Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How is austerity doing in Europe

- Thread starter Rshermr

- Start date

Rshermr

VIP Member

- Thread starter

- #662

No, me boy. Because I have not dealt with the numbers for over 45 years. And these folks have very recent and quite in depth dealings with the subject. So, I am listening. You should try it some time.And there is more of your opinion, me boy. It is definitely Greek to you. Easy to tell from your responses.

You are looking at basic economics, and your responses prove you to be lost. But, it does not stop your one actual skill: Attack, oldstyle. Insults and attacks are what you are all about. Nothing new. Just boring.

And aligning yourself perfectly with the dogma coming from the far, far right. What a surprise.

So, you just posted that you had these concepts in your macro economics class. You had exactly one of those, or so you have said. Now, here, you suggest that the discussion is at an advanced level. You seem confused.

Nah, I'm pretty comfortable with the discussion, Tommy...you on the other hand should probably come up with a good excuse why you can't take part. Gotta go rearrange your sock drawer...or something like that.

Last edited:

Kimura

VIP Member

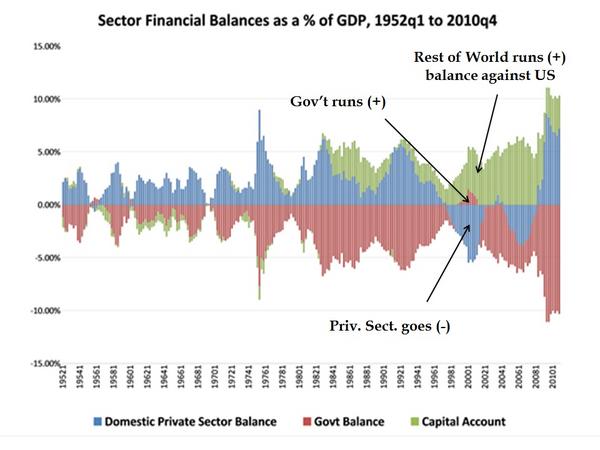

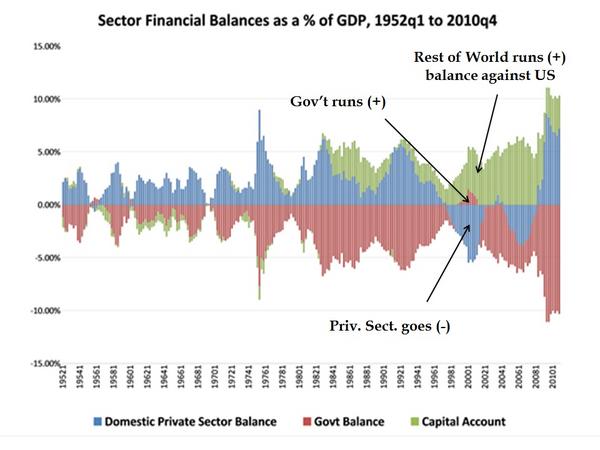

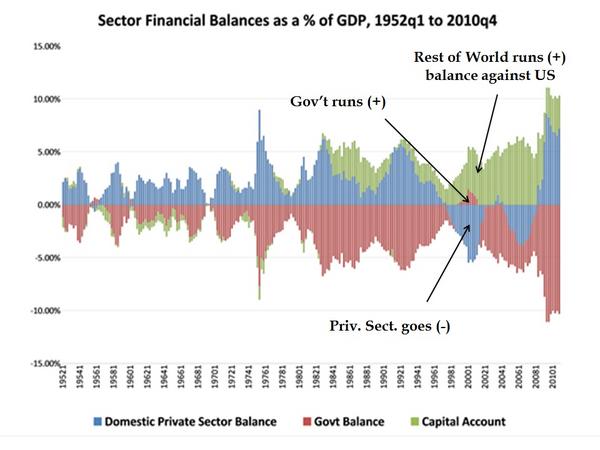

These are, of course, net numbers. It isn't to say that the private sector isn't itself

split up into smaller sectors, stock, bonds, consumer credit, savings accounts, mortgages, whatever. That is what bothers me. But, I guess we have to go through this first.

Excellent graph. You can see the 100% correlation.

Right. We're talking basic stock and flow, that's about it, in terms of sectoral macro-accounting.

We can divide this up into the domestic private sector, domestic government sector and the foreign sector (the rest of the world, including firms, households and national governments).

Domestic private sector + Domestic government sector + Foreign Sector = 0

For example, let's say, for the sake of argument, that the foreign sector is running a balanced budget. The identity I used has a foreign sector balance of zero.Let's also say that the domestic private sector's income is $500 billion and it's spending is $400 billion - a total net budget surplus of $100 billion for the year. By the identity alone, the domestic government sector will have a budget deficit of $100 billion over the course of the year. The domestic private sector will accrue $100 billion of net financial wealth, which consists of $100 billion in liabilities of the government sector over the course of the year.

If we use a second example, let's say that the foreign sector is spending less than its net income, with a total budget surplus of $300 billion. Simultaneously, during the same year, the domestic government sector also runs a budget surplus of $200 billion. When we get back to our identity, we know that the domestic private sector must have a budget deficit equal to $500 billion ($300 billion + $200 billion). During the same time period, its net financial wealth will have decreased by $500 billion as it must issue debt and sell off financial assets. The domestic government sector will increase its net financial wealth by $200 billion, decreasing its debt load and increasing its claims on the other sectors.

The bottom line is, if one sector runs a budget surplus, another sector must run a budget deficit. We're talking stock variables at the end of the day: one sector accrues net financial wealth, another must increase its debt load down to the last penny. It's impossible for every sector to simultaneously accrue financial wealth through budget surpluses.

I do remember the concept from Macro Econ, Kimura. So which sector is it that's accruing financial wealth at the moment? It's obvious that the domestic public sector isn't. So is the domestic private sector accumulating that wealth or is it the foreign sector? I'm seeing it as the foreign sector that's accruing financial wealth and if that IS the case how is that good for America?

We have to look at the correlation between deficits (flows) and (debts) stocks. The government sector is running a deficit, so the the domestic private sector is running a surplus. The foreign sector is also running a surplus against our trade deficit. The US benefits from the trade deficit in many ways, especially with a country like China, for example.

If we look at the CBO projections, which are determined by law, it's pretty schizophrenic. They don't utilize a stock-flow sectoral approach. It drives me insane. I've found that overall growth rates and CBO deficit projections imply highly improbable balances in the foreign sector and domestic private sector. Oh yeah, there's also private debt ratios.

I posted this graph of FRED data:

*Notice when the government sector goes into surplus during the Clinton Goldilocks time period. This government sector surplus caused the domestic private sector to increase its debt load to finance consumption. This contributed to private sector instability which ultimately resulted in the first recession of the 21st century.

Some more FRED data:

Government red ink is our black ink.

Last edited:

Right. We're talking basic stock and flow, that's about it, in terms of sectoral macro-accounting.

We can divide this up into the domestic private sector, domestic government sector and the foreign sector (the rest of the world, including firms, households and national governments).

Domestic private sector + Domestic government sector + Foreign Sector = 0

For example, let's say, for the sake of argument, that the foreign sector is running a balanced budget. The identity I used has a foreign sector balance of zero.Let's also say that the domestic private sector's income is $500 billion and it's spending is $400 billion - a total net budget surplus of $100 billion for the year. By the identity alone, the domestic government sector will have a budget deficit of $100 billion over the course of the year. The domestic private sector will accrue $100 billion of net financial wealth, which consists of $100 billion in liabilities of the government sector over the course of the year.

If we use a second example, let's say that the foreign sector is spending less than its net income, with a total budget surplus of $300 billion. Simultaneously, during the same year, the domestic government sector also runs a budget surplus of $200 billion. When we get back to our identity, we know that the domestic private sector must have a budget deficit equal to $500 billion ($300 billion + $200 billion). During the same time period, its net financial wealth will have decreased by $500 billion as it must issue debt and sell off financial assets. The domestic government sector will increase its net financial wealth by $200 billion, decreasing its debt load and increasing its claims on the other sectors.

The bottom line is, if one sector runs a budget surplus, another sector must run a budget deficit. We're talking stock variables at the end of the day: one sector accrues net financial wealth, another must increase its debt load down to the last penny. It's impossible for every sector to simultaneously accrue financial wealth through budget surpluses.

I do remember the concept from Macro Econ, Kimura. So which sector is it that's accruing financial wealth at the moment? It's obvious that the domestic public sector isn't. So is the domestic private sector accumulating that wealth or is it the foreign sector? I'm seeing it as the foreign sector that's accruing financial wealth and if that IS the case how is that good for America?

We have to look at the correlation between deficits (flows) and (debts) stocks. The government sector is running a deficit, so the the domestic private sector is running a surplus. The foreign sector is also running a surplus against our trade deficit. The US benefits from the trade deficit in many ways, especially with a country like China, for example.

If we look at the CBO projections, which are determined by law, it's pretty schizophrenic. They don't utilize a stock-flow sectoral approach. It drives me insane. I've found that overall growth rates and CBO deficit projections imply highly improbable balances in the foreign sector and domestic private sector. Oh yeah, there's also private debt ratios.

I posted this graph of FRED data:

*Notice when the government sector goes into surplus during the Clinton Goldilocks time period. This government sector surplus caused the domestic private sector to increase its debt load to finance consumption. This contributed to private sector instability which ultimately resulted in the first recession of the 21st century.

You side stepped my question, Kimura. Who's really been piling up financial assets...the domestic private sector or the foreign sector...and if it's the latter...then is that good for the economic health of the US?

Rshermr

VIP Member

- Thread starter

- #665

You are discussing your inventory valuation. Hardly a big deal, me boy. And, from my understanding, you just admitted to committing fraud. That whole gaap thing, you know.Uh, jesus, Oldstyle. Now you are comparing a restaurant with the us gov????? And in particular, you are comparing how you are "counting" with how the us gov numbers are counted. You need to get a grip.

I'm discussing accounting, Tommy...now run along before somebody asks you something that an economics major should know...

What is the name of the restaurant you claim you are managing???

You are discussing your inventory valuation. Hardly a big deal, me boy. And, from my understanding, you just admitted to committing fraud.Uh, jesus, Oldstyle. Now you are comparing a restaurant with the us gov????? And in particular, you are comparing how you are "counting" with how the us gov numbers are counted. You need to get a grip.

I'm discussing accounting, Tommy...now run along before somebody asks you something that an economics major should know...

What is the name of the restaurant you claim you are managing???

LOL...you're about as clueless about my business as you are about economics. The accounting method utilized wasn't chosen by me...I simply worked within it's parameters something that is in no way "fraud". It's what you do as a professional manager to maintain consistent numbers. That accounting method was what Planet Hollywood used when I was a manager for them. (Gee, Tommy...I thought your story was that I was a dishwasher? Now you want to know where I worked as a manager? Too funny...)

itfitzme

VIP Member

In this figure, is the govt balance in terms of total public debt or debt held by the public?

In this figure, is the govt balance in terms of total public debt or debt held by the public?

If you're talking sectors then public and private are separate...government goes into public.

Kimura

VIP Member

I do remember the concept from Macro Econ, Kimura. So which sector is it that's accruing financial wealth at the moment? It's obvious that the domestic public sector isn't. So is the domestic private sector accumulating that wealth or is it the foreign sector? I'm seeing it as the foreign sector that's accruing financial wealth and if that IS the case how is that good for America?

We have to look at the correlation between deficits (flows) and (debts) stocks. The government sector is running a deficit, so the the domestic private sector is running a surplus. The foreign sector is also running a surplus against our trade deficit. The US benefits from the trade deficit in many ways, especially with a country like China, for example.

If we look at the CBO projections, which are determined by law, it's pretty schizophrenic. They don't utilize a stock-flow sectoral approach. It drives me insane. I've found that overall growth rates and CBO deficit projections imply highly improbable balances in the foreign sector and domestic private sector. Oh yeah, there's also private debt ratios.

I posted this graph of FRED data:

*Notice when the government sector goes into surplus during the Clinton Goldilocks time period. This government sector surplus caused the domestic private sector to increase its debt load to finance consumption. This contributed to private sector instability which ultimately resulted in the first recession of the 21st century.

You side stepped my question, Kimura. Who's really been piling up financial assets...the domestic private sector or the foreign sector...and if it's the latter...then is that good for the economic health of the US?

The domestic private sector and the foreign sector are in surplus - both have accumulated financial wealth. Currently, the rest of the world (foreign sector) desires to net save in dollars so it's impossible for the US to run a trade surplus under the current arrangement.

Yes, it's fine for the economic health of the US to run a trade a deficit.

Last edited:

Rshermr

VIP Member

- Thread starter

- #670

What you just described was changing the cogs, thereby falsely stating profits. Sorry, me boy, though I am not familiar with the restaurant bus, I am familiar with what happens when you misstate cogs to increase or decrease profits. And regardless of what business you are in, the IRS does not much like it.You are discussing your inventory valuation. Hardly a big deal, me boy. And, from my understanding, you just admitted to committing fraud.I'm discussing accounting, Tommy...now run along before somebody asks you something that an economics major should know...

What is the name of the restaurant you claim you are managing???

LOL...you're about as clueless about my business as you are about economics. The accounting method utilized wasn't chosen by me...I simply worked within it's parameters something that is in no way "fraud". It's what you do as a professional manager to maintain consistent numbers. That accounting method was what Planet Hollywood used when I was a manager for them. (Gee, Tommy...I thought your story was that I was a dishwasher? Now you want to know where I worked as a manager? Too funny...)

No, not really. Just wanted to see your response. And, of course, it was as expected. If i put what you just did in writing, I would not want anyone to know where I worked either. Funny.

You just showed another dif between the gov and private bus. The gov is open. Anyone can see their books. And they are audited. On the other hand, business is less so. Yes, there are 10Q's and 10K's, and fiscal year ending fin. stmts. But still, much stays hidden. But if you are a restaurant, and privately owned, there is little that can be seen. No public statements required. Except, of course, that the IRS can look to their heart's content.

Last edited:

What you just described was changing the cogs, thereby falsely stating profits. Sorry, me boy, though I am not familiar with the restaurant bus, I am familiar with what happens when you misstate cogs to increase profits. And regardless of what business you are in, the IRS does not much like it.You are discussing your inventory valuation. Hardly a big deal, me boy. And, from my understanding, you just admitted to committing fraud.

What is the name of the restaurant you claim you are managing???

LOL...you're about as clueless about my business as you are about economics. The accounting method utilized wasn't chosen by me...I simply worked within it's parameters something that is in no way "fraud". It's what you do as a professional manager to maintain consistent numbers. That accounting method was what Planet Hollywood used when I was a manager for them. (Gee, Tommy...I thought your story was that I was a dishwasher? Now you want to know where I worked as a manager? Too funny...)

No, not really. Just wanted to see your response. And, of course, it was as expected. If i put what you just did in writing, I would not want anyone to know where I worked either. Funny.

You just showed another dif between the gov and private bus. The gov is open. Anyone can see their books. And they are audited. On the other hand, business is less so. Yes, there are 10Q's and 10K's, and fiscal year ending fin. stmts. But still, much stays hidden. But if you are a restaurant, and privately owned, there is little that can be seen. No public statements required. Except, of course, that the IRS can look to their heart's content.

Please, the IRS could care less about the accounting methods we used to determine our pour costs because THAT would have nothing to do with what profit or loss we were reporting to them. Why do you even bother trying to discuss something that you obviously know nothing about?

Rshermr

VIP Member

- Thread starter

- #672

Accounting methods are not what you are talking about. You are simply talking about modifying the cogs. Which changes profits.What you just described was changing the cogs, thereby falsely stating profits. Sorry, me boy, though I am not familiar with the restaurant bus, I am familiar with what happens when you misstate cogs to increase profits. And regardless of what business you are in, the IRS does not much like it.LOL...you're about as clueless about my business as you are about economics. The accounting method utilized wasn't chosen by me...I simply worked within it's parameters something that is in no way "fraud". It's what you do as a professional manager to maintain consistent numbers. That accounting method was what Planet Hollywood used when I was a manager for them. (Gee, Tommy...I thought your story was that I was a dishwasher? Now you want to know where I worked as a manager? Too funny...)

No, not really. Just wanted to see your response. And, of course, it was as expected. If i put what you just did in writing, I would not want anyone to know where I worked either. Funny.

You just showed another dif between the gov and private bus. The gov is open. Anyone can see their books. And they are audited. On the other hand, business is less so. Yes, there are 10Q's and 10K's, and fiscal year ending fin. stmts. But still, much stays hidden. But if you are a restaurant, and privately owned, there is little that can be seen. No public statements required. Except, of course, that the IRS can look to their heart's content.

Please, the IRS could care less about the accounting methods we used to determine our pour costs because THAT would have nothing to do with what profit or loss we were reporting to them. Why do you even bother trying to discuss something that you obviously know nothing about?

So, you do not make money of the liquor you sell??? If so, you would change profit by doing what you described. Go check gaap. Or, ask your accountant if it is ok with him if you tell the world how you modify the true cogs.

Last edited:

itfitzme

VIP Member

Some more FRED data:

Government red ink is our black ink.

Okay, good.. I was looking at*

FRED® Gross Private Saving

And trying to decide if it is the "private savings" I am looking for. *

That is an issue I've run into, the wealth of data sets an no consistent way to determine where they fit. *The set of everything can be divided up into numerous ways. *I couldn't find a description of GPSAVE and I don't like infering from the short description.

itfitzme

VIP Member

Accounting methods are not what you are talking about. *You are simply talking about modifying the cogs. *Which changes profits. *

So, you do not make money of the liquor you sell??? *If so, you would change profit by doing what you described. *Go check gaap. *Or, ask your accountant if it is ok with him if you tell the world how you modify the true cogs

.

There are endless ways to create an arguement. *Once I find that they are creating arguement, they go on the ignore list. *They are basically just jerking off in public. It's a form of self-gratification. Mental masturbation. *My time is better spent learning something than listening to the jerk off.

Last edited:

Rshermr

VIP Member

- Thread starter

- #675

Yup. Some times it is just kind of fun to watch a guy who makes a stupid statement back peddle as fast as possible. And bragging about changing costs was just too stupid.Accounting methods are not what you are talking about. *You are simply talking about modifying the cogs. *Which changes profits. *

So, you do not make money of the liquor you sell??? *If so, you would change profit by doing what you described. *Go check gaap. *Or, ask your accountant if it is ok with him if you tell the world how you modify the true cogs

.

There are endless ways to create an arguement. *Once I find that they are creating arguement, they go on the ignore list. *They are basically just jerking off in public. It's a form of self-gratification. Mental masturbation. *My time is better spent learning something than listening to the jerk off.

Accounting methods are not what you are talking about. You are simply talking about modifying the cogs. Which changes profits.What you just described was changing the cogs, thereby falsely stating profits. Sorry, me boy, though I am not familiar with the restaurant bus, I am familiar with what happens when you misstate cogs to increase profits. And regardless of what business you are in, the IRS does not much like it.

No, not really. Just wanted to see your response. And, of course, it was as expected. If i put what you just did in writing, I would not want anyone to know where I worked either. Funny.

You just showed another dif between the gov and private bus. The gov is open. Anyone can see their books. And they are audited. On the other hand, business is less so. Yes, there are 10Q's and 10K's, and fiscal year ending fin. stmts. But still, much stays hidden. But if you are a restaurant, and privately owned, there is little that can be seen. No public statements required. Except, of course, that the IRS can look to their heart's content.

Please, the IRS could care less about the accounting methods we used to determine our pour costs because THAT would have nothing to do with what profit or loss we were reporting to them. Why do you even bother trying to discuss something that you obviously know nothing about?

So, you do not make money of the liquor you sell??? If so, you would change profit by doing what you described. Go check gaap. Or, ask your accountant if it is ok with him if you tell the world how you modify the true cogs.

You don't change profits by one red cent doing what I was discussing, you buffoon. God but you're clueless...

Rshermr

VIP Member

- Thread starter

- #677

Right. Sure, me boy. Not one red cent. Just what you report. And what you pay taxes on. Funny, look at you back up.Accounting methods are not what you are talking about. You are simply talking about modifying the cogs. Which changes profits.Please, the IRS could care less about the accounting methods we used to determine our pour costs because THAT would have nothing to do with what profit or loss we were reporting to them. Why do you even bother trying to discuss something that you obviously know nothing about?

So, you do not make money of the liquor you sell??? If so, you would change profit by doing what you described. Go check gaap. Or, ask your accountant if it is ok with him if you tell the world how you modify the true cogs.

You don't change profits by one red cent doing what I was discussing, you buffoon. God but you're clueless...

Last edited:

Rshermr

VIP Member

- Thread starter

- #678

So, getting back to the topic of the thread, what seemed obvious was that austerity was not going to be successful in turning the recession in Europe around. That is, it was analogous to what happens when you decrease gov spending in the US during a downturn.

What we have seen in Europe is decreasing spending by governments in a number of countries. The effort being to decrease the deficit by starving it. What actually happened is that we saw a decrease in gov spending, a shut down of gov programs, resultant unemployment increases, and decreasing gov receipts. Those natural occurrences of decreasing gov spending on employment and the economy caused not just decreases in demand from employees laid off from gov jobs, but resultant losses of jobs in the private sector. And so it goes on.

Seems to me it was predictable. Increasing unemployment and decreasing consumer demand is just never a good idea in a recession. What are your thoughts.

By the way, I am in no way trying to change the subject being discussed in the thread now. Just trying to add to it.

What we have seen in Europe is decreasing spending by governments in a number of countries. The effort being to decrease the deficit by starving it. What actually happened is that we saw a decrease in gov spending, a shut down of gov programs, resultant unemployment increases, and decreasing gov receipts. Those natural occurrences of decreasing gov spending on employment and the economy caused not just decreases in demand from employees laid off from gov jobs, but resultant losses of jobs in the private sector. And so it goes on.

Seems to me it was predictable. Increasing unemployment and decreasing consumer demand is just never a good idea in a recession. What are your thoughts.

By the way, I am in no way trying to change the subject being discussed in the thread now. Just trying to add to it.

Kimura

VIP Member

So, getting back to the topic of the thread, what seemed obvious was that austerity was not going to be successful in turning the recession in Europe around. That is, it was analogous to what happens when you decrease gov spending in the US during a downturn.

What we have seen in Europe is decreasing spending by governments in a number of countries. The effort being to decrease the deficit by starving it. What actually happened is that we saw a decrease in gov spending, a shut down of gov programs, resultant unemployment increases, and decreasing gov receipts. Those natural occurrences of decreasing gov spending on employment and the economy caused not just decreases in demand from employees laid off from gov jobs, but resultant losses of jobs in the private sector. And so it goes on.

Seems to me it was predictable. Increasing unemployment and decreasing consumer demand is just never a good idea in a recession. What are your thoughts.

By the way, I am in no way trying to change the subject being discussed in the thread now. Just trying to add to it.

It was sort of my fault for the thread taking a different direction.

Yeah, austerity has never worked, it simply cannot work, especially if we follow the sectoral balances approach. Ultimately, the end result is a massive contraction of GDP, which has the concordant effect of causing labor and capital to atrophy and wither away. We need to look no further than Greece and Spain.

I've come to the conclusion austerity was never about "deficit reduction". It's just another way to suppress wages and reduce the economic rights and benefits of workers in these countries. We're dealing with counties that historically have had a much higher standard of living than the US in the post-WWII space. The goal is a race to the bottom with emerging markets in the third world. In order to accomplish this agenda, you must decimate worker protections, wages, and benefits.

itfitzme

VIP Member

Well, ive heard alot about it but haven't looked at it. This is greece UE men

Similar threads

- Replies

- 0

- Views

- 84

- Replies

- 1

- Views

- 349

- Replies

- 10

- Views

- 196

- Replies

- 3

- Views

- 76

- Replies

- 34

- Views

- 517

Latest Discussions

- Replies

- 164

- Views

- 775

- Replies

- 23

- Views

- 111

Forum List

-

-

-

-

-

Political Satire 8536

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 485

-

-

-

-

-

-

-

-

-

-