Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Militarism at the Heart of US Gun Violence

- Thread starter georgephillip

- Start date

Bush92

GHBush1992

- May 23, 2014

- 34,808

- 10,715

- 1,400

You’re an idiot. Our youth are pussified enough now the way it is.From February 2018:

Militarism at the heart of a violent culture

"AS THE president continued smearing millions of immigrants as violent gang members to justify racist deportations and a border wall, it happened again. A young white man entered a school, not far from where I graduated, and unloaded a legally purchased weapon of war, killing 17 innocent people in three minutes...."

"WE NOW need to expand the demand beyond gun control, and connect the issue of mass murder at home to state-sanctioned mass murder abroad.

"At age 19, shooter Nikolas Cruz has not lived a year of his life when the U.S. was not actively bombing or occupying other countries, and exporting war through lucrative weapons contracts.

"A teen who can't yet legally buy beer or rent a car was able to purchase a weapon made for tactical combat--but then again, the same legislators who allow the AR-15 to be sold more easily than a Bud Light have supported every U.S. war and every bloated military budget presented to them.

"The U.S.-manufactured ammunition that kills abroad kills just the same in Parkland, Florida.

"The crisis we have before us is not about rap music or video games, as has been charged in previous mass shootings.

"It is a capitalist crisis."

A crisis groomed since 1945 during which the Exceptional US has exterminated millions of innocent human beings from Korea to Kandahar.

Only someone as dense as Trump would be surprised when these chickens come home to roost.

Bush92

GHBush1992

- May 23, 2014

- 34,808

- 10,715

- 1,400

We have a Republic to defend.The first two paragraphs of your link should be required reading everywhere in the Greatest Purveyor of Violence in the World:What Militarism Does To Our Brains

Philosophy Weekend: What Militarism Does To Our Brains

"f you care about gun violence in the United States of America, I think you need to also care about militarism in the USA.

"We're not going to solve the domestic problem until we solve the global one.

"It can't be a coincidence that the most weaponed-up nation in the world also suffers regular epidemics of gun violence in schools, colleges, movie theaters, shopping malls, parking lots.

"We're talking about gun control and getting nowhere, and this is because we're not discussing the root cause.

"Domestic gun violence and militarism are co-dependents.

"They enable each other."

Some days I wonder if a two degree Celsius temperature rise over pre-industrial levels or three hundred million guns will end US civilization first. I suppose the latter will

On Wall Street, Capitalism In Its Descending Phase

We wish to find more evidence of immature brains under 25 years of age linked to militarism, though there is a militarism of financial violence.

'It goes without saying that when history goes into a deep rut it becomes hard to alter the course of affairs. But even at this late date the sundown scenario could be avoided. The Fed's financial repression and Wall Street-coddling policies could be pronounced a failure and abandoned. Crony capitalism could be put out of business by constitutional writ. Likewise, corpulent warfare and welfare states could be put into a constitutional chastity belt and the rule of no spending without equal taxation could be made the modus operandi of a shrunken state. Eventually, the free market could regain its vigor and capacity for wealth creation and, under a regime of sound money and honest finance, the 1 percent could continue to enjoy their opulence by earning it the old-fashioned way; that is, be delivering society inventions and enterprise that expand the economic pie, rather than reallocate it.

The crucial steps that would be needed are few but large. They would never be adopted in today's regime of money politics, fast money speculation, and Keynesian economics, but they can be listed. They are compelling.

1. Restore Banker's Bank and Sound Money

2. Abolish Deposit Insurance and Limit the Fed Discount Window to Narrow Depositories

3. Adopt Super Glass-Steagall II

4. Abolish Incumbency Through Omnibus Amendment

5. Require Each Two-Year Congress to Balance the Budget

6. End Macroeconomic Management and Separate the State and the Free Market

7. Abolish Social Insurance, Bailouts, and Economic Subsidies

8. Eliminate Ten Major Federal Agencies and Departments

9. Erect a Sturdy Cash-Based Means-Tested Safety Net and Abolish the Minimum Wage

10. Abolish Health "Insurance" in All Its Forms

11. Replace the Warfare State with Genuine National Defense

12. Impose a 30 Percent Wealth Tax; Pay Down the National Debt to 30 Percent of GDP

13. Repeal the Sixteenth Amendment; Feed the Beast with Universal Taxes on Consumption.'

(Stockman D, The Great Deformation: The Corruption of Capitalism in America, 2013)

Stockman expounds on points 1-13....

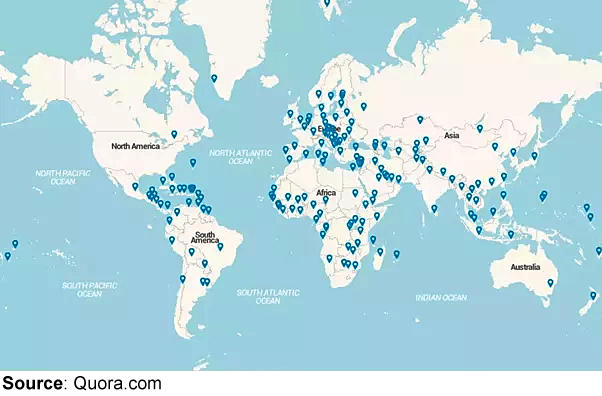

11. The warfare state would be demobilized and dismantled, with budget resources reduced to the Eisenhower Minimum outside of a declaration of war. Foreign policy would be based on the principle of non-intervention in the internal affairs of all other nations coupled with the Eisenhower policy of massive nuclear retaliation. In other words, the nation's conventional forces would be reduced by perhaps two-thirds and be used solely to shield the continent from conventional military attack; the domestic police forces would be in charge of warding off and controlling terrorist subversion; and any foreign aggressor contemplating a nuclear attack against the United States would know with certainty that the consequence would be incineration of their own nation. At the present time the Eisenhower Minimum would amount to about 2.5 percent of GDP and would more than meet the legitimate defense needs of a nation that is broke and which was never elected policeman of the world in the first place.'Closing hundreds of US military bases around the world could help reduce the defense budget.In other words, the nation's conventional forces would be reduced by perhaps two-thirds and be used solely to shield the continent from conventional military attack; the domestic police forces would be in charge of warding off and controlling terrorist subversion

Imho, we should take a page from FDR's New Deal and enlist the US military to manage a 21st Century Green New Deal. Millions of US civilians could join active duty troops and perform some genuine national defense.

Base Nation - U.S. Military Bases Worldwide - The History Reader

miketx

Diamond Member

- Dec 25, 2015

- 121,555

- 70,536

- 2,645

- Banned

- #265

Why would I shoot up anything? I'm not a murderous pos democrat.Come try and take mine.From February 2018:

Militarism at the heart of a violent culture

"AS THE president continued smearing millions of immigrants as violent gang members to justify racist deportations and a border wall, it happened again. A young white man entered a school, not far from where I graduated, and unloaded a legally purchased weapon of war, killing 17 innocent people in three minutes...."

"WE NOW need to expand the demand beyond gun control, and connect the issue of mass murder at home to state-sanctioned mass murder abroad.

"At age 19, shooter Nikolas Cruz has not lived a year of his life when the U.S. was not actively bombing or occupying other countries, and exporting war through lucrative weapons contracts.

"A teen who can't yet legally buy beer or rent a car was able to purchase a weapon made for tactical combat--but then again, the same legislators who allow the AR-15 to be sold more easily than a Bud Light have supported every U.S. war and every bloated military budget presented to them.

"The U.S.-manufactured ammunition that kills abroad kills just the same in Parkland, Florida.

"The crisis we have before us is not about rap music or video games, as has been charged in previous mass shootings.

"It is a capitalist crisis."

A crisis groomed since 1945 during which the Exceptional US has exterminated millions of innocent human beings from Korea to Kandahar.

Only someone as dense as Trump would be surprised when these chickens come home to roost.Shoot up a Walmart and they will take your gun from your cold, dead hand.Come try and take mine.

Good riddance.

georgephillip

Diamond Member

- Thread starter

- #266

We have a Republic to defend.The first two paragraphs of your link should be required reading everywhere in the Greatest Purveyor of Violence in the World:What Militarism Does To Our Brains

Philosophy Weekend: What Militarism Does To Our Brains

"f you care about gun violence in the United States of America, I think you need to also care about militarism in the USA.

"We're not going to solve the domestic problem until we solve the global one.

"It can't be a coincidence that the most weaponed-up nation in the world also suffers regular epidemics of gun violence in schools, colleges, movie theaters, shopping malls, parking lots.

"We're talking about gun control and getting nowhere, and this is because we're not discussing the root cause.

"Domestic gun violence and militarism are co-dependents.

"They enable each other."

Some days I wonder if a two degree Celsius temperature rise over pre-industrial levels or three hundred million guns will end US civilization first. I suppose the latter will

On Wall Street, Capitalism In Its Descending Phase

We wish to find more evidence of immature brains under 25 years of age linked to militarism, though there is a militarism of financial violence.

'It goes without saying that when history goes into a deep rut it becomes hard to alter the course of affairs. But even at this late date the sundown scenario could be avoided. The Fed's financial repression and Wall Street-coddling policies could be pronounced a failure and abandoned. Crony capitalism could be put out of business by constitutional writ. Likewise, corpulent warfare and welfare states could be put into a constitutional chastity belt and the rule of no spending without equal taxation could be made the modus operandi of a shrunken state. Eventually, the free market could regain its vigor and capacity for wealth creation and, under a regime of sound money and honest finance, the 1 percent could continue to enjoy their opulence by earning it the old-fashioned way; that is, be delivering society inventions and enterprise that expand the economic pie, rather than reallocate it.

The crucial steps that would be needed are few but large. They would never be adopted in today's regime of money politics, fast money speculation, and Keynesian economics, but they can be listed. They are compelling.

1. Restore Banker's Bank and Sound Money

2. Abolish Deposit Insurance and Limit the Fed Discount Window to Narrow Depositories

3. Adopt Super Glass-Steagall II

4. Abolish Incumbency Through Omnibus Amendment

5. Require Each Two-Year Congress to Balance the Budget

6. End Macroeconomic Management and Separate the State and the Free Market

7. Abolish Social Insurance, Bailouts, and Economic Subsidies

8. Eliminate Ten Major Federal Agencies and Departments

9. Erect a Sturdy Cash-Based Means-Tested Safety Net and Abolish the Minimum Wage

10. Abolish Health "Insurance" in All Its Forms

11. Replace the Warfare State with Genuine National Defense

12. Impose a 30 Percent Wealth Tax; Pay Down the National Debt to 30 Percent of GDP

13. Repeal the Sixteenth Amendment; Feed the Beast with Universal Taxes on Consumption.'

(Stockman D, The Great Deformation: The Corruption of Capitalism in America, 2013)

Stockman expounds on points 1-13....

11. The warfare state would be demobilized and dismantled, with budget resources reduced to the Eisenhower Minimum outside of a declaration of war. Foreign policy would be based on the principle of non-intervention in the internal affairs of all other nations coupled with the Eisenhower policy of massive nuclear retaliation. In other words, the nation's conventional forces would be reduced by perhaps two-thirds and be used solely to shield the continent from conventional military attack; the domestic police forces would be in charge of warding off and controlling terrorist subversion; and any foreign aggressor contemplating a nuclear attack against the United States would know with certainty that the consequence would be incineration of their own nation. At the present time the Eisenhower Minimum would amount to about 2.5 percent of GDP and would more than meet the legitimate defense needs of a nation that is broke and which was never elected policeman of the world in the first place.'Closing hundreds of US military bases around the world could help reduce the defense budget.In other words, the nation's conventional forces would be reduced by perhaps two-thirds and be used solely to shield the continent from conventional military attack; the domestic police forces would be in charge of warding off and controlling terrorist subversion

Imho, we should take a page from FDR's New Deal and enlist the US military to manage a 21st Century Green New Deal. Millions of US civilians could join active duty troops and perform some genuine national defense.

Base Nation - U.S. Military Bases Worldwide - The History Reader

Actually, it's been an Empire since 1945, and there is no defense for terrorism.We have a Republic to defend.

Base Nation - U.S. Military Bases Worldwide - The History Reader

"From a hilltop at the Guantánamo Bay naval station, you can look down on a secluded part of the base bordered by the Caribbean Sea. There you’ll see thick coils of razor wire, guard towers, search lights, and concrete barriers.

"This is the U.S. prison that has garnered so much international attention and controversy, with so many prisoners held for years without trial.

"But the prison facilities take up only a few acres of the forty-five-square-mile naval station.

"Most of the base looks nothing like the detention center. Instead, the landscape features suburban-style housing developments, a golf course, and recreational boating facilities.

"This part of the base has received much less attention than the prison. Yet in its own way, it is far more important for understanding who we are as a country and how we relate to the rest of the world."

Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )

georgephillip

Diamond Member

- Thread starter

- #268

The Next Bush Incarnation?Make bushes respectful again: put them to work in the CCC!

George P. Bush - Wikipedia

"Bush served in Operation Enduring Freedom for eight months and returned to the United States in 2011.[2][22][23] During that deployment, he was given a different name for security purposes. Not even those he was serving alongside knew his real identity.[24] Bush left the U.S. Navy Reserve on May 9, 2017 at the rank of Lieutenant.[25][26]"

georgephillip

Diamond Member

- Thread starter

- #269

Why would I shoot up anything? I'm not a murderous pos democrat.Come try and take mine.From February 2018:

Militarism at the heart of a violent culture

"AS THE president continued smearing millions of immigrants as violent gang members to justify racist deportations and a border wall, it happened again. A young white man entered a school, not far from where I graduated, and unloaded a legally purchased weapon of war, killing 17 innocent people in three minutes...."

"WE NOW need to expand the demand beyond gun control, and connect the issue of mass murder at home to state-sanctioned mass murder abroad.

"At age 19, shooter Nikolas Cruz has not lived a year of his life when the U.S. was not actively bombing or occupying other countries, and exporting war through lucrative weapons contracts.

"A teen who can't yet legally buy beer or rent a car was able to purchase a weapon made for tactical combat--but then again, the same legislators who allow the AR-15 to be sold more easily than a Bud Light have supported every U.S. war and every bloated military budget presented to them.

"The U.S.-manufactured ammunition that kills abroad kills just the same in Parkland, Florida.

"The crisis we have before us is not about rap music or video games, as has been charged in previous mass shootings.

"It is a capitalist crisis."

A crisis groomed since 1945 during which the Exceptional US has exterminated millions of innocent human beings from Korea to Kandahar.

Only someone as dense as Trump would be surprised when these chickens come home to roost.Shoot up a Walmart and they will take your gun from your cold, dead hand.Come try and take mine.

Good riddance.

Do you want a medal?Why would I shoot up anything? I'm not a murderous pos democrat

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/MW56MTM4JNHFLKURY4HPO3BLVA.jpg)

A Jekyll and Hyde portrait emerges of the SEAL accused of murdering an Islamic State prisoner

The authors don't mention anything specific in the abstract:

A Psychosocial Vaccine Against Militarism

A psychosocial vaccine against militarism. - PubMed - NCBI

2008

Archeology of Militarism

The elephant in the room: critical reflections on militarism, war, and their health contingencies. - PubMed - NCBI

2013

The Elephant in the Room: Militarism - The Good Men Project

2016

Militarism: The Elephant in the Room

2018 Sweden, Militarism and Globalization: Is There An Empirical Link?

Militarism and globalization: Is there an empirical link? - PubMed - NCBI

A Psychosocial Vaccine Against Militarism

A psychosocial vaccine against militarism. - PubMed - NCBI

2008

Archeology of Militarism

The elephant in the room: critical reflections on militarism, war, and their health contingencies. - PubMed - NCBI

2013

The Elephant in the Room: Militarism - The Good Men Project

2016

Militarism: The Elephant in the Room

2018 Sweden, Militarism and Globalization: Is There An Empirical Link?

Militarism and globalization: Is there an empirical link? - PubMed - NCBI

georgephillip

Diamond Member

- Thread starter

- #271

Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )

The US has used its creditor and debtor status to gain control of other countries's economies since the end of WWI. The gold standard never held in times of major conflicts, and once the US began its occupation of South Vietnam, it gave way completely.'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate

Over the past few decades, international finance seems to have provided many of the same benefits as military occupation without the threat to social order we saw during Vietnam.

Super-Imperialism at the Pentagon | Michael Hudson

"After World War II, the US created the World Bank and the International Monetary Fund IMF. These instruments were created as essential control mechanisms to control other countries financially.

"This became particularly apparent after the US abolished its gold-standard in 1971.

"Since then, the US has always sought to force other states to hold their own currency reserves in US dollars.

"That means that those governments must then obtain the money through the US Federal Reserve.

"To make it clear: You buy US government bonds, most central banks do not buy stocks or companies, they buy government bonds.

"At least that was the case until recently."

"Dollars have been pumped into the world economic cycle for a long time, also to finance the military spending of the United States. As a result, the private sector is in a fairly difficult position.

"So briefly stated: The US military spending is pumping a lot of dollars into foreign economies. Those central banks are told by the FED, they should hold these dollars, including central banks of Europe, central banks of the Third World, China and such.

"Then – in turn – to buy these US government bonds, the buying central banks then lend exactly those dollars back to the US Federal Reserve.

"In effect, these states are actually financing the US military budget. As you can see, this is a circular cycle. So: Foreign countries are paying the US military budget. This is the common unipolar policy of the United States."

Toddsterpatriot

Diamond Member

Why would I shoot up anything? I'm not a murderous pos democrat.Come try and take mine.From February 2018:

Militarism at the heart of a violent culture

"AS THE president continued smearing millions of immigrants as violent gang members to justify racist deportations and a border wall, it happened again. A young white man entered a school, not far from where I graduated, and unloaded a legally purchased weapon of war, killing 17 innocent people in three minutes...."

"WE NOW need to expand the demand beyond gun control, and connect the issue of mass murder at home to state-sanctioned mass murder abroad.

"At age 19, shooter Nikolas Cruz has not lived a year of his life when the U.S. was not actively bombing or occupying other countries, and exporting war through lucrative weapons contracts.

"A teen who can't yet legally buy beer or rent a car was able to purchase a weapon made for tactical combat--but then again, the same legislators who allow the AR-15 to be sold more easily than a Bud Light have supported every U.S. war and every bloated military budget presented to them.

"The U.S.-manufactured ammunition that kills abroad kills just the same in Parkland, Florida.

"The crisis we have before us is not about rap music or video games, as has been charged in previous mass shootings.

"It is a capitalist crisis."

A crisis groomed since 1945 during which the Exceptional US has exterminated millions of innocent human beings from Korea to Kandahar.

Only someone as dense as Trump would be surprised when these chickens come home to roost.Shoot up a Walmart and they will take your gun from your cold, dead hand.Come try and take mine.

Good riddance.Do you want a medal?Why would I shoot up anything? I'm not a murderous pos democrat

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/MW56MTM4JNHFLKURY4HPO3BLVA.jpg)

A Jekyll and Hyde portrait emerges of the SEAL accused of murdering an Islamic State prisoner

Acquitted.

Toddsterpatriot

Diamond Member

Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )The US has used its creditor and debtor status to gain control of other countries's economies since the end of WWI. The gold standard never held in times of major conflicts, and once the US began its occupation of South Vietnam, it gave way completely.'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate

Over the past few decades, international finance seems to have provided many of the same benefits as military occupation without the threat to social order we saw during Vietnam.

Super-Imperialism at the Pentagon | Michael Hudson

"After World War II, the US created the World Bank and the International Monetary Fund IMF. These instruments were created as essential control mechanisms to control other countries financially.

"This became particularly apparent after the US abolished its gold-standard in 1971.

"Since then, the US has always sought to force other states to hold their own currency reserves in US dollars.

"That means that those governments must then obtain the money through the US Federal Reserve.

"To make it clear: You buy US government bonds, most central banks do not buy stocks or companies, they buy government bonds.

"At least that was the case until recently."

"Dollars have been pumped into the world economic cycle for a long time, also to finance the military spending of the United States. As a result, the private sector is in a fairly difficult position.

"So briefly stated: The US military spending is pumping a lot of dollars into foreign economies. Those central banks are told by the FED, they should hold these dollars, including central banks of Europe, central banks of the Third World, China and such.

"Then – in turn – to buy these US government bonds, the buying central banks then lend exactly those dollars back to the US Federal Reserve.

"In effect, these states are actually financing the US military budget. As you can see, this is a circular cycle. So: Foreign countries are paying the US military budget. This is the common unipolar policy of the United States."

I love your Marxist sources.

Very convincing.

georgephillip

Diamond Member

- Thread starter

- #274

Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )The US has used its creditor and debtor status to gain control of other countries's economies since the end of WWI. The gold standard never held in times of major conflicts, and once the US began its occupation of South Vietnam, it gave way completely.'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate

Over the past few decades, international finance seems to have provided many of the same benefits as military occupation without the threat to social order we saw during Vietnam.

Super-Imperialism at the Pentagon | Michael Hudson

"After World War II, the US created the World Bank and the International Monetary Fund IMF. These instruments were created as essential control mechanisms to control other countries financially.

"This became particularly apparent after the US abolished its gold-standard in 1971.

"Since then, the US has always sought to force other states to hold their own currency reserves in US dollars.

"That means that those governments must then obtain the money through the US Federal Reserve.

"To make it clear: You buy US government bonds, most central banks do not buy stocks or companies, they buy government bonds.

"At least that was the case until recently."

"Dollars have been pumped into the world economic cycle for a long time, also to finance the military spending of the United States. As a result, the private sector is in a fairly difficult position.

"So briefly stated: The US military spending is pumping a lot of dollars into foreign economies. Those central banks are told by the FED, they should hold these dollars, including central banks of Europe, central banks of the Third World, China and such.

"Then – in turn – to buy these US government bonds, the buying central banks then lend exactly those dollars back to the US Federal Reserve.

"In effect, these states are actually financing the US military budget. As you can see, this is a circular cycle. So: Foreign countries are paying the US military budget. This is the common unipolar policy of the United States."

I love your Marxist sources.

Very convincing.

Why does the US start so many wars?I love your Marxist sources.

Very convincing.

"Is this the reason why the US government leads so many wars worldwide?

https://michael-hudson.com/2019/02/super-imperialism-at-the-pentagon/

"The United States lost almost the entire stock of US state gold during the Vietnam War.

"The problem: Keeping a war going is very expensive.

"The key is to balance the expenses.

"The limit is the balance of payments.

"In principle, the US has created all this about its own balance of payments deficit.

"How can the US now entertain its huge global military apparatus?

"They can only do that if the dollar value does not go down.

"That’s why the US has always been about keeping other countries from exchanging their dollars for gold.

"Therefore, the US saying: 'Please just hold the dollars, okay? Thank you.

"Or invest in our US Treasury bonds.”

"Basically, the US has often told the European Union (EU): 'Do not create your own deficit in balance of payments. Please do not create so many euros that the Euro will end up being a rival to the dollar. We only want countries that hold the dollar.'

"That’s a kind of tribute.

"These countries therefore finance the US balance of payments deficit."

miketx

Diamond Member

- Dec 25, 2015

- 121,555

- 70,536

- 2,645

- Banned

- #275

Why do buttstain traitors like you lie so much?Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )The US has used its creditor and debtor status to gain control of other countries's economies since the end of WWI. The gold standard never held in times of major conflicts, and once the US began its occupation of South Vietnam, it gave way completely.'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate

Over the past few decades, international finance seems to have provided many of the same benefits as military occupation without the threat to social order we saw during Vietnam.

Super-Imperialism at the Pentagon | Michael Hudson

"After World War II, the US created the World Bank and the International Monetary Fund IMF. These instruments were created as essential control mechanisms to control other countries financially.

"This became particularly apparent after the US abolished its gold-standard in 1971.

"Since then, the US has always sought to force other states to hold their own currency reserves in US dollars.

"That means that those governments must then obtain the money through the US Federal Reserve.

"To make it clear: You buy US government bonds, most central banks do not buy stocks or companies, they buy government bonds.

"At least that was the case until recently."

"Dollars have been pumped into the world economic cycle for a long time, also to finance the military spending of the United States. As a result, the private sector is in a fairly difficult position.

"So briefly stated: The US military spending is pumping a lot of dollars into foreign economies. Those central banks are told by the FED, they should hold these dollars, including central banks of Europe, central banks of the Third World, China and such.

"Then – in turn – to buy these US government bonds, the buying central banks then lend exactly those dollars back to the US Federal Reserve.

"In effect, these states are actually financing the US military budget. As you can see, this is a circular cycle. So: Foreign countries are paying the US military budget. This is the common unipolar policy of the United States."

I love your Marxist sources.

Very convincing.Why does the US start so many wars?I love your Marxist sources.

Very convincing.

"Is this the reason why the US government leads so many wars worldwide?

Super-Imperialism at the Pentagon | Michael Hudson

"The United States lost almost the entire stock of US state gold during the Vietnam War.

"The problem: Keeping a war going is very expensive.

"The key is to balance the expenses.

"The limit is the balance of payments.

"In principle, the US has created all this about its own balance of payments deficit.

"How can the US now entertain its huge global military apparatus?

"They can only do that if the dollar value does not go down.

"That’s why the US has always been about keeping other countries from exchanging their dollars for gold.

"Therefore, the US saying: 'Please just hold the dollars, okay? Thank you.

"Or invest in our US Treasury bonds.”

"Basically, the US has often told the European Union (EU): 'Do not create your own deficit in balance of payments. Please do not create so many euros that the Euro will end up being a rival to the dollar. We only want countries that hold the dollar.'

"That’s a kind of tribute.

"These countries therefore finance the US balance of payments deficit."

Toddsterpatriot

Diamond Member

Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )The US has used its creditor and debtor status to gain control of other countries's economies since the end of WWI. The gold standard never held in times of major conflicts, and once the US began its occupation of South Vietnam, it gave way completely.'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate

Over the past few decades, international finance seems to have provided many of the same benefits as military occupation without the threat to social order we saw during Vietnam.

Super-Imperialism at the Pentagon | Michael Hudson

"After World War II, the US created the World Bank and the International Monetary Fund IMF. These instruments were created as essential control mechanisms to control other countries financially.

"This became particularly apparent after the US abolished its gold-standard in 1971.

"Since then, the US has always sought to force other states to hold their own currency reserves in US dollars.

"That means that those governments must then obtain the money through the US Federal Reserve.

"To make it clear: You buy US government bonds, most central banks do not buy stocks or companies, they buy government bonds.

"At least that was the case until recently."

"Dollars have been pumped into the world economic cycle for a long time, also to finance the military spending of the United States. As a result, the private sector is in a fairly difficult position.

"So briefly stated: The US military spending is pumping a lot of dollars into foreign economies. Those central banks are told by the FED, they should hold these dollars, including central banks of Europe, central banks of the Third World, China and such.

"Then – in turn – to buy these US government bonds, the buying central banks then lend exactly those dollars back to the US Federal Reserve.

"In effect, these states are actually financing the US military budget. As you can see, this is a circular cycle. So: Foreign countries are paying the US military budget. This is the common unipolar policy of the United States."

I love your Marxist sources.

Very convincing.Why does the US start so many wars?I love your Marxist sources.

Very convincing.

"Is this the reason why the US government leads so many wars worldwide?

Super-Imperialism at the Pentagon | Michael Hudson

"The United States lost almost the entire stock of US state gold during the Vietnam War.

"The problem: Keeping a war going is very expensive.

"The key is to balance the expenses.

"The limit is the balance of payments.

"In principle, the US has created all this about its own balance of payments deficit.

"How can the US now entertain its huge global military apparatus?

"They can only do that if the dollar value does not go down.

"That’s why the US has always been about keeping other countries from exchanging their dollars for gold.

"Therefore, the US saying: 'Please just hold the dollars, okay? Thank you.

"Or invest in our US Treasury bonds.”

"Basically, the US has often told the European Union (EU): 'Do not create your own deficit in balance of payments. Please do not create so many euros that the Euro will end up being a rival to the dollar. We only want countries that hold the dollar.'

"That’s a kind of tribute.

"These countries therefore finance the US balance of payments deficit."

Why does Communism fail every time it's tried?

miketx

Diamond Member

- Dec 25, 2015

- 121,555

- 70,536

- 2,645

- Banned

- #277

Oh oh! I know, I know! The liberal shit stains haven't done it right?Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )The US has used its creditor and debtor status to gain control of other countries's economies since the end of WWI. The gold standard never held in times of major conflicts, and once the US began its occupation of South Vietnam, it gave way completely.'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate

Over the past few decades, international finance seems to have provided many of the same benefits as military occupation without the threat to social order we saw during Vietnam.

Super-Imperialism at the Pentagon | Michael Hudson

"After World War II, the US created the World Bank and the International Monetary Fund IMF. These instruments were created as essential control mechanisms to control other countries financially.

"This became particularly apparent after the US abolished its gold-standard in 1971.

"Since then, the US has always sought to force other states to hold their own currency reserves in US dollars.

"That means that those governments must then obtain the money through the US Federal Reserve.

"To make it clear: You buy US government bonds, most central banks do not buy stocks or companies, they buy government bonds.

"At least that was the case until recently."

"Dollars have been pumped into the world economic cycle for a long time, also to finance the military spending of the United States. As a result, the private sector is in a fairly difficult position.

"So briefly stated: The US military spending is pumping a lot of dollars into foreign economies. Those central banks are told by the FED, they should hold these dollars, including central banks of Europe, central banks of the Third World, China and such.

"Then – in turn – to buy these US government bonds, the buying central banks then lend exactly those dollars back to the US Federal Reserve.

"In effect, these states are actually financing the US military budget. As you can see, this is a circular cycle. So: Foreign countries are paying the US military budget. This is the common unipolar policy of the United States."

I love your Marxist sources.

Very convincing.Why does the US start so many wars?I love your Marxist sources.

Very convincing.

"Is this the reason why the US government leads so many wars worldwide?

Super-Imperialism at the Pentagon | Michael Hudson

"The United States lost almost the entire stock of US state gold during the Vietnam War.

"The problem: Keeping a war going is very expensive.

"The key is to balance the expenses.

"The limit is the balance of payments.

"In principle, the US has created all this about its own balance of payments deficit.

"How can the US now entertain its huge global military apparatus?

"They can only do that if the dollar value does not go down.

"That’s why the US has always been about keeping other countries from exchanging their dollars for gold.

"Therefore, the US saying: 'Please just hold the dollars, okay? Thank you.

"Or invest in our US Treasury bonds.”

"Basically, the US has often told the European Union (EU): 'Do not create your own deficit in balance of payments. Please do not create so many euros that the Euro will end up being a rival to the dollar. We only want countries that hold the dollar.'

"That’s a kind of tribute.

"These countries therefore finance the US balance of payments deficit."

Why does Communism fail every time it's tried?

georgephillip

Diamond Member

- Thread starter

- #278

Circa 1945

'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate. Indeed, over the next quarter century the canons of financial orthodoxy found intermittent, and sometimes poignant, expression under President Harry Truman and Dwight D. Eisenhower, and the long-reigning Fed chairman William McChesney Martin. Even President John F. Kennedy kept orthodoxy alive, at least in the Treasury Department and its international dollar policies.

So the road from Pearl Harbor to Richard Nixon's decision to default on the nationa's Bretton Woods obligation to redeem its debts in gold, eventually ushering in printing-press money and giant fiscal deficits, is important to retrace.

....

And rarely noted is that President Kennedy's first economic policy address was a ringing commitment to maintain the nation's Bretton Woods obligations and to defend the gold dollar.

....

The American Empire and the End of Sound Money....The London Gold Market Panic of October 1960: A Shot Across the Keynesian Bow

At the time, the London gold market was a genuine free market in which traders, both private parties and official institutions, could buy or sell gold at an auction price. It functioned parallel to the official Bretton Woods system under which transfers of gold among nations in settlement of payments imbalances occurred exclusively between central banks, and only at the official parities centered on $35 gold. The rub was that this gold settlement process under the official Bretton Woods was highly discretionary and political, not automatic and market driven as under the pre-1014 gold standard. Consequently, official gold settlements did not necessarily "clear the market" and fore immediate monetary tightening and economic adjustments in the deficit countries, as occurred under the classic gold standard mechanism.

Under dollar-based gold exchange standard, in fact, trading partners with dollar surpluses could be "persuaded" (by Washington) to forego the conversion of these dollars at the U.S. gold window. They were instead forced to accumulate short-term dollar claims which counted as monetary "reserve" assets.

As the hegemonic power during the early Cold War era, the United States self-evidently had the wherewithal to enforce a de facto policy of involuntary reserve accumulation. The overseas hoard of dollars piled up in foreign central banks was thereby steadily enlarged, even as the U.S. balance of payments deficits grew during the 1960s and remained uncured.

The one escape valve was the ability of countries with unwanted dollars to quietly swap them for gold in the London market. Accordingly, in the early days of Bretton Woods, bureaucrats at the International Monetary Fund (IMF) made efforts to get participants to outlaw private gold markets.

They recognized that someday official parities could be threatened if the free market price of gold diverged too far from $35 per ounce. But the presence of makeshift private gold markets in places like macau, Tangiers and Hong Kong, along with the steady clandestine sale of gold for desperately needed har currency by the Soviet Union, finally encouraged the Bank of England to reopen the old London gold market in March 1954.'

(Stockman, op cit )The US has used its creditor and debtor status to gain control of other countries's economies since the end of WWI. The gold standard never held in times of major conflicts, and once the US began its occupation of South Vietnam, it gave way completely.'The New Deal's ad hoc statism was eventually superseded by the real thing: the full-bore warfare state spawned by the Japanese attack on Pearl Harbor. Under the exigencies of total war, all of the tools of modern fiscal expansion and monetary manipulation were discovered, tested, amended, and perfected. But when peace came in 1945, the victory of these warfare state-inspired policy tools was neither complete nor immediate

Over the past few decades, international finance seems to have provided many of the same benefits as military occupation without the threat to social order we saw during Vietnam.

Super-Imperialism at the Pentagon | Michael Hudson

"After World War II, the US created the World Bank and the International Monetary Fund IMF. These instruments were created as essential control mechanisms to control other countries financially.

"This became particularly apparent after the US abolished its gold-standard in 1971.

"Since then, the US has always sought to force other states to hold their own currency reserves in US dollars.

"That means that those governments must then obtain the money through the US Federal Reserve.

"To make it clear: You buy US government bonds, most central banks do not buy stocks or companies, they buy government bonds.

"At least that was the case until recently."

"Dollars have been pumped into the world economic cycle for a long time, also to finance the military spending of the United States. As a result, the private sector is in a fairly difficult position.

"So briefly stated: The US military spending is pumping a lot of dollars into foreign economies. Those central banks are told by the FED, they should hold these dollars, including central banks of Europe, central banks of the Third World, China and such.

"Then – in turn – to buy these US government bonds, the buying central banks then lend exactly those dollars back to the US Federal Reserve.

"In effect, these states are actually financing the US military budget. As you can see, this is a circular cycle. So: Foreign countries are paying the US military budget. This is the common unipolar policy of the United States."

I love your Marxist sources.

Very convincing.Why does the US start so many wars?I love your Marxist sources.

Very convincing.

"Is this the reason why the US government leads so many wars worldwide?

Super-Imperialism at the Pentagon | Michael Hudson

"The United States lost almost the entire stock of US state gold during the Vietnam War.

"The problem: Keeping a war going is very expensive.

"The key is to balance the expenses.

"The limit is the balance of payments.

"In principle, the US has created all this about its own balance of payments deficit.

"How can the US now entertain its huge global military apparatus?

"They can only do that if the dollar value does not go down.

"That’s why the US has always been about keeping other countries from exchanging their dollars for gold.

"Therefore, the US saying: 'Please just hold the dollars, okay? Thank you.

"Or invest in our US Treasury bonds.”

"Basically, the US has often told the European Union (EU): 'Do not create your own deficit in balance of payments. Please do not create so many euros that the Euro will end up being a rival to the dollar. We only want countries that hold the dollar.'

"That’s a kind of tribute.

"These countries therefore finance the US balance of payments deficit."

Why does Communism fail every time it's tried?

Lack of a global reserve currency?Why does Communism fail every time it's tried?

Not enough hired killers?

Why do you think capitalism kills everything it touches?

georgephillip

Diamond Member

- Thread starter

- #279

Have the shit stains made America Great yet?Oh oh! I know, I know! The liberal shit stains haven't done it right?Circa 1945