excalibur

Diamond Member

- Mar 19, 2015

- 20,313

- 39,237

OK.

www.breitbart.com

www.breitbart.com

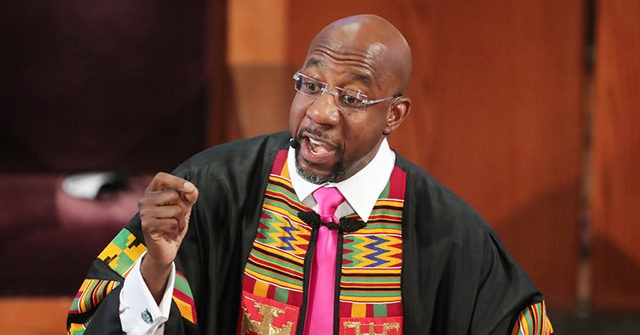

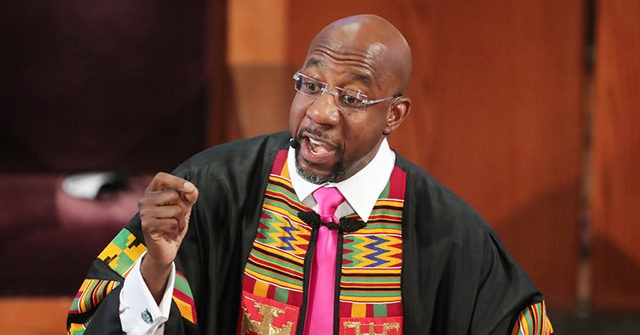

Report: Raphael Warnock’s Church Tried to Evict Tenants During Pandemic

Democrat Sen. Raphael Warnock’s (D-GA) church tried to evict tenants during the pandemic while he raked in a $120,000 salary.