Ray From Cleveland

Diamond Member

- Aug 16, 2015

- 97,215

- 37,439

- 2,290

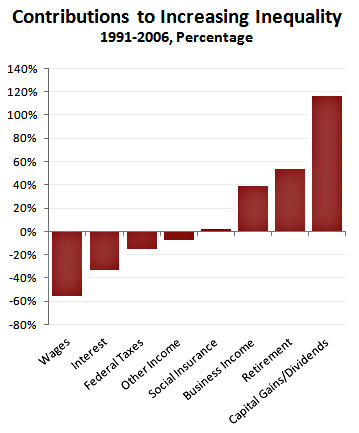

You are stuck on income taxes, and refusing to look at all taxes. Are you stupid?It is truly sad that average Americans fail to see the fraud being committed against them, with this absurd wealth inequality.

Do they really think the 1% deserve socialism, but the poor get rigged individualism?

Your complaint falls on deaf ears because you refuse to separate taxes. There are different taxes for different things. Nearly half of our country pays no income taxes while the top 20% pay close to 90% of all collected income taxes. and yet, people think they should be paying even more than 88%. So how much more should they be paying? Because when I ask people that question, nobody can come up with a straight answer.

As I explained, those other taxes are for infrastructure that everybody uses. You are paying for the services rendered to you. Even still, the wealthy are paying more into those programs as well. And as I explained, you get much or all of your social program tax back when you retire. So is it really a tax when they take money from you, and give it back later???

Your state and local taxes are nothing. The big deductions are SS and FISA tax, followed by Medicare. FISA is just a fancy acronym for SS and Medicare. That's what it's used for.

Now if you take those out of the mix, the poor and middle-class are not paying much in those other taxes at all, and the well-to-do people are still paying more into those coffers than you and I are.