Couchpotato

Platinum Member

- Mar 2, 2021

- 12,618

- 5,994

SVB failed because they had huge amounts of their assets tied up in Government Bonds. The problem with that is that if the Fed jacks up the rates trying to get run away inflation under control, there's no market for the bonds you own that have a lower rate. So you have to sell them at a discount. Was there some regulation that used to be in place that didnt allow banks to invest in Government Bonds?Yes, the Traitor did repeal banking regulations that led to failure of SVB.

Trump signs the biggest rollback of bank rules since the financial crisis

The measure designed to ease rules on all but the largest U.S. banks passed both chambers of Congress with bipartisan support.www.cnbc.com

It never fails, banking regulations get rolled back or repealed and then banks fail. The banking disaster of 2008 was a direct result of banking speculation. As usual, it took a Democrat to fix what the ConJobs fucked up. Mortgage Backed Securities are a crap shoot and major investment firms who pushed failed.....who'd a thunk it.

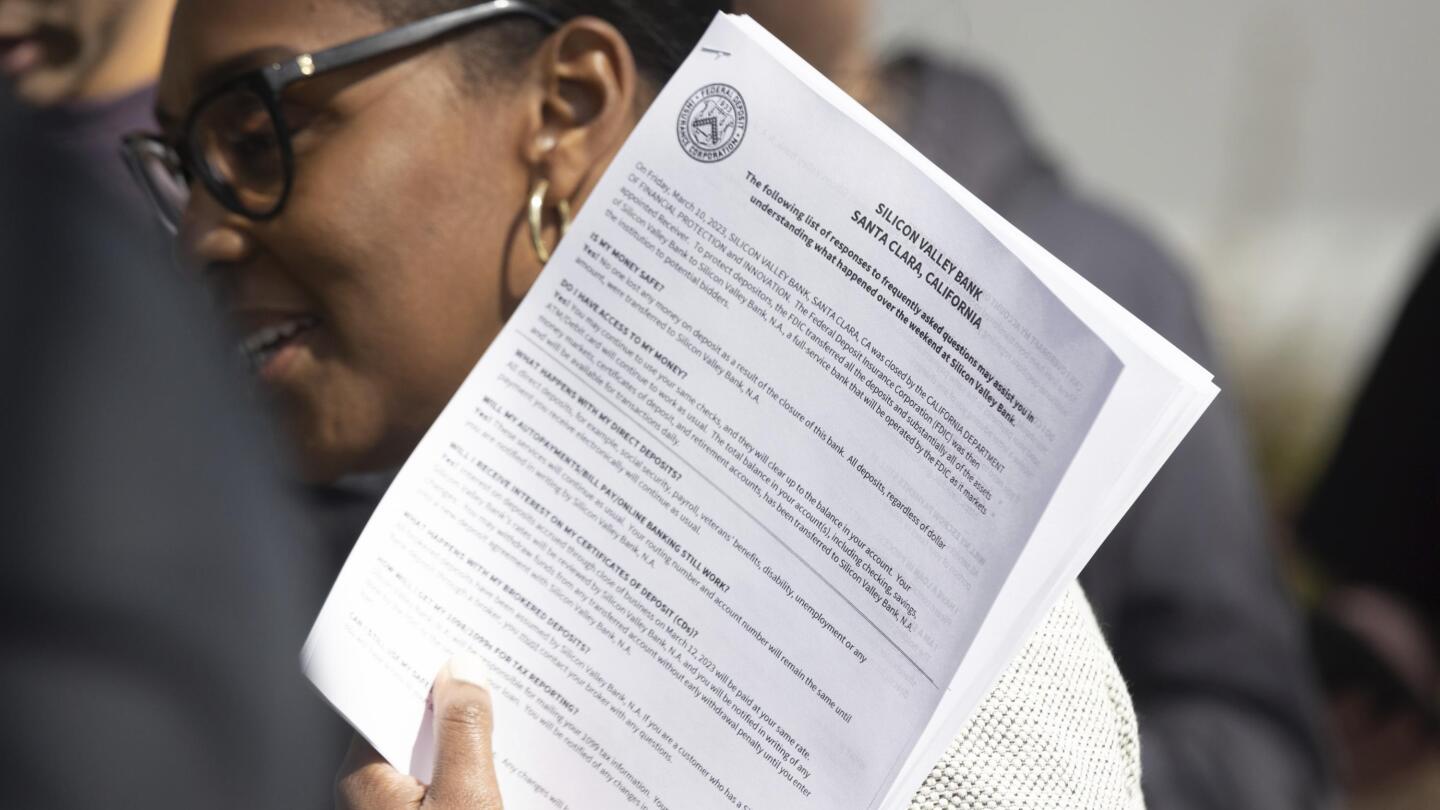

Yes, Mr. Biden is acting quickly to support the accounts owners SVB.

Government races to reassure US that banking system is safe

Depositors withdrew savings, and investors broadly sold off bank shares as the federal government raced to reassure Americans that the banking system is secure following two bank failures.apnews.com

NO, the people who invested in SVB will NOT get their money back. When you invest you are taking a gamble of success, but you are also responsible for what you have done. You played and you lost.

Depositors will with accounts up to $250,000.00 will get their money back.

Investors get shit, you fucked up eat it.