CommieKillingMommy

Gold Member

- May 26, 2022

- 337

- 352

That is a lie so big that its worthy of Hitler or Stalin. You can't possibly be that stupid to believe that crapBiden exploding MAGA heads by reducing the deficit

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

That is a lie so big that its worthy of Hitler or Stalin. You can't possibly be that stupid to believe that crapBiden exploding MAGA heads by reducing the deficit

Well hopefully you can say how good Biden is doing next year when his .gov agency's funding gets gutted like a fish when the house is under gop control......You know, EPA, DOJ, DOE, HHS, DHS, etc.

Can’t make it upIt has nothing to do with Biden, he got the vaccine from Trump REMEMBER.

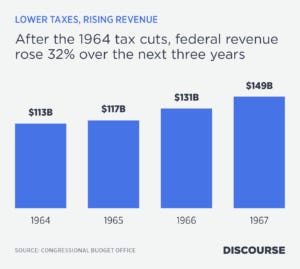

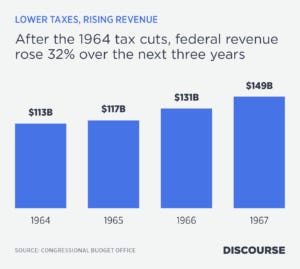

Exactly. More science avoided by democratsIn Actual Dollars, Tax Cuts Boost Revenue Time After Time

From the Kennedy legislation in 1964 to the Trump package in 2017, the naysayers are proven wrong again and again

One problem: Federal revenue didn’t fall after the big Trump administration tax cuts, much less by $2 trillion. Instead, total revenue rose.

In fact, after trimming the rates for five of the seven brackets and nearly doubling the standard deduction, the government collected nearly $100 billion more in personal income tax revenue for the year ended Sept. 30, 2018. That was the biggest jump in three years.

After President George W. Bush’s 2003 tax cuts, revenue rose for the next four years, with the deficit shrinking to as little as $161 billion in fiscal 2007. After the 1986 Reagan tax reform, which cut the top personal income tax rate from 50% to 28% and lowered the rates for other brackets, the deficit plummeted 32% the next year and stayed at that low level for another two years while revenue rose dramatically for three straight years.

In Actual Dollars, Tax Cuts Boost Revenue Time After Time

From the Kennedy legislation in 1964 to the Trump package in 2017, the naysayers are proven wrong again and againwww.discoursemagazine.com

Biden Wants to Raise Taxes, Yet Many Trump Tax Cuts Are Here to Stay

While Democrats have vowed to repeal the former president’s signature 2017 law, his successor is more likely to tinker with it, given constraints.

Biden Wants to Raise Taxes, Yet Many Trump Tax Cuts Are Here to Stay (Published 2021)

While Democrats have vowed to repeal the former president’s signature 2017 law, his successor is more likely to tinker with it, given constraints.www.nytimes.com

More con jobbingBiden’s first budget is on trend to be the lowest deficit in years continuing the fiscal responsibility of democratic administrations. Thanks Biden!

The federal budget deficit was $475 billion in the first five months of fiscal year 2022, CBO estimates. That amount is less than deficits recorded during the same period in the three prior fiscal years: It is less than half the shortfall recorded for the same months in fiscal year 2021 ($1,047 billion) and three-quarters of the deficit recorded in 2020 ($624 billion), just before the start of the coronavirus pandemic. It is slightly below 2019.

Monthly Budget Review: February 2022

The federal budget deficit was $475 billion in the first five months of fiscal year 2022, CBO estimates. That amount is less than deficits recorded during the same period in the two prior fiscal years.www.cbo.gov

Deficit Tracker | Bipartisan Policy Center

Even as the U.S. economy expands, the federal government continues to run large and growing budget deficits that will soon exceed $1 trillion per…bipartisanpolicy.org

View attachment 613426