The5thHorseman

Platinum Member

- Nov 22, 2022

- 12,136

- 6,575

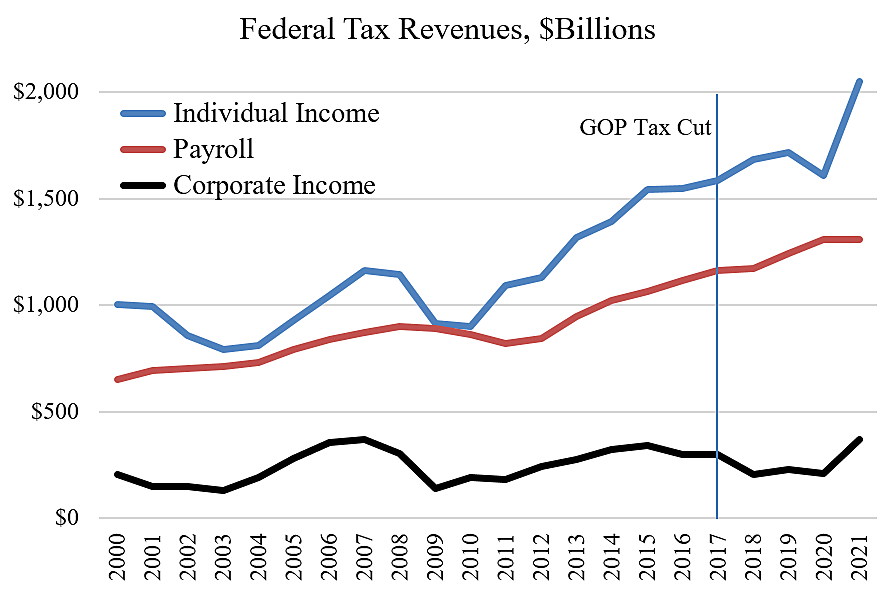

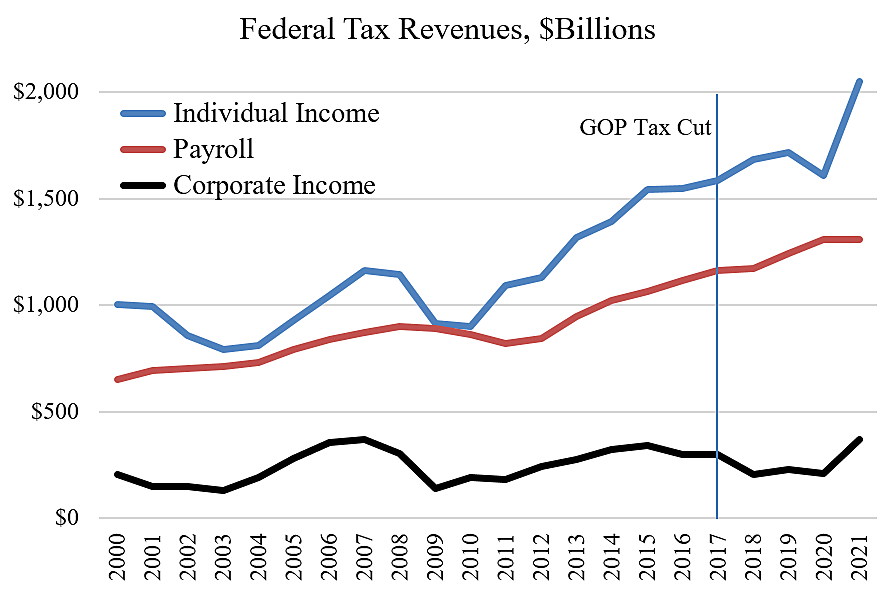

You haven't proven tax receipts went down due to Republican tax cuts. The only thing that has gotten worse is that we continue spending more.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You haven't proven tax receipts went down due to Republican tax cuts. The only thing that has gotten worse is that we continue spending more.

Post the growth rate of federal spending under the past 5 presidents, Bri..When are Dims going to understand the consequences of massive spending increases?

It is democrats who are clueless as the results of tax cuts.

Economists also generally agree that large tax changes can move the economy. For example, tax cuts can temporarily stimulate economic activity by boosting demand. In the longer run, a tax system with low rates and a broad base is more likely to promote prosperity than one with high rates and a narrow base.

Tax Policy Center › briefing-book › what-d...

The only reason why enemy democrats like tax increases is because they think that the wealthy are being punished. Even if the poor see no benefit and the middle class is hurt, democrats will cling to the idea that it takes from the rich and that's enough.

No they don't.Economists also generally agree that large tax changes can move the economy.

Nonsense. Of course they do. Who do you think is in the Tax Policy Institute.No they don't.

It’s a pretty basic concept. If spending is not adequately cut and taxes are cut (something republicans do), this means that there is less revenue to pay for spending. If bewilders me how republicans think you can cut taxes and think it doesn’t have consequences. We know it has consequences because the deficit blew up under Trump.

Oh and news flash: trickle down economics is not a real thing. Why would corporations bother investing in labor when it is easier for them to just keep the huge amount of money they save from tax cuts? After all their profits are already at an all time high.

United States Corporate Profits

Corporate Profits in the United States decreased to 2726.80 USD Billion in the first quarter of 2024 from 2803.20 USD Billion in the fourth quarter of 2023. This page provides the latest reported value for - United States Corporate Profits - plus previous releases, historical high and low...tradingeconomics.com

It isn't presidents who control spending. It's the House.Post the growth rate of federal spending under the past 5 presidents, Bri..

I suspect we're dealing with yet another example of your eager credulity.

Biden attempted to make the child tax credits permanent and pass a new permanent middle class tax cut for BBB but couldn’t get all the democrats on board. That’s definitely more than I can say for Republicans who didn’t even try.

I’m not giving you a link because I already know how your dumbass is going to react. You’re desperately going to ask new questions about it on the spot that you hope I won’t answer while never providing your own sources. You aren’t clever. Your game is just old. You have nothing intellectual to on offer this board.

Look it up yourself. Not only did the 2009 stimulus include a middle class tax cut, but it cut taxes for small businesses.

Biden attempted to make the child tax credits permanent and pass a new permanent middle class tax cut for BBB but couldn’t get all the democrats on board.

Why didn't he make the Trump cuts permanent? He'd have gotten Republican votes for that too.

He could have been a uniter, instead of a divider.

Not only did the 2009 stimulus include a middle class tax cut, but it cut taxes for small businesses.

Tax cut? You mean the temporary $600 credit? Why didn't he permanently cut middle class taxes?

Small business tax cut? You mean allowing 50% first year depreciation? Why didn't he make it 100%, like Trump did?

As far as boosting demand, this ONLY happens in the poor and middle class. It doesn’t boost demand for top earners.It is democrats who are clueless as the results of tax cuts.

Economists also generally agree that large tax changes can move the economy. For example, tax cuts can temporarily stimulate economic activity by boosting demand. In the longer run, a tax system with low rates and a broad base is more likely to promote prosperity than one with high rates and a narrow base.

Tax Policy Center › briefing-book › what-d...

The only reason why enemy democrats like tax increases is because they think that the wealthy are being punished. Even if the poor see no benefit and the middle class is hurt, democrats will cling to the idea that it takes from the rich and that's enough.

Moderate tax cuts usually do not reduce income to the federal spending monsterIt’s a pretty basic concept. If spending is not adequately cut and taxes are cut (something republicans do), this means that there is less revenue to pay for spending. If bewilders me how republicans think you can cut taxes and think it doesn’t have consequences. We know it has consequences because the deficit blew up under Trump.

Oh and news flash: trickle down economics is not a real thing. Why would corporations bother investing in labor when it is easier for them to just keep the huge amount of money they save from tax cuts? After all their profits are already at an all time high.

United States Corporate Profits

Corporate Profits in the United States decreased to 2726.80 USD Billion in the first quarter of 2024 from 2803.20 USD Billion in the fourth quarter of 2023. This page provides the latest reported value for - United States Corporate Profits - plus previous releases, historical high and low...tradingeconomics.com

Of course is does, dumbfuck. For one thing, it gives them more money to spend instead of handing it over to the government.As far as boosting demand, this ONLY happens in the poor and middle class. It doesn’t boost demand for top earners.

Please f yourself.Article I, Section 7 of the Constitution

All Bills for raising Revenue shall originate in the House of Representatives; but the Senate may propose or concur with Amendments as on other Bills.

Article I, Section 8 of the Constitution

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;To borrow Money on the credit of the United States;·

·

·

Moderate tax cuts usually do not reduce income to the federal spending monster

Its the ever growing spending thats the problem

Anyone on planet Earth can propose, numskull.Please f yourself.

President proposes...

Stop being an idiot.Nonsense. Of course they do. Who do you think is in the Tax Policy Institute.

Not spending, bri.Anyone on planet Earth can propose, numskull.

Please f yourself.

President proposes...

Stop being an idiot.

You can't name 3 economists.

Only 2 of whom are alive.Don't be shy...use the whole word.....

Thomas Sowell.....Walter Willaims.....Ludwig von Mises.....Friedrich Bastiat......Milton Friedman.......right off the top of my head.......

You are the one who thinks raising taxes is beneficial.Stop being an idiot.

You can't name 3 economists.

Only 2 of whom are alive.

At least one, just barely.