Ray From Cleveland

Diamond Member

- Aug 16, 2015

- 97,215

- 37,438

- 2,290

I'm not sure many of us "love" working. Most of us want to stay active. But imo its not at all uncommon, since the great recession and it will get worse now, that workers over the age of 60 are cast aside. Employers find they are not "essential" or employers find cheaper workers.The point I tried to make is simply that imo most people taking benefits before full retirement age do so because they don't have a choice. They couldn't work and couldn't get disability, or disability didn't pay as much as they needed.

So while raising full retirement age might be necessary, I don't think we can really raise early retirement age

It all depends on how much you love working. I always hated working in my later years, and wanted to retire at 62. You only lose 25% of your max collection, and who knows if you'll even live that long to collect full benefits. You can still earn up to 17.5 K, so depending on your situation, it's better to take early retirement if you can get by on it.

But you make a good point. If the goal is to preserve soc sec, maybe we should raise the full retirement age, and require some showing of loss of full time employment to get early benefits.

Increase the retirement age, and a lot of people will be filing for disability. You really don't solve much that way. When we get older, most of us develop physical conditions that we could use to get out of working at that age.

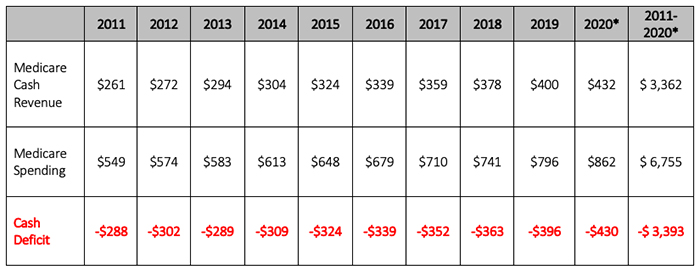

Like I said, if we as a majority want to keep these programs, we simply have to pay for them. That's the real solution.

We simply can't. Again, Greece tried that. Didn't work. Venezuela tired that. Didn't work.

There is no possible way to just "pay for them". There simply isn't enough money for these programs.

Then people down the road area going to have to make a decision. Either fund the program, allow the program to collapse, or keep borrowing the money and the entire economy of the country collapses.