Melvin01

Rookie

- Banned

- #1

My wife stopped in a little town near here yesterday and she said an old man came in and pumped a single gallon of gas into his old truck. That gallon of gas had about a half dollar of state and federal tax on it. There's one of the ways the poor get screwed. That half a dollar of tax on him was just about the same rate of taxation Mitt Romney paid on his $14 million of investment income in taxable year 2011.

You think that's something look at payroll taxes which the working poor have to pay.

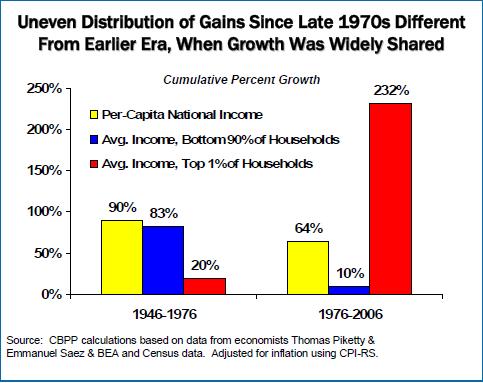

The Republican party has prostituted the progressive system of taxation this nation was built with:

You think that's something look at payroll taxes which the working poor have to pay.

The Republican party has prostituted the progressive system of taxation this nation was built with:

Last edited: