OnePercenter

Gold Member

- Apr 10, 2013

- 23,667

- 1,880

- 265

- Thread starter

- #141

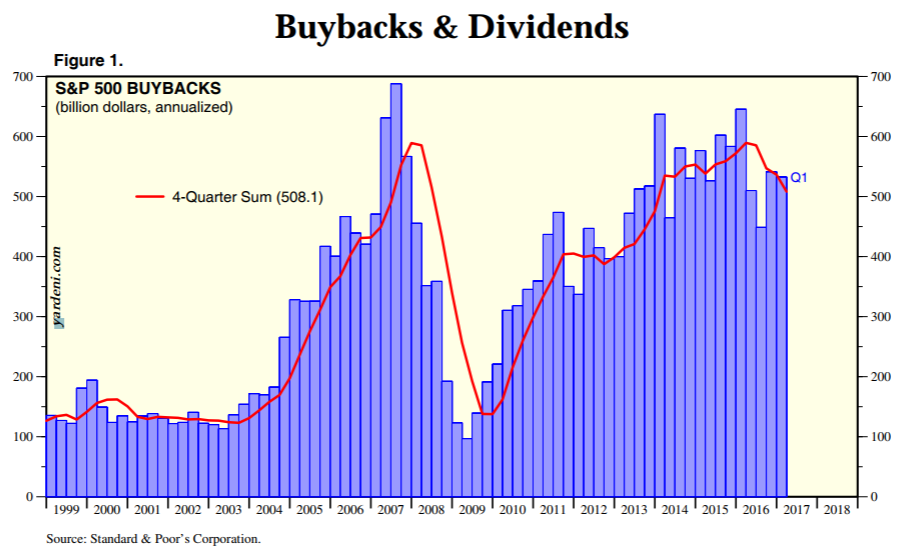

The issue is stock manipulation, $4 trillion since 2009.

$4 trillion hasn’t been returned to shareholders. Sorry.

Do the math.

I thought you were referencing Walmart.

If the government passed a law making buybacks prohibitively expensive like in that bill, companies would stop buying back stock and start paying their cash out in dividends. They wouldn’t increase the pay of their employees.

The reason why is because what shareholders want is cash returned to them. Right now, it’s more tax efficient to return cash via buybacks than dividends. But if you made it more tax efficient to return cash via dividends by raising taxes on buybacks, companies will just increase dividends.

The Walmart seven are taking the company private. A shareholder either takes the market offer or stands the risk of their stock losing value. To pay for this, Walmart has paid their employees crap, taught their employees to live off of public assistance, and manipulated government subsidies to build stores. Once the subsidy ran out, the majority of the subsidized stores developed a nationwide plumbing problem and closed.

I think the absolute least Walmart can do is paying their employees $15.00 per hour.

The Walmart seven are taking the company private.

You're lying.

Why are they buying all of their stock back?