georgephillip

Diamond Member

- Thread starter

- #21

Research Study on Ongoing Crime Spree by Wall Street Mega Banks Gets News Blackout: Here's Why

"One day before Democrats on the House Financial Services Committee held an historic grilling of the CEOs of the mega banks on Wall Street, the nonprofit watchdog, Better Markets, released an in-depth research report on 'Wall Street’s Six Biggest Bailed-Out Banks: Their RAP Sheets & Their Ongoing Crime Spree....'"

"Wall Street On Parade, after carefully reading and digesting the report, published an article on its contents the next morning, April 10.

"Then we began to hear from our outraged readers, who wanted to know why they weren’t reading about this report at major business media outlets.

"We checked the Wall Street Journal, the New York Times, Financial Times, Bloomberg News, Reuters, CNBC, and CNN.

"We could find no mention of the Better Markets report. (We checked again this morning. There is still a news blackout.)...."

"There are four words in this outstanding report from Better Markets that rendered it unpalatable to corporate business media: 'rap sheets' and 'criminal enterprise.'

"We searched Bloomberg News, the Wall Street Journal and the New York Times back to 2004 to see if at any time they had used the words “rap sheet” to describe the unprecedented serial crime sprees of these Wall Street mega banks.

"They had not."

Since at least 2013 there has been a concerted effort on the part of lawyers and PR firms to convince Americans Wall Street is not a criminal enterprise.

It should come as no surprise to find any evidence to the contrary will be buried by the bipartisan corporate press.

Precisely what crimes are you saying have been committed?

According to my link:Precisely what crimes are you saying have been committed?

"8.2 Trillion in Bailouts.

351 Legal Actions

Almost $200 Billion in Fines and Settlements"

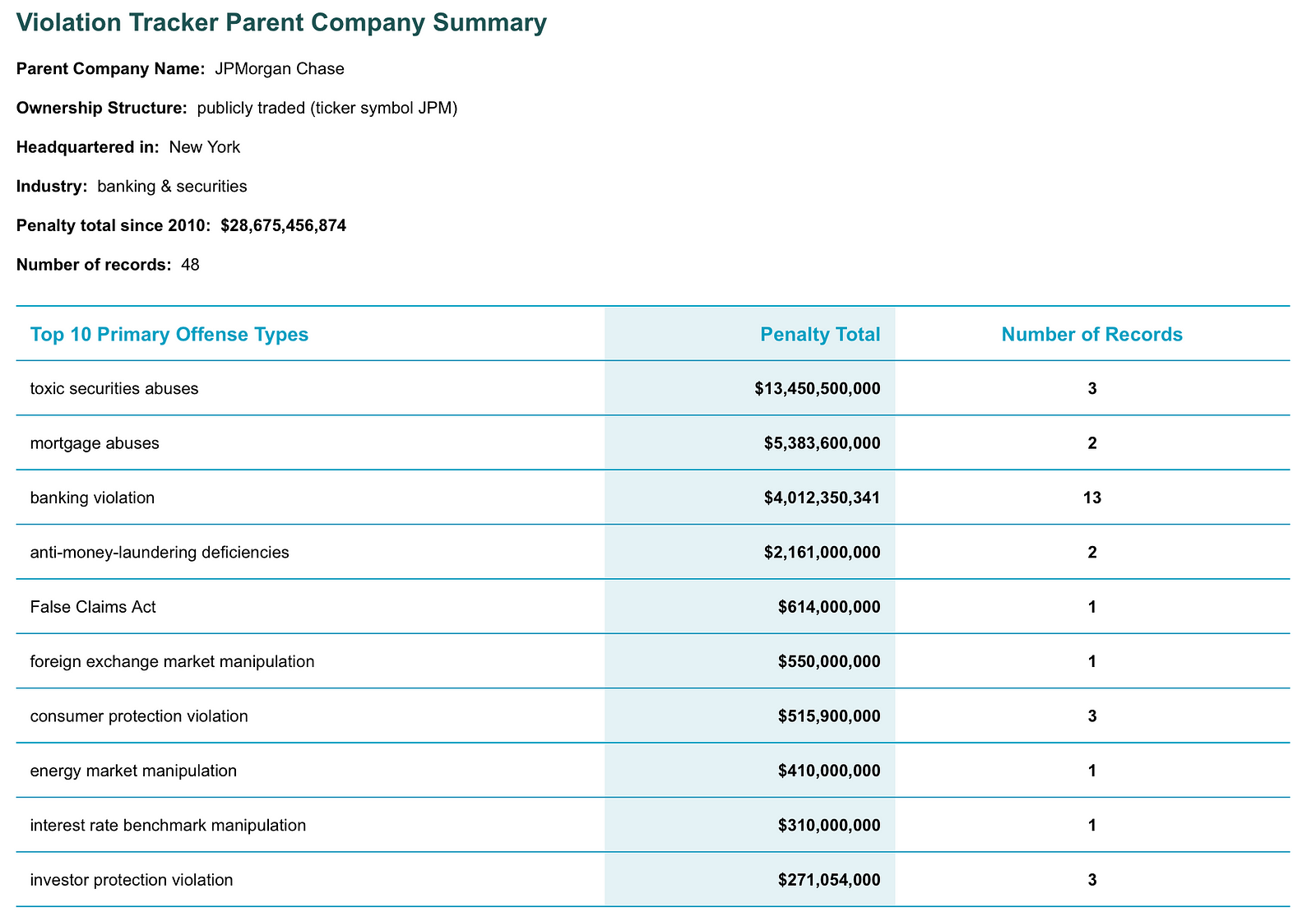

"To help you decide if these rap sheets are as bad as we suggest, here’s the rap sheet of JPMorgan Chase, the largest bank in the United States, as chronicled by two trial attorneys in the book JPMadoff: The Unholy Alliance between America’s Biggest Bank and America’s Biggest Crook.

“In April 2011, JPMC agreed to pay $35 million to settle claims that it overcharged members of the military service on their mortgages in violation of the Service Members Civil Relief Act and the Housing and Economic Recovery Act of 2008.

“In March 2012, JPMC paid the government $659 million to settle charges that it charged veterans hidden fees in mortgage refinancing transactions.

“In October 2012, JPMC paid $1.2 billion to settle claims that it, along with other banks, conspired to set the price of credit and debit card interchange fees.

“On January 7, 2013, JPMC announced that it had agreed to a settlement with the Office of the Controller of the Currency (‘OCC’) and the Federal Reserve Bank of charges that it had engaged in improper foreclosure practices.

“In September 2013, JPMC agreed to pay $80 million in fines and $309 million in refunds to customers whom the bank billed for credit monitoring services that the bank never provided.

“On November 15, 2013, JPMC announced that it had agreed to pay $4.5 billion to settle claims that it defrauded investors in mortgage-backed securities in the time period between 2005 and 2008."