BlindBoo

Diamond Member

- Sep 28, 2010

- 56,638

- 16,608

- 2,180

Not trolling - you missed my point.Obama could have prevented this by leading Democrats to pass their own Tax Reform Bill......except Democrats TAKE - they don't give back, and Obama was too busy funding terrorists around the world and illegals inside the US.

^^Russian Active Measure^^. Stop trolling my thread, you Russian troll.

Democrats could have prevented this when they held a near super majority control of Congress. They could have passed their own Tax Reform...but it was not a priority.

Yeah cause raising taxes during a massive recession, with stock prices tumbling and an economy that was losing a half a million jobs a month, would have been great for the country.......

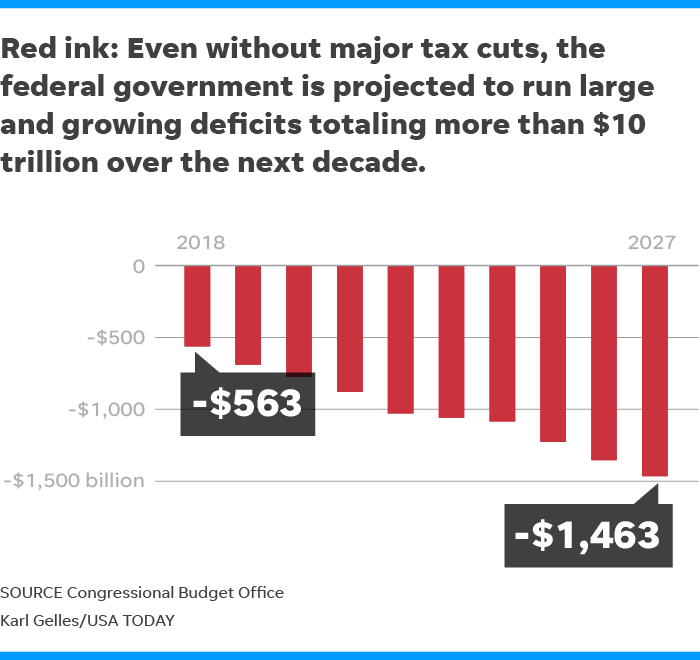

Trumps populism sure has morphed into elitism mighty fast. Immediately goes for a massive increase in the national debt by pushing a permanent large tax cut for the rich while making the working poor's tiny one temporary.

But spreading lies and sowing deception is part an parcel isn't it?

But then again if Americans are too stupid to remember 8 years ago by falling for that lame attempt then they deserve what they get. They did elect a Dumpster in Trump so it not impossible.