- Thread starter

- #221

[

Ughh. . . . Are you really incapable of grasping the simple, basic, indisputable facts at hand? We're talking about what happened after the massive 2003 tax cuts. Revenue rose 4 years in a row and was higher in the fifth and sixth years than it was in any of the first three years after the cuts were passed. This is Math 100 for GED students.

.

Bill Clinton raised taxes in 1993 and revenues rose for 7 years in a row.

Which is better? 4 years in a row or 7 years in a row?

LOL! Bill Clinton signed one of the biggest capital gains tax cuts in history and increased tax cuts for people with dependent children! Sheesh, seriously, how can you not know this stuff? Yes, Clinton raised some taxes, but he cut others, and he held spending to its lowest rate of increase since JFK, which is the opposite of what Obama has done.

Stand in front of a mirror and just dare yourself to read some facts:

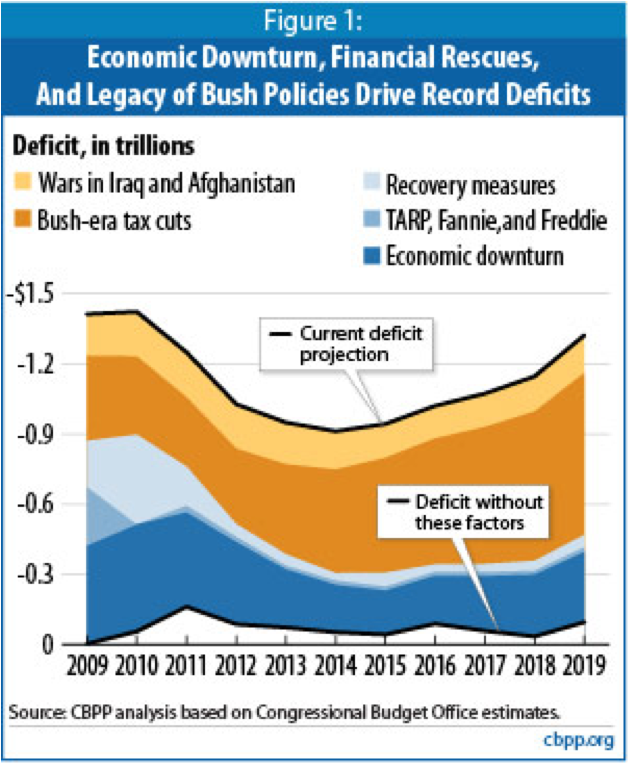

The Facts About Tax Cuts, Revenue, and Growth