Grumblenuts

Gold Member

- Oct 16, 2017

- 14,682

- 4,900

- 210

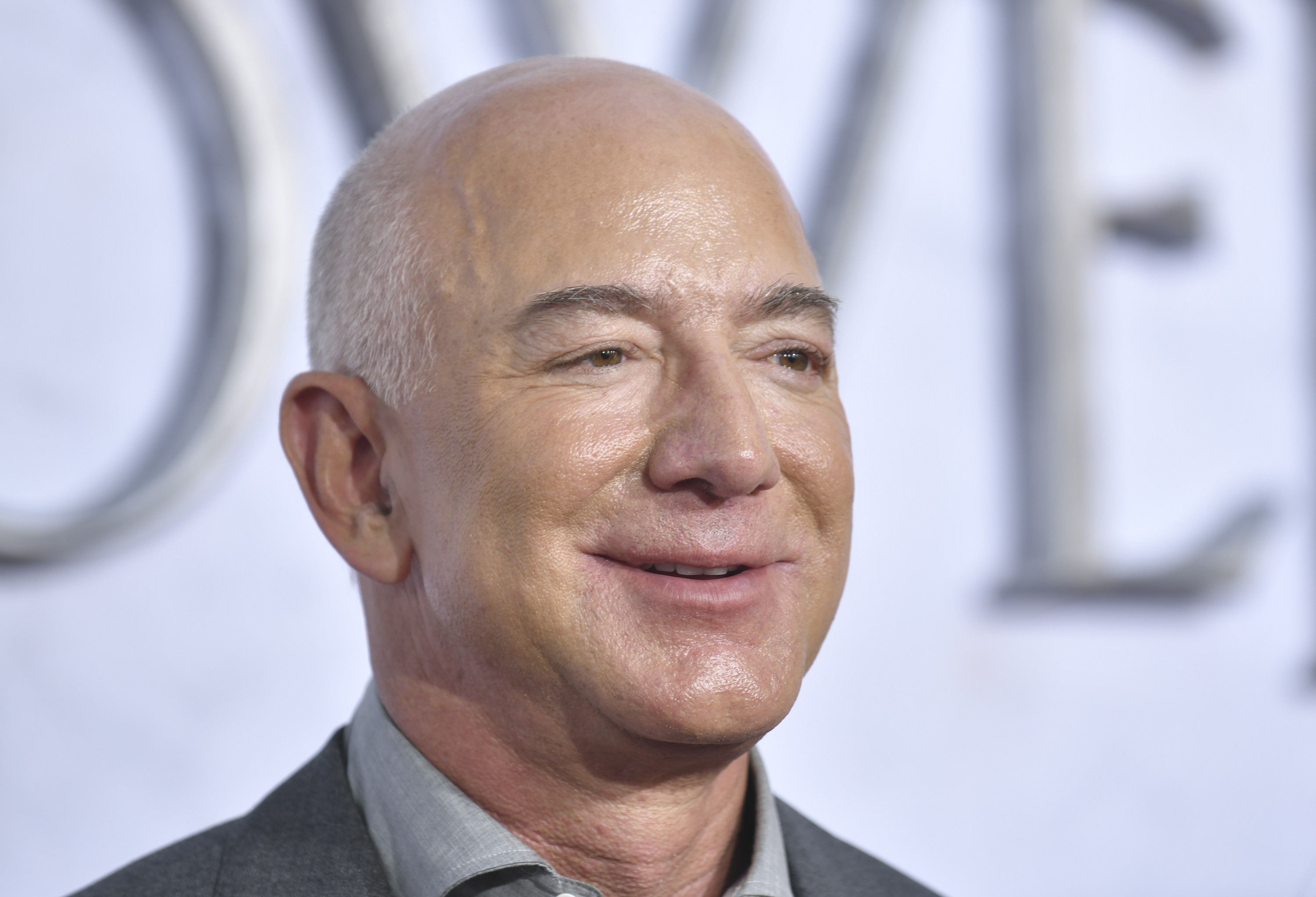

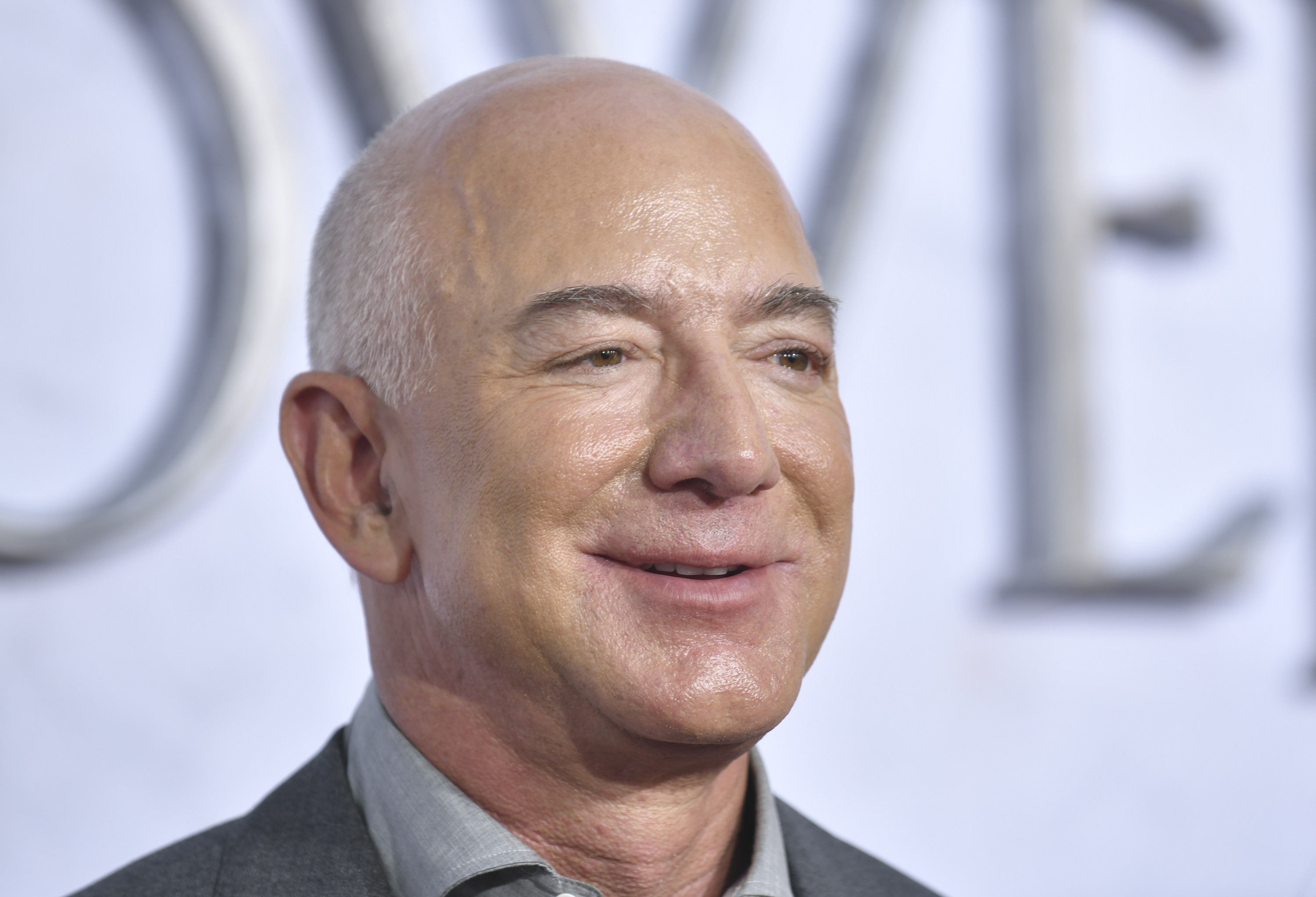

We've all seen it coming, but the day is suddenly arrived at long last. Our billionaire heroes like Jeff Bezos and Melinda Gates are no doubt giving themselves a huge pat on the back. Well, us working slobs can celebrate this day too. We've earned it. U.S.A.! U.S.A.!

www.newsweek.com

www.newsweek.com

Richest Americans now pay less tax than working class in historical first

America's top billionaires are now paying less tax than they have for decades.