depotoo

Diamond Member

- Sep 9, 2012

- 40,718

- 13,425

- 2,280

No hypocrisy. I will explain.

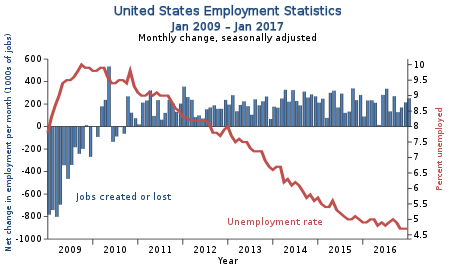

U-6 was 10.1 in July 2016. Today it is down to 8.6.

You're welcome.

U-6 was 10.1 in July 2016. Today it is down to 8.6.

You're welcome.

Wow, look at the loony Democrat butthurt whining on this thread. Good news for Americans, is clearly bad news for Democrats. They suck.

No . Just pointing out more GOP hypocrisy. These numbers where "lies" during the election. Unemployment was like 30% according to trump . Now they are true ?

Feel free to explain.