bripat9643

Diamond Member

- Apr 1, 2011

- 170,162

- 47,306

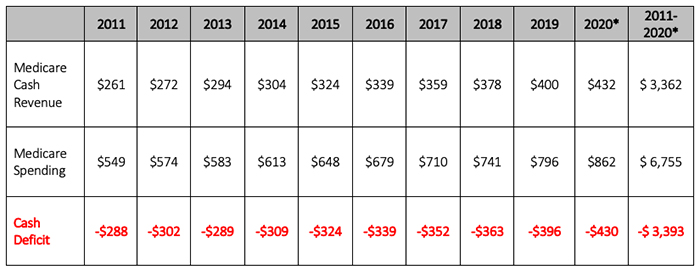

He hasn't mismanaged anything, shit for brains.Given that Trump, by way of his mismanagement of the government response to COVID, is responsible for the degree of the spread and severity of the economic impact, Repubs should pay a political price for electing and supporting a moron.Which party will raise taxes to save SS & Medicare for future generations?