CrusaderFrank

Diamond Member

- May 20, 2009

- 146,680

- 69,826

- 2,330

Morgenthal quote when run thru the Prog Context Filter, "Obama's the greatest!"

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

His name was Morgenthau Frank, not Morganthal. The topic of his quote had nothing to do with today and Obama. He was discussing using government guaranteed loans and federally financed jobs programs in 1939. Nothing was wrong with his ideas and concepts. They just weren't compatible with FDR's programs at the time. You are obsessed.Morgenthal quote when run thru the Prog Context Filter, "Obama's the greatest!"

In case you didn't notice, after GOP presidencies of the 1920's, they never were able to gain the White House for a generation...Because of how they handled the economy...

The way "they handled the economy..." was known as the 'Roaring Twenties."

And, of course, Republican President Harding was far superior to Democrat Roosevelt in fighting recessions.

The Roaring Twenties were the period of sustained economic prosperity with a distinctive cultural edge in New York, Montreal, Chicago, Detroit, Paris, Berlin, London, Los Angeles, and many other major cities during the 1920s in the United States, Canada and Europe.

Roaring Twenties - Wikipedia, the free encyclopedia

Wikipedia, the free encyclopediaRoaring_Twenties

Must I teach you obvious things like this each and every day???????

1921 and All That

The recovery from the 1920-21 recession supposedly demonstrates that deflation and hands-off monetary policy is the way to go.

But have the people making these arguments really looked at what happened back then? Or are they relying on vague impressions about a distant episode, with bad data, that has been spun as a confirmation of their beliefs?

OK, I’m not going to invest a lot in this. But even a cursory examination of the available data suggests that 1921 has few useful lessons for the kind of slump we’re facing now.

Brad DeLong has recently written up a clearer version of a story I’ve been telling for a while (actually since before the 2008 crisis) — namely, that there’s a big difference between inflation-fighting recessions, in which the Fed squeezes to bring inflation down, then relaxes — and recessions brought on by overstretch in debt and investment. The former tend to be V-shaped, with a rapid recovery once the Fed relents; the latter tend to be slow, because it’s much harder to push private spending higher than to stop holding it down.

And the 1920-21 recession was basically an inflation-fighting recession — although the Fed was trying to bring the level of prices, rather than the rate of change, down. What you had was a postwar bulge in prices, which was then reversed:

Money was tightened, then loosened again:

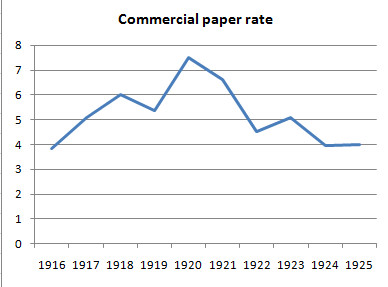

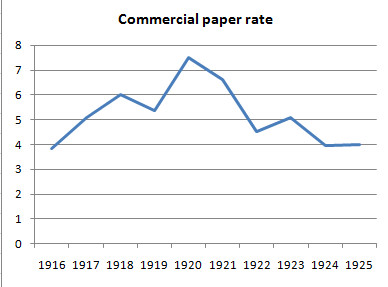

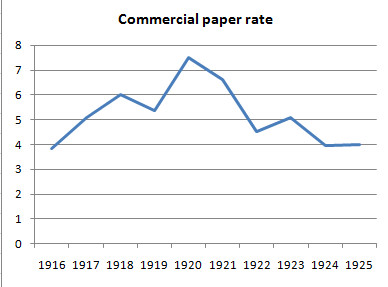

Discount rates are a problematic indicator, but here’s what happened to commercial paper rates:

Historical statistics, Millennial edition

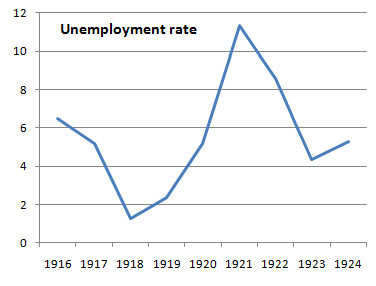

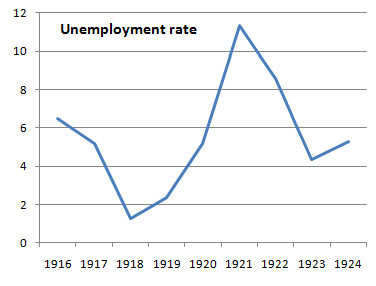

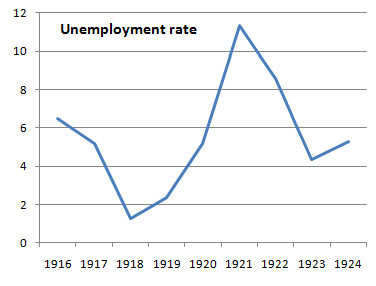

And so there was a V-shaped recovery:

The deflation may have helped by increasing the real money supply — at least Meltzer thinks so (pdf) — but if so, the key point was that the economy was nowhere near the zero lower bound, so there was plenty of room for the conventional monetary channel to work.

All of this has zero relevance to an economy in our current situation, in which the recession was brought on by private overstretch, not tight money, and in which the zero lower bound is all too binding.

So do we have anything to learn from the macroeconomics of Warren Harding? No.

http://krugman.blogs.nytimes.com/2011/04/01/1921-and-all-that/

YES, HOOVER INHERITED HARDING/COOLIDGE'S BUBBLE, AND COULDN'T FIX IT IN 3+ YEARS.

Those who do not learn history are probably voting for Democrats

Obama still has the biggest deficits in recorded history

Remember when Obama was totally against the Brutal Sequester spending cuts?

Morgenthal quote when run thru the Prog Context Filter, "Obama's the greatest!"

It roared alright, until the house of cards that created it came to a crashing halt, literally: Causes of the Great DepressionThe way "they handled the economy..." was known as the 'Roaring Twenties."

And, of course, Republican President Harding was far superior to Democrat Roosevelt in fighting recessions.

The Roaring Twenties were the period of sustained economic prosperity with a distinctive cultural edge in New York, Montreal, Chicago, Detroit, Paris, Berlin, London, Los Angeles, and many other major cities during the 1920s in the United States, Canada and Europe.

Roaring Twenties - Wikipedia, the free encyclopedia

Wikipedia, the free encyclopediaRoaring_Twenties

Must I teach you obvious things like this each and every day???????

The causes that catapulted the recession into the 'Great Depression' were

1. The actions of the federal reserve

2. The sky-high Smoot-Hawley Tariff

3. The actions of Hoover that were continued by

Roosevelt

4. And, mainly, the abject ineptitude of Roosevelt.

a. In 1935, the Brookings Institution (left-leaning) delivered a 900-page report on the New Deal and the National Recovery Administration, concluding that “ on the whole it retarded recovery.”

article - AEI

I'd be happy to provide a list of the lies of Roosevelt that magnified and advanced the problems....

...say the word.

More of your lies. Unemployment peaked in Roosevelt's first year. EVERYTHING got better from then on.

1. Arthur Schlesinger, Jr., liberal New Deal historian wrote in The National Experience, in 1963, “Though the policies of the Hundred Days had ended despair, they had not produce recovery…” He also wrote honestly about the devastating crash of 1937- in the midst of the “second New Deal” and Roosevelt’s second term. “The collapse in the months after September 1937 was actually more severe than it had been in the first nine months of the depression: national income fell 13 %, payrolls 35 %, durable goods production 50 %, profits 78% .

Now you tell us how 1937 was worse than 32 or 33.

Hardly, as the sky is not a physical limitation...1921 and All That

The recovery from the 1920-21 recession supposedly demonstrates that deflation and hands-off monetary policy is the way to go.

But have the people making these arguments really looked at what happened back then? Or are they relying on vague impressions about a distant episode, with bad data, that has been spun as a confirmation of their beliefs?

OK, I’m not going to invest a lot in this. But even a cursory examination of the available data suggests that 1921 has few useful lessons for the kind of slump we’re facing now.

Brad DeLong has recently written up a clearer version of a story I’ve been telling for a while (actually since before the 2008 crisis) — namely, that there’s a big difference between inflation-fighting recessions, in which the Fed squeezes to bring inflation down, then relaxes — and recessions brought on by overstretch in debt and investment. The former tend to be V-shaped, with a rapid recovery once the Fed relents; the latter tend to be slow, because it’s much harder to push private spending higher than to stop holding it down.

And the 1920-21 recession was basically an inflation-fighting recession — although the Fed was trying to bring the level of prices, rather than the rate of change, down. What you had was a postwar bulge in prices, which was then reversed:

Money was tightened, then loosened again:

Discount rates are a problematic indicator, but here’s what happened to commercial paper rates:

Historical statistics, Millennial edition

And so there was a V-shaped recovery:

The deflation may have helped by increasing the real money supply — at least Meltzer thinks so (pdf) — but if so, the key point was that the economy was nowhere near the zero lower bound, so there was plenty of room for the conventional monetary channel to work.

All of this has zero relevance to an economy in our current situation, in which the recession was brought on by private overstretch, not tight money, and in which the zero lower bound is all too binding.

So do we have anything to learn from the macroeconomics of Warren Harding? No.

http://krugman.blogs.nytimes.com/2011/04/01/1921-and-all-that/

YES, HOOVER INHERITED HARDING/COOLIDGE'S BUBBLE, AND COULDN'T FIX IT IN 3+ YEARS.

Those who do not learn history are probably voting for Democrats

Clinton raised the national debt by 41%.

Obama raised it to the sky.

How come you ignored "Clinton raised the national debt 41%"?

They evidently did not listen to their conservative masters in a monarchy and legislature of their home country...we all enjoy letting someone tell us what is better,,,good thing the Founders didn't listen...

Oh, but they did. You should read their writings sometime.

It roared alright, until the house of cards that created it came to a crashing halt, literally: Causes of the Great Depression

The causes that catapulted the recession into the 'Great Depression' were

1. The actions of the federal reserve

2. The sky-high Smoot-Hawley Tariff

3. The actions of Hoover that were continued by

Roosevelt

4. And, mainly, the abject ineptitude of Roosevelt.

a. In 1935, the Brookings Institution (left-leaning) delivered a 900-page report on the New Deal and the National Recovery Administration, concluding that “ on the whole it retarded recovery.”

article - AEI

I'd be happy to provide a list of the lies of Roosevelt that magnified and advanced the problems....

...say the word.

More of your lies. Unemployment peaked in Roosevelt's first year. EVERYTHING got better from then on.

1. Arthur Schlesinger, Jr., liberal New Deal historian wrote in The National Experience, in 1963, “Though the policies of the Hundred Days had ended despair, they had not produce recovery…” He also wrote honestly about the devastating crash of 1937- in the midst of the “second New Deal” and Roosevelt’s second term. “The collapse in the months after September 1937 was actually more severe than it had been in the first nine months of the depression: national income fell 13 %, payrolls 35 %, durable goods production 50 %, profits 78% .

Now you tell us how 1937 was worse than 32 or 33.

I guess she won't be showing us this anytime soon.

btw, for anyone relatively new around here, this is about the 10th time PoliticalChic has run in this 'argument' of hers,

every time with the same old worn out propaganda, and she's lost the argument every time.

Their patience mattered little to the King, or the Conservatives who supported him, and fled to Canada eh?They didn't just wake up one morning and say "let's start a revolution".

Their patience mattered little to the King, or the Conservatives who supported him, and fled to Canada eh?They didn't just wake up one morning and say "let's start a revolution".

I believe that every president has raised the debt, but for one, Andrew Jackson...Hardly, as the sky is not a physical limitation...Those who do not learn history are probably voting for Democrats

Clinton raised the national debt by 41%.

Obama raised it to the sky.

How come you ignored "Clinton raised the national debt 41%"?

Nope, but I saw it ooze back under ground, like most of what gets said here...Their patience mattered little to the King, or the Conservatives who supported him, and fled to Canada eh?They didn't just wake up one morning and say "let's start a revolution".

Did you feel the draft as that flew over your head ?

I believe that every president has raised the debt, but for one, Andrew Jackson...Hardly, as the sky is not a physical limitation...

Clinton raised the national debt by 41%.

Obama raised it to the sky.

How come you ignored "Clinton raised the national debt 41%"?

I thought Clinton actually lowered it.

The causes that catapulted the recession into the 'Great Depression' were

1. The actions of the federal reserve

2. The sky-high Smoot-Hawley Tariff

3. The actions of Hoover that were continued by

Roosevelt

4. And, mainly, the abject ineptitude of Roosevelt.

a. In 1935, the Brookings Institution (left-leaning) delivered a 900-page report on the New Deal and the National Recovery Administration, concluding that “ on the whole it retarded recovery.”

article - AEI

I'd be happy to provide a list of the lies of Roosevelt that magnified and advanced the problems....

...say the word.

More of your lies. Unemployment peaked in Roosevelt's first year. EVERYTHING got better from then on.

1. Arthur Schlesinger, Jr., liberal New Deal historian wrote in The National Experience, in 1963, “Though the policies of the Hundred Days had ended despair, they had not produce recovery…” He also wrote honestly about the devastating crash of 1937- in the midst of the “second New Deal” and Roosevelt’s second term. “The collapse in the months after September 1937 was actually more severe than it had been in the first nine months of the depression: national income fell 13 %, payrolls 35 %, durable goods production 50 %, profits 78% .

Now you tell us how 1937 was worse than 32 or 33.

I guess she won't be showing us this anytime soon.

btw, for anyone relatively new around here, this is about the 10th time PoliticalChic has run in this 'argument' of hers,

every time with the same old worn out propaganda, and she's lost the argument every time.

Not to you.

Wow!

Look at five Liberal Roosevelt-groupies screech, howl, and fume over the truth being revealed!!!

And pouring more truth-gasoline on this fire is my guilty pleasure.

How about some more?

"We have tried spending money. We are spending more than we have ever spent before and it does not work."

And FDR's Treasury Secretary also told Congress:

"I say after eight years of this Administration we have just as much unemployment as when we started. ... And an enormous debt to boot!"

Morgenthau made this“startling confession,” as historian Burton W. Folsom Jr. calls it, during the seventh year of FDR’s New Deal programs to combat the rampant unemployment of the Great Depression.

“In these words, Morgenthau summarized a decade of disaster, especially during the years Roosevelt was in power. Indeed average unemployment for the whole year in 1939 would be higher than that in 1931, the year before Roosevelt captured the presidency from Herbert Hoover,”Folsom writes in his new book, “New Deal or Raw Deal?: How FDR’s Economic Legacy Has Damaged America.”

Indeed, with those words, Morgenthau confessed what so many keepers of FDR’s flame won’t admit today: The New Deal was failed public policy. Massive spending on public works programs didn’t erase historic unemployment. It didn’t produce a recovery.

Some of the most desperate defenders of New Deal doctrine are getting a little shrill about this hard truth. It’s an important truth, nevertheless, especially because the same characters insist that Barack Obama must push through a “bold” economic stimulus that depends on hundreds of billions in new government spending to create or “save” jobs.

Budget and financial experts here at The Heritage Foundation are among cooler heads cautioning that President Obama ought not to repeat President Roosevelt’s mistakes. In one such effort, Heritage last week distributeda chart showing that FDR’s programs didn’t succeed in pushing unemployment below 20 percent.

'We're Spending More Than Ever and It Doesn't Work'

the most desperate defenders of New Deal doctrine are getting a little shrill ...

Morgenthau confessed what so many keepers of FDR’s flame won’t admit today...

average unemployment for the whole year in 1939 would be higher than that in 1931

FDR made it worse, and never.....never.....accomplished his goals!!!

Wow!

Look at five Liberal Roosevelt-groupies screech, howl, and fume over the truth being revealed!!!

And pouring more truth-gasoline on this fire is my guilty pleasure.

How about some more?

"We have tried spending money. We are spending more than we have ever spent before and it does not work."

And FDR's Treasury Secretary also told Congress:

"I say after eight years of this Administration we have just as much unemployment as when we started. ... And an enormous debt to boot!"

Morgenthau made this“startling confession,” as historian Burton W. Folsom Jr. calls it, during the seventh year of FDR’s New Deal programs to combat the rampant unemployment of the Great Depression.

“In these words, Morgenthau summarized a decade of disaster, especially during the years Roosevelt was in power. Indeed average unemployment for the whole year in 1939 would be higher than that in 1931, the year before Roosevelt captured the presidency from Herbert Hoover,”Folsom writes in his new book, “New Deal or Raw Deal?: How FDR’s Economic Legacy Has Damaged America.”

Indeed, with those words, Morgenthau confessed what so many keepers of FDR’s flame won’t admit today: The New Deal was failed public policy. Massive spending on public works programs didn’t erase historic unemployment. It didn’t produce a recovery.

Some of the most desperate defenders of New Deal doctrine are getting a little shrill about this hard truth. It’s an important truth, nevertheless, especially because the same characters insist that Barack Obama must push through a “bold” economic stimulus that depends on hundreds of billions in new government spending to create or “save” jobs.

Budget and financial experts here at The Heritage Foundation are among cooler heads cautioning that President Obama ought not to repeat President Roosevelt’s mistakes. In one such effort, Heritage last week distributeda chart showing that FDR’s programs didn’t succeed in pushing unemployment below 20 percent.

'We're Spending More Than Ever and It Doesn't Work'

the most desperate defenders of New Deal doctrine are getting a little shrill ...

Morgenthau confessed what so many keepers of FDR’s flame won’t admit today...

average unemployment for the whole year in 1939 would be higher than that in 1931

FDR made it worse, and never.....never.....accomplished his goals!!!

For the life of me Political Chic I can't understand how Conservatives could ever think they have been correct about economic theory when most of the time they moderate from a position of failure. The economy during the first four years of FDR's administration did quite well and only was interrupted in 1937 when he slashed spending trying to balance the budget while wrongly thinking the economy was well enough to sustain itself. Even then, GDP did not drop and was strong throughout the recovery. When FDR realized what was happening he reversed course and GDP soared by 10.9% in 1939 and industrial production was up by 23%. You might pay attention to the garbage you're getting your sourcing from, it looks like typical conservative tripe not worth the paper it's written on.

"I can't understand how Conservatives could ever think they have been correct about economic theory when most of the time they moderate from a position of failure."

Lots of things you can't understand...

Watch me make you eat those words.

1. "Henry Morgenthau, Jr. (/ˈmɔrɡənθɔː/; May 11, 1891 – February 6, 1967) was the U.S. Secretary of the Treasury during the administration of Franklin D. Roosevelt. He played a major role in designing and financing the New Deal."

Henry Morgenthau, Jr. - Wikipedia, the free encyclopedia.

2. Don't take my word for the ineptitude, here is Roosevelt BFF, secretary of the treasury, expert on finance and compendium of statistics on the economy of the 1930's:

"“We have tried spending money. We are spending more than we have ever spent before andit does not work.And I have just one interest, and if I am wrong…somebody else can have my job. I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises…I say after eight years of this administration we have just as much unemployment as when we started…And an enormous debt to boot!”

Morgenthau Diary, May 9, 1939, Franklin Roosevelt Presidential Library

a. In 1935, the Brookings Institution (left-leaning) delivered a 900-page report on the New Deal and the National Recovery Administration, concluding that “on the whole it retarded recovery.”

article - AEI

How ya' like them apples, boyyyyyeeeeeeee????

I thought the part you cut out was really cute: ."We have never begun to tax the people in this country the way they should be.... I don't pay what I should. People of my class don't. People who have it should pay.... After eight years of this administration we have just as much unemployment as when we started...and an enormous debt to boot!"[8]

Hardly, as the sky is not a physical limitation...1921 and All That

The recovery from the 1920-21 recession supposedly demonstrates that deflation and hands-off monetary policy is the way to go.

But have the people making these arguments really looked at what happened back then? Or are they relying on vague impressions about a distant episode, with bad data, that has been spun as a confirmation of their beliefs?

OK, I’m not going to invest a lot in this. But even a cursory examination of the available data suggests that 1921 has few useful lessons for the kind of slump we’re facing now.

Brad DeLong has recently written up a clearer version of a story I’ve been telling for a while (actually since before the 2008 crisis) — namely, that there’s a big difference between inflation-fighting recessions, in which the Fed squeezes to bring inflation down, then relaxes — and recessions brought on by overstretch in debt and investment. The former tend to be V-shaped, with a rapid recovery once the Fed relents; the latter tend to be slow, because it’s much harder to push private spending higher than to stop holding it down.

And the 1920-21 recession was basically an inflation-fighting recession — although the Fed was trying to bring the level of prices, rather than the rate of change, down. What you had was a postwar bulge in prices, which was then reversed:

Money was tightened, then loosened again:

Discount rates are a problematic indicator, but here’s what happened to commercial paper rates:

Historical statistics, Millennial edition

And so there was a V-shaped recovery:

The deflation may have helped by increasing the real money supply — at least Meltzer thinks so (pdf) — but if so, the key point was that the economy was nowhere near the zero lower bound, so there was plenty of room for the conventional monetary channel to work.

All of this has zero relevance to an economy in our current situation, in which the recession was brought on by private overstretch, not tight money, and in which the zero lower bound is all too binding.

So do we have anything to learn from the macroeconomics of Warren Harding? No.

http://krugman.blogs.nytimes.com/2011/04/01/1921-and-all-that/

YES, HOOVER INHERITED HARDING/COOLIDGE'S BUBBLE, AND COULDN'T FIX IT IN 3+ YEARS.

Those who do not learn history are probably voting for Democrats

Clinton raised the national debt by 41%.

Obama raised it to the sky.

How come you ignored "Clinton raised the national debt 41%"?

lol... what an amusing little troll thread