sparky

Diamond Member

- Oct 19, 2008

- 32,976

- 19,769

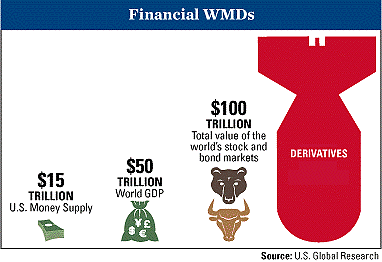

here's the bottom line, my friends: big bankers made a fortune by cheating people & stealing money

bank regulators knew about the swindle and could have shut it down, but did nothing.

30 million people became jobless. 10 million people became homeless.

thousands of suicides were linked to the financial crisis.

the 2008 crash cost the economy 22 trillion and more human pain than anyone could ever count.

Obama already did that. Trump rolled back the laws and regulations Obama signed into law because he’s undoing everything OBama did.

Indeed he is, as he was elected to do.

For his wall street bro's....at OUR expense.....

Paving Way for Next Taxpayer-Funded Wall Street Bailout, Trump Fed Unveils Plan to Gut Volcker Rule

Instead of draining the swamp, Trump has become Wall Street’s best buddy | Will Hutton

~S~