Dad2three

Gold Member

Wow!

Look at five Liberal Roosevelt-groupies screech, howl, and fume over the truth being revealed!!!

And pouring more truth-gasoline on this fire is my guilty pleasure.

How about some more?

"We have tried spending money. We are spending more than we have ever spent before and it does not work."

And FDR's Treasury Secretary also told Congress:

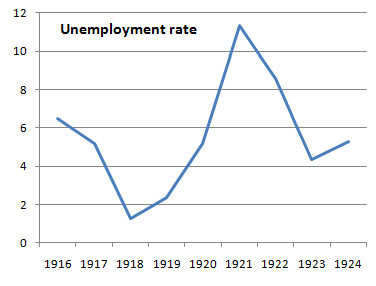

"I say after eight years of this Administration we have just as much unemployment as when we started. ... And an enormous debt to boot!"

Morgenthau made this“startling confession,” as historian Burton W. Folsom Jr. calls it, during the seventh year of FDR’s New Deal programs to combat the rampant unemployment of the Great Depression.

“In these words, Morgenthau summarized a decade of disaster, especially during the years Roosevelt was in power. Indeed average unemployment for the whole year in 1939 would be higher than that in 1931, the year before Roosevelt captured the presidency from Herbert Hoover,”Folsom writes in his new book, “New Deal or Raw Deal?: How FDR’s Economic Legacy Has Damaged America.”

Indeed, with those words, Morgenthau confessed what so many keepers of FDR’s flame won’t admit today: The New Deal was failed public policy. Massive spending on public works programs didn’t erase historic unemployment. It didn’t produce a recovery.

Some of the most desperate defenders of New Deal doctrine are getting a little shrill about this hard truth. It’s an important truth, nevertheless, especially because the same characters insist that Barack Obama must push through a “bold” economic stimulus that depends on hundreds of billions in new government spending to create or “save” jobs.

Budget and financial experts here at The Heritage Foundation are among cooler heads cautioning that President Obama ought not to repeat President Roosevelt’s mistakes. In one such effort, Heritage last week distributeda chart showing that FDR’s programs didn’t succeed in pushing unemployment below 20 percent.

'We're Spending More Than Ever and It Doesn't Work'

the most desperate defenders of New Deal doctrine are getting a little shrill ...

Morgenthau confessed what so many keepers of FDR’s flame won’t admit today...

average unemployment for the whole year in 1939 would be higher than that in 1931

FDR made it worse, and never.....never.....accomplished his goals!!!

How odd that by the diary date---1939--FDR was only in office for six years yet his own Treasury Sec says they'd been doing it for eight years.

You'd think he'd get the years he'd been working there correct, I mean it's a lot easier than the numbers involving a national budget.