- Thread starter

- #141

That’s because the Europeans were smart enough to learn from previous mistakes.I don't know if you noticed, or if you are suffering from amnesia of recent history, but the 2008 collapse was global.

What's more, if you look at the list of banks which failed in 2008, you will not see Lehman Brothers, Bear Stearns, Merrill Lynch, Morgan Stanley, or AIG on that list. Because they weren't banks, and yet they were the primary drivers of the economic collapse.

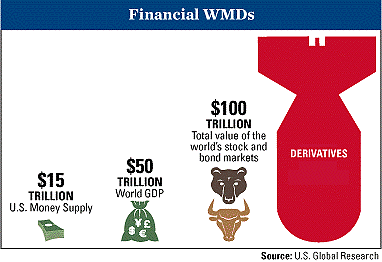

Complicating things even more where the endless trillions of derivatives on the books of these broker-dealers out there. No one knew what their counterparty risk was any more and so credit froze up, leading to a liquidity crisis.

And this was GLOBAL.

So we aren't even in the same ballpark as 2008.

They go through great lengths to ensure housing bubbles don’t happen. They require large downpayment for a home purchase.

But we continue to let a bunch of petulant children and radical leftwing extremists run our banking industry and the Fed.

But hey, I guess if only US banks fail, we’re okay. I’m sure the Europeans and CCP will bail us out.

:max_bytes(150000):strip_icc()/GettyImages-893177500-f66fe8abf4a74fd6af8b8322d949e0aa.jpg)