No I didn’t, lead to a booming economy.You forgot about little Ronnie Raygun and his tax cuts?

And here I thought he was some kinda RWNJ hero.

And it didn’t lead to what we seeing today

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

No I didn’t, lead to a booming economy.You forgot about little Ronnie Raygun and his tax cuts?

And here I thought he was some kinda RWNJ hero.

You forgot about little Ronnie Raygun and his tax cuts?

And here I thought he was some kinda RWNJ hero.

How are the wealthy 'Blue Bloods" doing over there living the rich and infamous lifestyles on the Britstain tax dollars?Its shocking. Why did we buy this shit ?

Time to tax the poor same as they tax the rich and middle class./---/ You use tax rate to gaslight those who don't understand the tax laws very well.

- The average income tax rate in 2020 was 13.6 percent. The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

- Summary of the Latest Federal Income Tax Data, 2023 Update

What happened to the tax rate for the wealthy?No I didn’t, lead to a booming economy.

And it didn’t lead to what we seeing today

It was cut, like everyone else’sWhat happened to the tax rate for the wealthy?

Fake news.The tax simplification signed by President Reagan was passed by BIPARTISAN majorities in Congress.

It just wasn't him alone.

Further, even though the RATES were cut dramatically, tax REVENUES soared.

The notorious inheritance tax (supported by Warren Buffet back in the day) would cause the children of million dollar farms to have to sell the farmland just to pay the taxes. This made the land cheap so Warren could come in buy up the property then build cheap housing on once land for crops. Oh yeah, Warren Buffet is a flaming liberal...Go figure.It seems as if the authors of this "study" want the government to tax "unrealized" capital gains, as those gains aren't taxed by the government yet it appears as if they are counting those unrealized gains as income.

To do as the authors of this bullshit suggest would require a legion of assessors to assign a value to each asset in the country and outside the country for property owned by US citizens.

It would lead to tens of thousands of appeals as people would contest those tax assessments, it would be one expensive venture.

Further, if a property owner disposes of property to get the funds to pay the tax, that will reduce the value of that class of property, should it reduce the tax owed?

If Bezos has to sell a million shares of AMZN to pay his tax, what will that do to the nest eggs and retirement of the other shareholders?

EVERYBODY ought to have some stake in the game. Part of our problem is that you have massive numbers of people who pay nothing. Make everyone cut a check for at least $250 or so a year to the feds and maybe people will start caring more.Time to tax the poor same as they tax the rich and middle class.

Capitalism where everyone with a brain, can make something of themselves by using their God given talents and a little bit of elbow grease.proving once again the wonders of capitalism.

Go back to the contract with America, which Bill Clinton, signed into law, where you only got welfare for 2 years, and then you either had to get education or work, before you could apply for welfare again. Bill Clinton was credited with a roaring success, for working across the aisle with Republicans.EVERYBODY ought to have some stake in the game. Part of our problem is that you have massive numbers of people who pay nothing. Make everyone cut at least $250 or so a year to the feds and maybe people will start caring more.

The Marginal tax rate on the highest income earners in 1960 was 91%.Total BS. Nobody paid 56% tax rate in 1960.

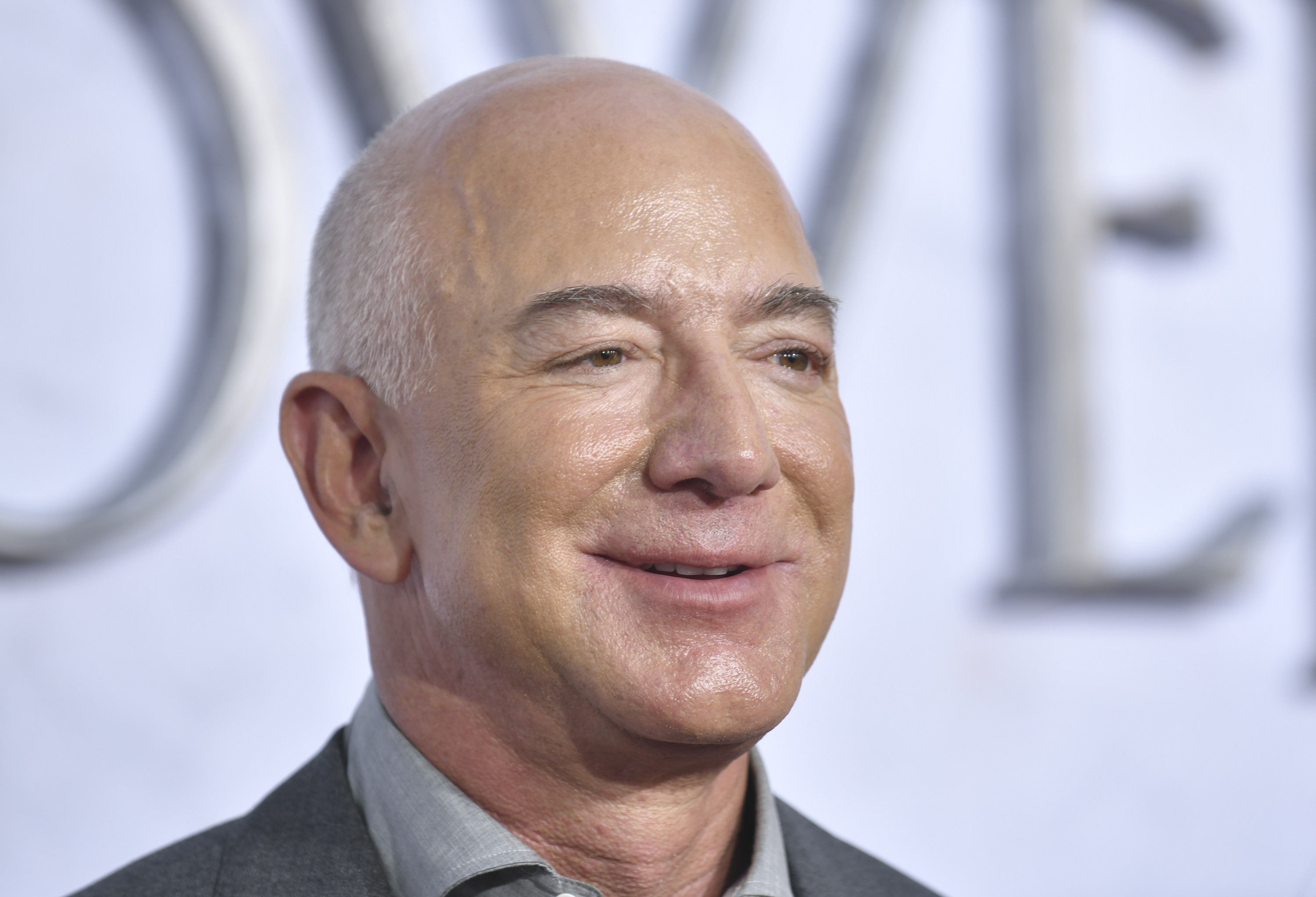

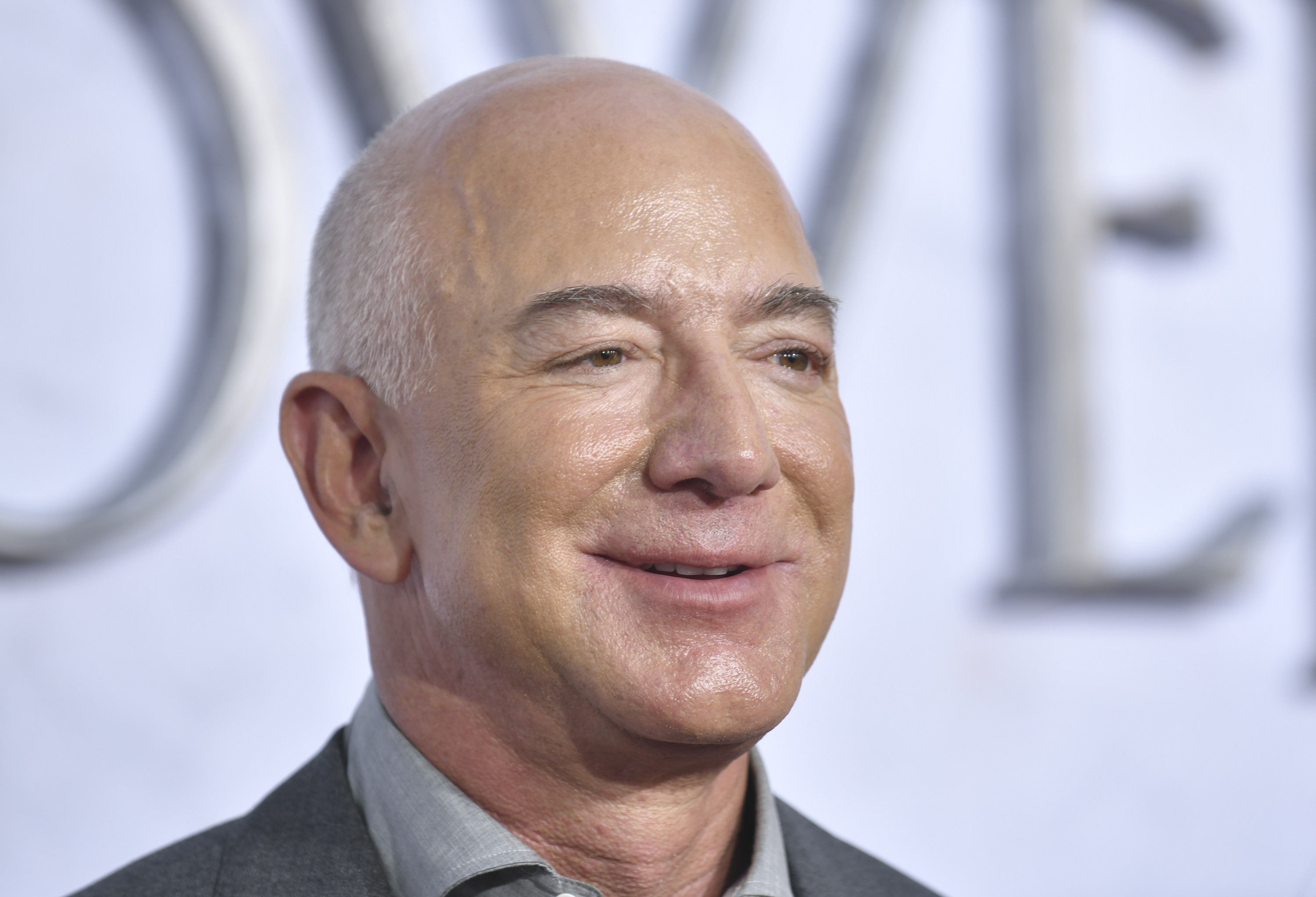

We've all seen it coming, but the day is suddenly arrived at long last. Our billionaire heroes like Jeff Bezos and Melinda Gates are no doubt giving themselves a huge pat on the back. Well, us working slobs can celebrate this day too. We've earned it. U.S.A.! U.S.A.!

Richest Americans now pay less tax than working class in historical first

America's top billionaires are now paying less tax than they have for decades.www.newsweek.com

Its shocking. Why did we buy this shit ?

We've all seen it coming, but the day is suddenly arrived at long last. Our billionaire heroes like Jeff Bezos and Melinda Gates are no doubt giving themselves a huge pat on the back. Well, us working slobs can celebrate this day too. We've earned it. U.S.A.! U.S.A.!

Richest Americans now pay less tax than working class in historical first

America's top billionaires are now paying less tax than they have for decades.www.newsweek.com

The poor not only don't pay taxes but are the beneficiaries of tax-funded welfare programs.Time to tax the poor same as they tax the rich and middle class.

There reaches a point where the Laffer curve, NO LONGER WORKS ...... It no longer works the way it originally did....

The Historical Lessons of Lower Tax Rates

There is a distinct pattern throughout American history: When tax rates are reduced, the economy's growth rate improves and living standards increase. Good tax policy has a number of interesting side effects. For instance, history tells us that tax revenues grow and "rich" taxpayers pay more tax...www.heritage.org

The Kennedy tax cuts

President Hoover dramatically increased tax rates in the 1930s and President Roosevelt compounded the damage by pushing marginal tax rates to more than 90 percent. Recognizing that high tax rates were hindering the economy, President Kennedy proposed across-the-board tax rate reductions that reduced the top tax rate from more than 90 percent down to 70 percent. What happened? Tax revenues climbed from $94 billion in 1961 to $153 billion in 1968, an increase of 62 percent (33 percent after adjusting for inflation).

According to President John F. Kennedy:

Our true choice is not between tax reduction, on the one hand, and the avoidance of large Federal deficits on the other. It is increasingly clear that no matter what party is in power, so long as our national security needs keep rising, an economy hampered by restrictive tax rates will never produce enough revenues to balance our budget just as it will never produce enough jobs or enough profits… In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now.

Such were the times when dems were not retarded.