- Thread starter

- #121

LOl! And how do you think I feel about you?By not creating and passing an actual Budget the House Democrats broke the law, as I already mentioned a Budget is required by Law every year...

The fact that you did not know that, did not know that out of control spending is one of the results of not producing a budget, and your refusal to acknowledge the Democrats have been wasting millions of tax dollars on their 3.5 year coup attempt for the PARTY'S benefit makes talking to you a waste of time, which perfectly describes this thread.

Your intelligence is wasted on BWK. Clearly from the OP.

The one you're attempting to educate and reason with is intellectually equivalent to .....

View attachment 297652

Last edited:

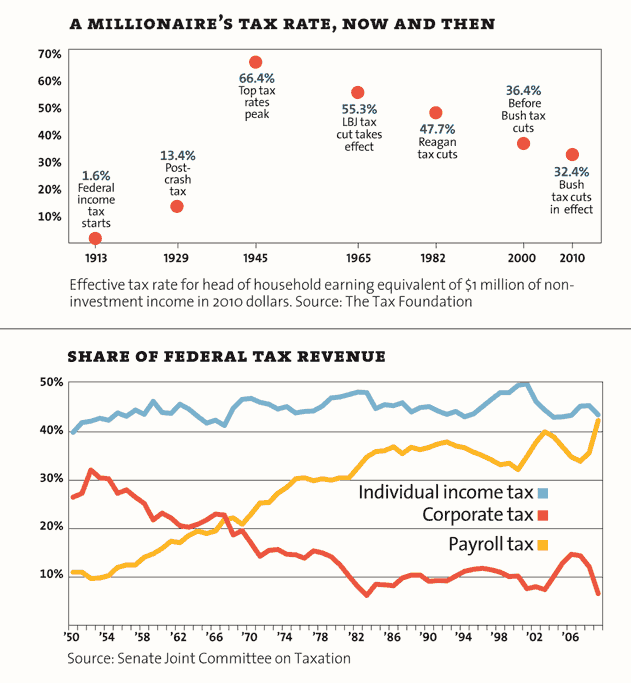

I thought the Republican party was the conservative party that was all about spending cuts to keep the deficit down?

I thought the Republican party was the conservative party that was all about spending cuts to keep the deficit down?