Huh? Anybody else? How is it the same as anybody else? Be specific.How do you calculate the effective rate for corporate taxes?

the US corporate tax rate is 35%, the highest in the world. I thought you libs did not like corporate income deductions and exemptions.

But my point remains valid. Cut the corporate tax rate to zero, allow foreign profits to be spent in this country tax free and you would see our economy boom like never before. There would be mor jobs than applicants and wages would go up due to supply and demand.

Economics is not really very complicated.

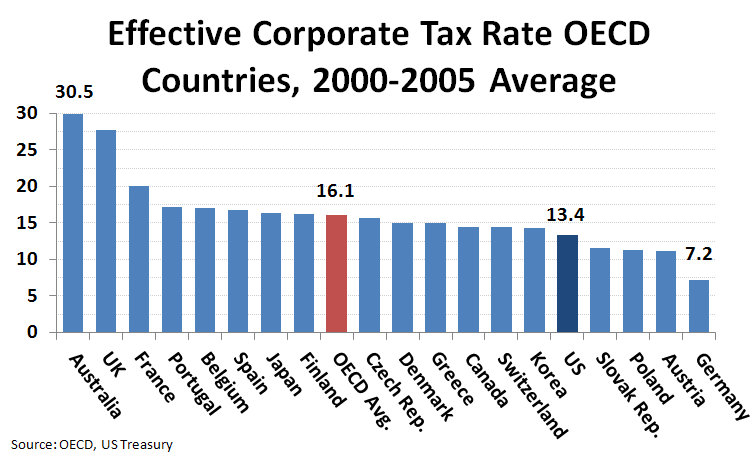

The listed maximum rate and what corporations actually pay are worlds apart. 35% corporate rate with a 13% effective rate

Corporations pay a lower effective rate than I do

Same as for anybody else. It's a matter of rate minus deductions compared to income. Public disclosures usually have that information.

Last edited: