Care4all

Warrior Princess

- Mar 24, 2007

- 73,879

- 28,798

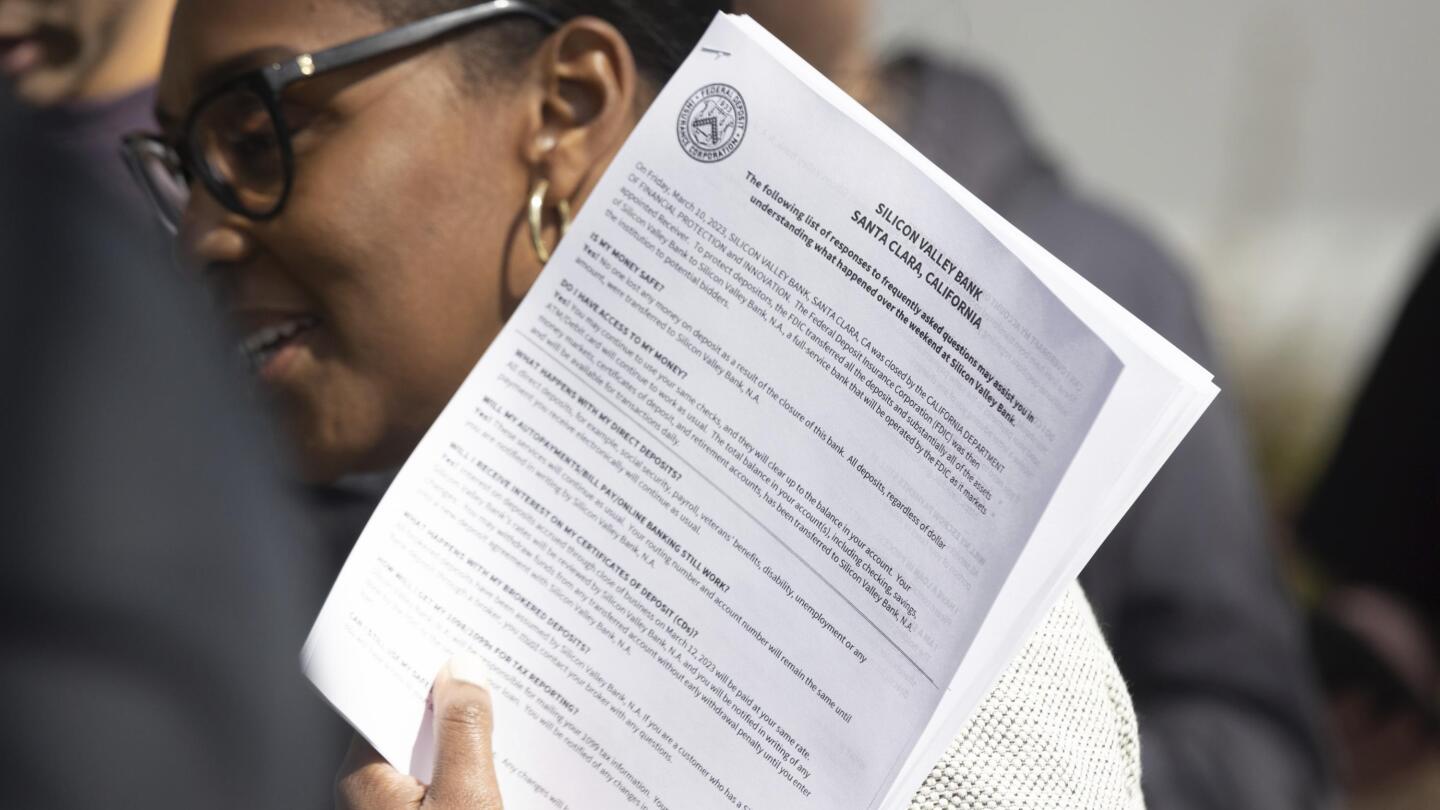

I don't understand why a bank as LARGE as SVB is not considered a big bank, and under big bank rules?But he did advocate and sign the kinds of reforms that *might* have prevented this. To be completely fair, the bill had fairly strong bipartisan support. Dems can't win elections without the support of the banking/finance sector, so they are forced to moderate from time to time.

The reality of this should rattle us awake - all of us. We need to get beyond the political point scoring and understand we got lucky this time. Next time we may not be so fortunate if the risk of unrealized risk and losses begins to seep into the really big banks. We're in danger of a financial blowup that would take not just months but years or even decades to fix.

Dems that supported it, supported it for the right reason, but picked the wrong law.... Allegedly this was to ease regulations on small local banks and midsize banks.... So they could be a part of local and community lending....

SVB deals in over 100 billion to 200 billion, don't they? How are those amounts a small or midsize bank???