quarter, you would see how upset people would get paying those very same taxes they pay now. A wakeup call.

My other problem is that nearly half of the people in our country pay no income tax period. So nearly one half is paying the bill for the other half. Then when the Democrats start yelping about free college, paid time off, reparations, Medicare for all, the people that don't have to pay for it are supportive of their ideas.

They go out in the street and ask people if they'd like cleaner air and cleaner water? Well duh! How do you think they're going to reply? Now if we had a consumption tax, and every time we did any major spending, that tax went up, you'd get quite a different result from that question.

A VAT is a hidden tax, which is precisely thugs such as you like it.That is literally the moral code of a thug:Someone needs to pay the bills, might should be the folks with all the money.The wealthy have gotten themselves many tax cuts. They can buy politicians.So what you really meant to say is that Dims will raise all our taxes.WTF are you hallucinating about? Who writes the tax laws?Neither one, dumass. Political parties don't pay taxes.The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

Who wrote the last tax cuts that aren't working no matter what Manuchin says?

We already knew that, dumbass.

What they will do is raise taxes on the wealthy, and perhaps tobacco users; two groups that cannot protect themselves via vote.

Given the fact they pay most of the federal income tax for the rest of us, who would you suggest get a tax break?

View attachment 329424

Your proposed cuts added together are about $400b. So you're about $600b short of a Balanced Budget.

Someone needs to pay the fucking bills. Who should that be?

A VAT is paid by everyone, as an example.

I'm fine having the tax shown on the receipt. Call it a VAT, a sales tax, or a consumption tax. We need to raise revenue.