Flopper

Diamond Member

There would have to be a lot of changes for Americans to accept the idea that individual insurance would be better for them than employer provided insurance. One only has to look at the cost and benefits of individual insurance to see that most employee plans are much better. Employers pay on average about 25% of the premium. Many companies pay as much as 50%. Employee plans tend to be HMO's and PPO's which have much better benefits than individual plans.I agree that health insurance should be decoupled from employment. In my opinion, it is the only way to make a stand to lower cost across the board. The government is allowing businesses with under 50 employees to opt out of providing health coverage. There are approximately 30 million people that are employed with under 50 employee limit.

78% of them have coverage right now so it definitely would make an impact if all those employers stopped providing benefits all at the same time. If this could become a reality, the over 50 employee limit would definitely join forces with them.

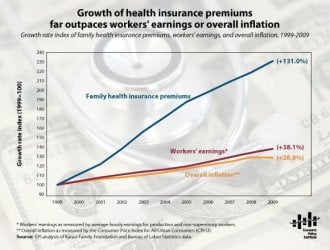

It is the only way the citizens of this country can demand real change in the healthcare industry and reduce cost that is aligned with our wages. If we don't do anything, eventually healthcare will be stripped down to bare bone coverage with higher premiums and higher out of pocket costs.

Most of the big top ten insurance companies have already begun expanding their market to Brazil and other areas that are not under a government system. They are also beginning to outsource their administration depts which further adds to unemployment rates. They do get tax deductions for overseas market so our government is supporting their efforts. Our premiums are paying for all of it.

The ACA has put requirements on them that they must spend 80% on healthcare expenses but there is no penalties or big fines if they don't. I don't see how it is possible for them to pay 80% when 76% of the workforce population has coverage through their employer group plans with high deductibles annually before the insurance company is obligated to pay on our healthcare expenses.

Insurance companies are worthless to us now that they switched the population from HMO plans where we only had to pay a co-pay to PPO plans that have higher premiums and higher out of pocket cost. The fee schedule allowables always manage to stay under our deductible so we are paying for all of our healthcare at a reduced rate.

There is too much fraud and abuse on all levels in the healthcare industry and we are footing the entire bill.

The currently available alternative to this employer-based system is horrifying. Individuals buying insurance don't have the same purchasing power as large businesses and end up paying much higher prices to cover administrative costs and risks. They also don't get the tax breaks that employers get for buying health insurance. In most states, insurance companies have the right to discriminate against individuals. It is no surprise that, when given the choice between the employer-based system and buying health insurance on their own, the vast majority of Americans reject the latter.

Current individual health insurance can best be describe as insurance for people who will never needed it or for those who have the financial resources to cover all but the most horrendous cost. With that said, if individual insurance could be offered at the same premium and benefits as employee plans, then I would be all for it because individual plans are portable between employers and there would be choices. Possibly the ACA exchanges will be a step in that direction.