hazlnut

Gold Member

- Sep 18, 2012

- 12,387

- 1,923

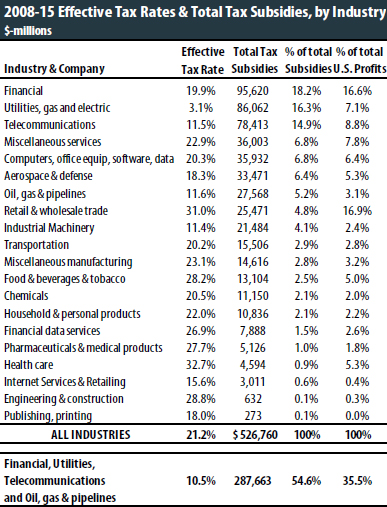

The 35 Percent Corporate Tax Myth

Corporate Tax Avoidance by Fortune 500 Companies, 2008 to 2015

I know, realizing you've been lied to by Fox News hosts you've trusted… it hurts.

Corporate Tax Avoidance by Fortune 500 Companies, 2008 to 2015

I know, realizing you've been lied to by Fox News hosts you've trusted… it hurts.