EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

they could easily double prices

How?

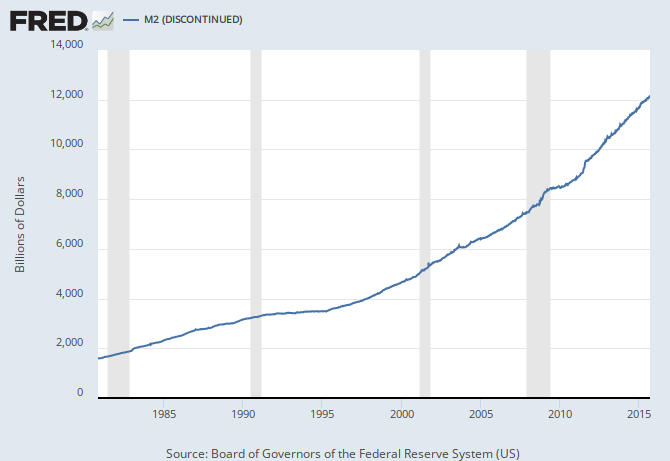

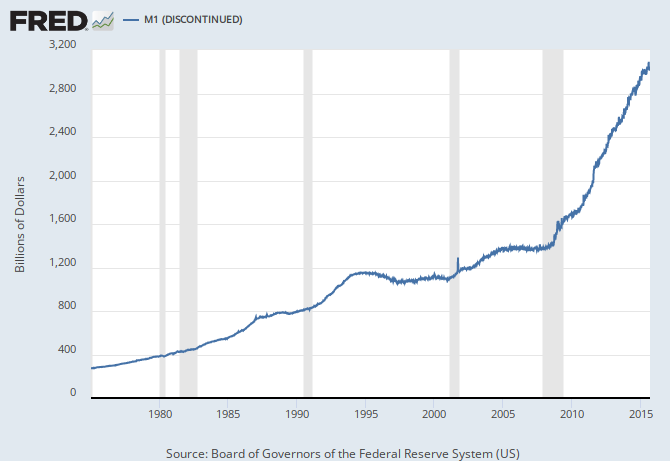

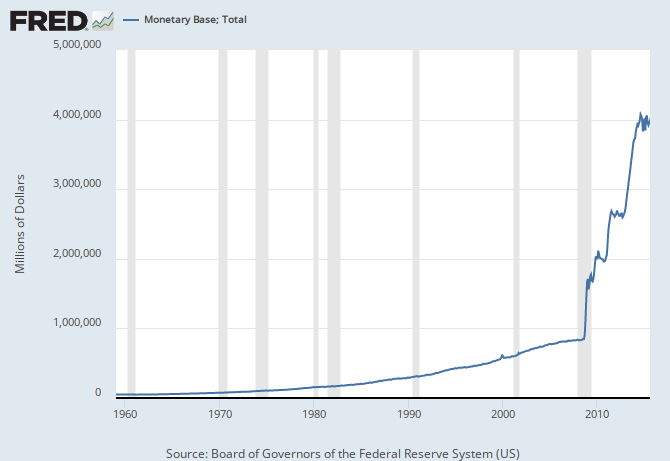

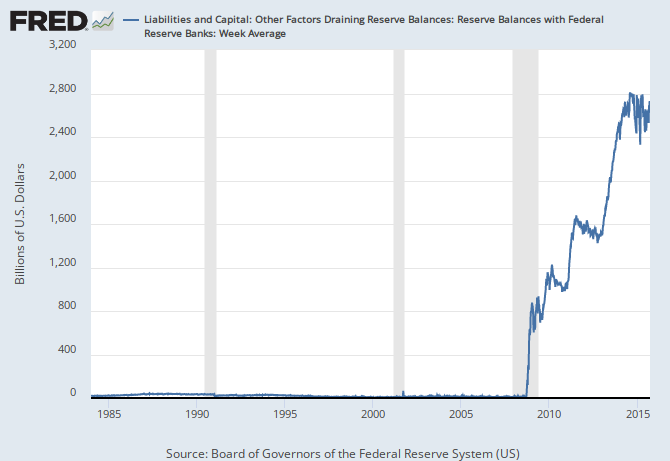

Quantitive easing 4, 5, 6, 7, 8, 9, 10 or any other they wanted as per section 13(3). Sorry.

If they can easily double prices, why the need for more than one QE?

You must be confused.

dear, they double every 10-15 years or so without 13 (3). Why persist in being stupid long after you've lost??