- Thread starter

- #21

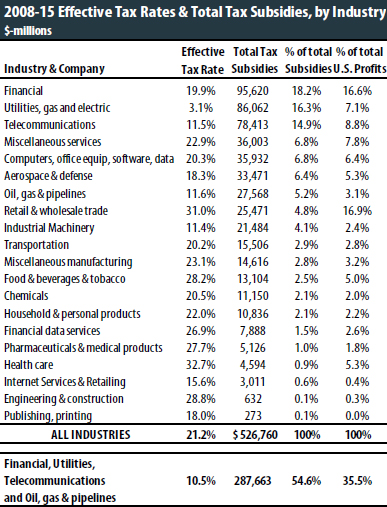

Tax Subsidies by Industry:

We also looked at the size of the total tax subsidies received by each industry for the 258 companies in our study. Among the notable findings:

• 55 percent of the total tax subsidies went to just four industries: financial, utilities, telecommunications, and oil, gas & pipelines — even though these companies only enjoyed 35.5 percent of the U.S. profits in our sample.

• Other industries receive a disproportionately small share of tax subsidies. Companies engaged in retail and wholesale trade, for example, represented 17 percent of the eight-year U.S. profits in our sample, but enjoyed less than 5 percent of the tax subsidies.

It seems rather odd, not to mention highly wasteful, that the industries with the largest subsidies are ones that would seem to need them least. Regulated utilities, for example, make investment decisions in concert with their regulators based on needs of communities they serve. Oil and gas companies are so profitable that even President George W. Bush said they did not need tax breaks. He could have said the same about telecommunications companies. Financial companies get so much federal support that adding huge tax breaks on top of that seems unnecessary.

HISTORICAL COMPARISONS OF TAX RATES AND TAX SUBSIDIES

How do our results for 2008 to 2015 compare to corporate tax rates in earlier years? The answer illustrates how corporations have managed to get around some of the corporate tax reforms enacted in 1986, and how tax avoidance has surged with the help of our political leaders.

By 1986, President Ronald Reagan fully repudiated his earlier policy of showering tax breaks on corporations. Reagan’s Tax Reform Act of 1986 closed tens of billions of dollars in corporate loopholes, so that by 1988, our survey of large corporations (published in 1989) found that the overall effective corporate tax rate was up to 26.5 percent, compared to only 14.1 percent in 1981-83.[2] That improvement occurred even though the statutory corporate tax rate was cut from 46 percent to 34 percent as part of the 1986 reforms.[3]

In the 1990s, however, many corporations began to find ways around the 1986 reforms, abetted by changes in the tax laws as well as by tax-avoidance schemes devised by major accounting firms. As a result, in our 1996 to1998 survey of 250 companies, we found that their average effective corporate tax rate had fallen to only 21.7 percent. Our September 2004 study found that corporate tax cuts adopted in 2002 had driven the effective rate down to only 17.2 percent in 2002 and 2003. The eight-year average rate found in the current study is only slightly higher, at 21.2 percent.

As a share of GDP, overall federal corporate tax collections in fiscal 2002 and 2003 fell to only 1.24 percent. At the time, that was their lowest sustained level as a share of the economy since World War II. Corporate taxes as a share of GDP recovered somewhat in the mid-2000s after the 2002-enacted tax breaks expired, averaging 2.3 percent of GDP from fiscal 2004 through fiscal 2008. But over the past five fiscal years (2011 to 2015) that this study examines, total corporate income tax payments fell back to only 1.6 percent of GDP on average.

Corporate taxes paid for more than a quarter of federal outlays in the 1950s and a fifth in the 1960s. They began to decline during the Nixon administration and remained low in the Reagan era. By fiscal year 2015, corporate taxes paid for a mere 10.6 percent of the federal government’s expenses.

In this context, it seems odd that anyone would insist that corporate tax reform should be “revenue neutral.” If we are going to get our nation’s fiscal house back in order, increasing corporate income tax revenues should play an important role.

Hilly's husband pardoned the most notorious corporate criminal in history while he was on the FBI 10 most wanted for a couple of bucks donated to the Clinton library. That's the way the hypocrite democrat institution works. Barry Hussein didn't just give corporate breaks to so-called alternate energy enterprises. He gave away billions in taxpayer dollars to Solindra against advice from experts and Solindra corporate execs retired in comfort when the company went under. Democrats don't hate corporations, they are corporations. What they hate is smart republican administrations who don't care about the political bullshit.

I'd like to take the time to read this bullshit, but it's just cut and pasted shit like regressive parasite posts and ends up getting debunked and ridiculed.

No one is under any delusions the "rich" are getting soaked by the feds. They OWN the feds.

Conservatives want to take power away from the feds and make them less valuable to sociopaths who buy senate campaigns and presidents. They still pay almost all the fucking taxes, but bed wetting parasites won't be satisfied until everyone is as poor and worthless as they are.

You gotta love a leftist who is phony as the day is long. Do you think the leftist knows that corporations are NOT people, lol. Where do they GET their money to pay taxes? FROM PEOPLE! So what happens when taxes go up? Why prices go up, which means people are the ones actually paying the taxes. You see, corporations are NOT taxed, they are TAX COLLECTORS!

So, let me get this straight…. I'm not really taxed… I'm collecting taxes from by boss via my paycheck and giving a portion to the IRS…. (by your logic)

How come when I get a refund I don't have to give it back to the boss?

Wow, you're a fucking genius….

Why prices go up? -- um that's two semesters in an MBA program or econ school. Start with supply and demand.

How about when the market economy detached from the Real Economy starting in the 1980s and corps realized in order to stay "competitive" in the market economy they had to pay high dividends to share holders (hint: those are not customers) -- if they didn't pay healthy dividends their share price dropped and they'd be vulnerable to corporate raiders.

Also, prices on consumer goods in the U.S. are highly completive… you know, once we started making things in Mexico and China… (labor .90/hr)

The level of ignorance you revealed with your "Prices go up" comment is just staggering...Don't fucking post in my thread unless you KNOW WHAT YOU ARE TALKING ABOUT.

Claro?