gipper

Diamond Member

- Jan 8, 2011

- 67,251

- 35,823

- 2,605

If losing reserve currency status results in termination of the USG war machine, I’m all for it. Though I suppose the consequences could be economically harmful for many Americans.Ditch the Dollar?

"Should the common currency be formed, it will be based on a basket of the currencies of the BRICS countries; the Chinese RMB Yuan, the Russian Ruble, the Indian Rupee, the Brazilian Real, and the South African Rand."

- "The prospect of establishing a common currency will be a top agenda at the upcoming BRICS Summit in Durban, South Africa later this year.

- The Shanghai Cooperation Organization (SCO) is working towards trading in their own national currencies.

- Roughly 40 percent of international trade transactions in goods are invoiced in dollars."

BRICS Countries keen on having common currency to replace US dollar

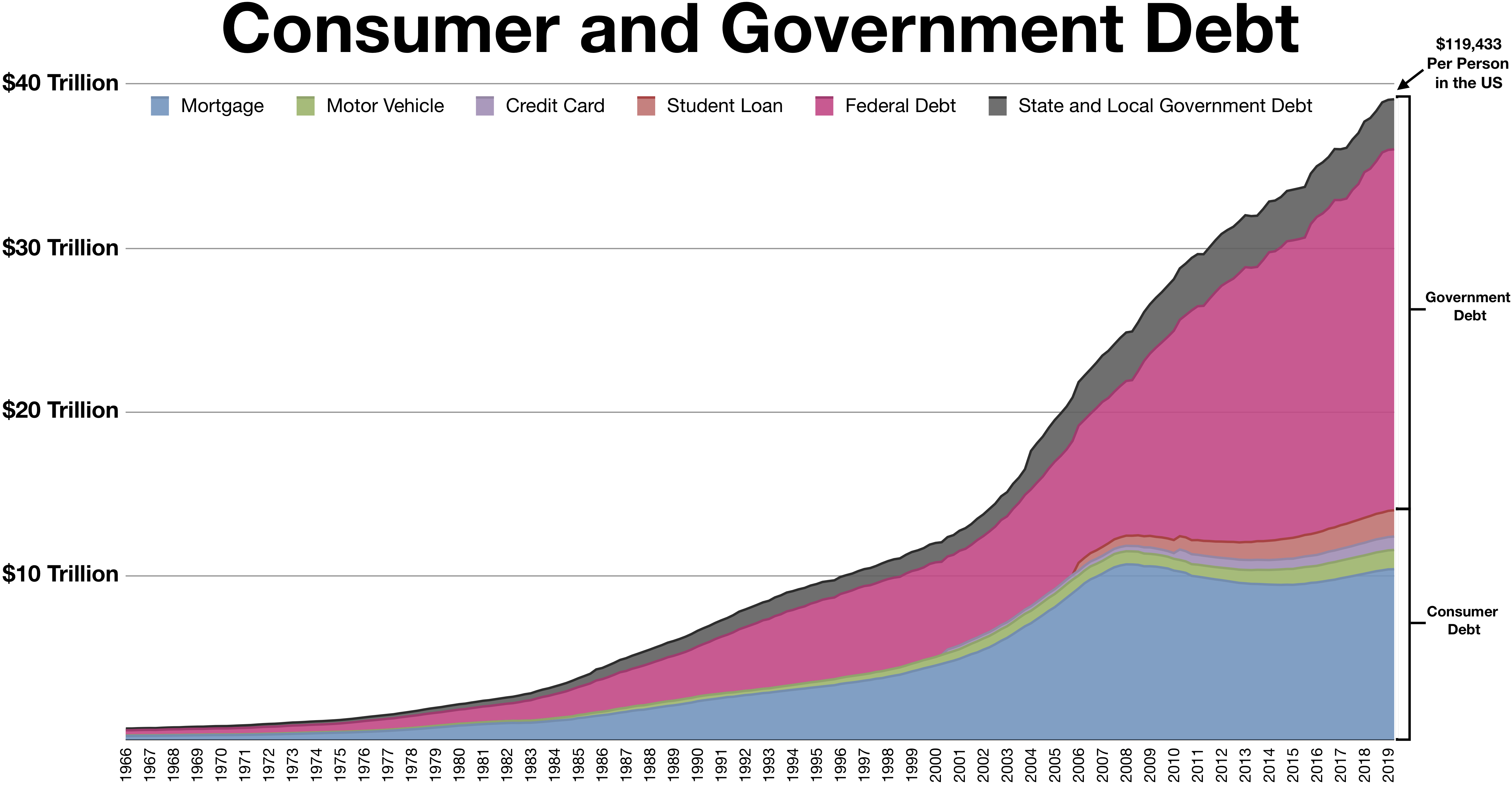

The dollar-based financial system has been built up since the end of WWII; how long before excessing sanction usage puts an end to that economic "free lunch?"

View attachment 771997

The Hard Fist of American Imperialism | Michael Hudson

lots out there on this....~S~

lots out there on this....~S~