Redfish

Diamond Member

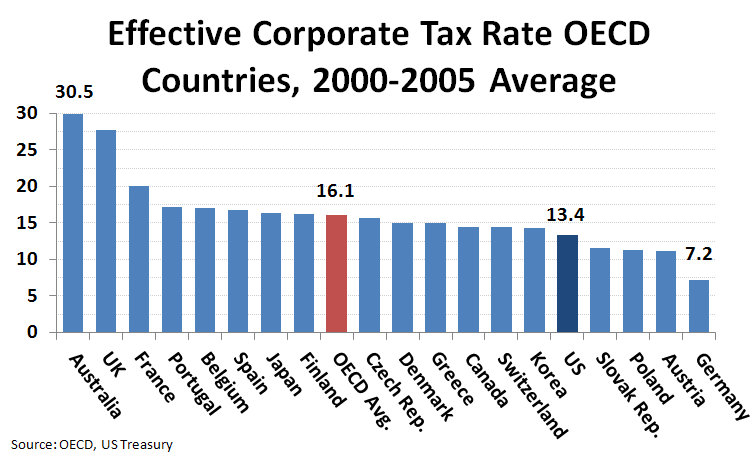

How do you calculate the effective rate for corporate taxes?

Same as for anybody else. It's a matter of rate minus deductions compared to income. Public disclosures usually have that information.

corporate income is not as simple as your personal income. is it gross or net? IBIT, IBITI ?

the point is that the chartmaker could get any answer he wanted by taking income in one of many ways.

Gross and net have exactly the same meaning no matter what your income level is, and is used in the same way.

Free? How do corporations get a free ride? Who is this corporation person that gets a free ride and how is their ride free?OK, why specifically, do you want corporations to pay more taxes? You do realize that taxes are a cost of doing business and as such are passed along to consumers in the prices of products.

So, you want to pay more for everything you buy because it will somehow make you feel that you are sticking it to some rich guy? Thats foolish.

So, now tell us exactly why you want corps to pay more taxes and how that would benefit average americans.

Because corporations have been getting a free ride for too long. If they would pay their fair share, the burden wouldn't be so high on everybody else as a percentage of total ability to pay.

20 big profitable U.S. companies paid no taxes America s Markets

thats a list of corporations, not a list of deductions and exemptions. I asked you for a list of the corporate tax breaks that you would cancel. do you have one or are you just spouting liberal jibberish?

This is the post that is in response to.

Has the Left Terminally Brainwashed Americans Page 23 US Message Board - Political Discussion Forum

If you want a list of their individual deductions, you'll have to look that up yourself.

earlier you said that corporations get a free ride on taxes and that they don't pay their "fair share" and that those deductions should be eliminated.

I want to know what parts of the corporate tax code you think give corps a free ride and which deductions you feel are unfair.

Yes, corporations do pay taxes. But the money they use to pay them comes from consumers who buy their products------------TAXES ARE INCLUDED IN THE PRICE OF THE PRODUCTS WE ALL BUY. make the corporate tax rate zero and prices would go down, money would be spent on expansion and hiring more people. If you really want to see a boom, allow foreign profits to be spent in this country tax free.

Currently a corporation selling in Germany pays german taxes and then US taxes if it brings its german profits back to the US. We are screwing ourselves and you libs keep saying "harder, more, deeper"