Ray From Cleveland

Diamond Member

- Aug 16, 2015

- 97,215

- 37,438

Well we had the opportunity in 2000 to fund the revenue gap we boomers will cause, but we chose tax cuts instead. assuming we can get through this, our kids in the millennium generation will get their chance to do what we didn't have the stones for.I'm not sure many of us "love" working. Most of us want to stay active. But imo its not at all uncommon, since the great recession and it will get worse now, that workers over the age of 60 are cast aside. Employers find they are not "essential" or employers find cheaper workers.The point I tried to make is simply that imo most people taking benefits before full retirement age do so because they don't have a choice. They couldn't work and couldn't get disability, or disability didn't pay as much as they needed.

So while raising full retirement age might be necessary, I don't think we can really raise early retirement age

It all depends on how much you love working. I always hated working in my later years, and wanted to retire at 62. You only lose 25% of your max collection, and who knows if you'll even live that long to collect full benefits. You can still earn up to 17.5 K, so depending on your situation, it's better to take early retirement if you can get by on it.

But you make a good point. If the goal is to preserve soc sec, maybe we should raise the full retirement age, and require some showing of loss of full time employment to get early benefits.

Increase the retirement age, and a lot of people will be filing for disability. You really don't solve much that way. When we get older, most of us develop physical conditions that we could use to get out of working at that age.

Like I said, if we as a majority want to keep these programs, we simply have to pay for them. That's the real solution.

We simply can't. Again, Greece tried that. Didn't work. Venezuela tired that. Didn't work.

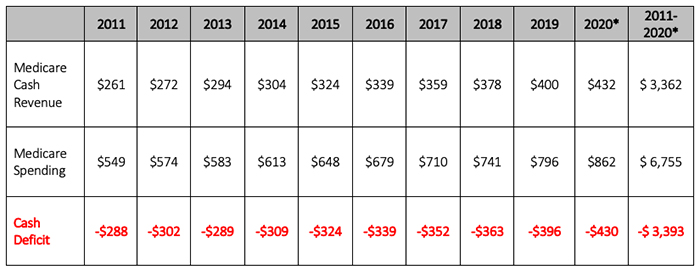

There is no possible way to just "pay for them". There simply isn't enough money for these programs.

Then people down the road area going to have to make a decision. Either fund the program, allow the program to collapse, or keep borrowing the money and the entire economy of the country collapses.

This can't last forever which is why it needs to totally change. SS sends out pamphlets now and then. They tell you how much you contributed to the system since you started working each year. Take that pamphlet to a reputable investment company, and ask them how much you'd be worth today if all the money you and your employer contributed all these years, were invested in a conservative growth account. You'd probably pass out.

Bush had a good idea that everybody rejected. He wanted to allow workers to be able to contribute a small percentage of their SS contribution to a private account. The reason the Democrats hated it is because once people seen their own money actually accrue interest, they would demand they allow a higher percentage. If that demand kept up, eventually SS would be a thing of the past in future generations, and problem solved.

All true, but I remember when Bill Clinton took the SS money into the Budget and called it a "unified budget".

Prior to that SS had a private separate account aka Al Gore's "lock box". SS was separate from the Budget.

Not true. SS was never a separate account. That's how Presidents for many years were able to borrow the money anytime they wanted.