gipper

Diamond Member

- Jan 8, 2011

- 67,186

- 35,787

- 2,605

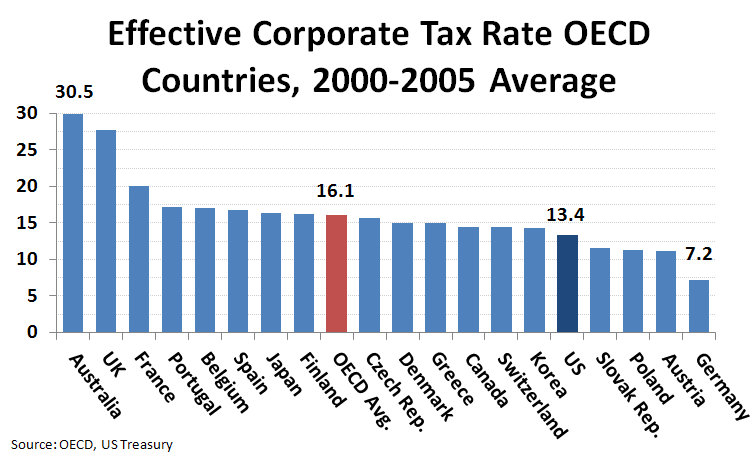

Okay Leftnutter that may be the first post of yours I can agree with.Hey Lil' Joe and Leftnutter is it true Rs are responsible for this and Ds are not?Now, lets see what US corporations ACTUALLY pay in taxes

Dude, you found the same chart I did!!!

Of course not

Both Democrats and Republicans understand the Golden Rule

He who has the gold, makes the rules

Are you feeling okay this morning?

about Effective Income Tax Rates and Capital Gains Tax Rates, that still wouldn't explain why the US is one of ONLY 5 Countries in the OECD to charge a repatriation Income Tax.

about Effective Income Tax Rates and Capital Gains Tax Rates, that still wouldn't explain why the US is one of ONLY 5 Countries in the OECD to charge a repatriation Income Tax.