Well this is coming from News Max... What the fuck do we expect...

Now we are getting somewhere.

Capital Gains Tax increase will hit the wealthy.

Every trade, they owe the government half of their profits. (CAPITAL GAINS)

I buy 100 shares of a stock for $10/share = $1,000

I sell 100 shares of a stock for $20/share = $2,000

Capital gains = $2,000 - $1,000 = $1000

Tax @ 50% = 50% x $1,000 = $500

Note: This ignored broker fees on both transactions

I AM ALL FOR THIS. PASS IT AND LETS SHUT UP ABOUT THE RICH NOT PAYING THEIT FAIR SHARE.

You guys sure THE RICH will allow Congress to pass this bill?

Read what Forbes says, might be a bit more balanced..

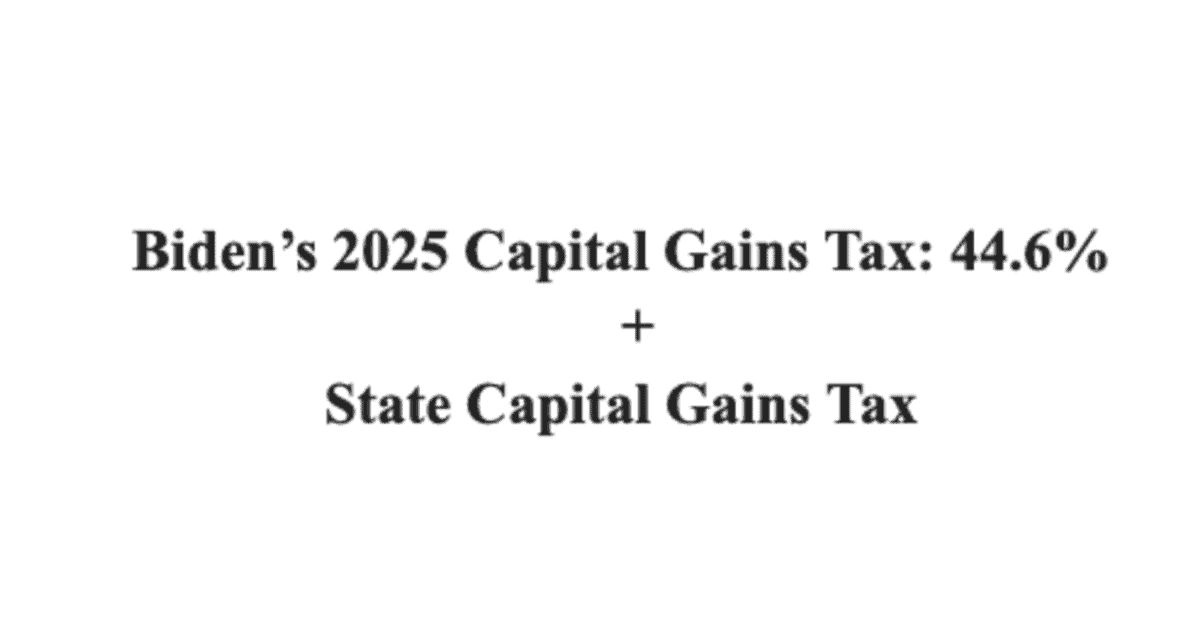

Biden Capital Gains Rate Proposal: 44.6%?

The number being bandied about is 44.6%, which would be the highest formal federal capital gains rate since its inception.

www.forbes.com

www.forbes.com

Top rate for top earners...