Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

🌟 Exclusive 2024 Prime Day Deals! 🌟

Unlock unbeatable offers today. Shop here: https://amzn.to/4cEkqYs 🎁

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If American Politicians Are Owned By Corporations, How Come

- Thread starter Edgetho

- Start date

daws101

Diamond Member

- Banned

- #22

thanks for proving my point .LOL. You never answered a single thing. Your first post was "someone else wrote the OP." How is that answering anything?

He/She/It may think someone else answered it since He/She/It hasn't a clue.

But nobody has yet to answer it.

If Corporations control America, how come they pay the highest Corporate Taxes in the World?

And how come they pay the highest Cap Gains in the OECD?

And how come they have to pay repatriation taxes, unlike ANY other Country in the OECD?

Some numbskull of an excuse for a waste of skin brought up a straw man by mentioning the VAT....

What the FUCK does that have to do with the price of pussy in Peking?

In fact, it only further proves my point.

If Corporations Controlled America they would be making EVERYDAY AMERICANS pay more in taxes and pay less themselves.

dimocraps aren't just lying scum, they really are dumb.

I mean drool cup, slobbering, babbling, stupid, dishonest motherfuckers

Just lying fucking morons.

All of them

When they can't think of an answer, they just make up some bullshit

scum

if you are going to rant there is no need to ask questions you don't' want hear the answers to.

NYcarbineer

Diamond Member

The Value Added Tax is not considered in Corporate Income TaxesMost other countries have a VAT tax.

Genius

It's a big revenue source and therefore makes it easier for governments to keep the corporate income tax low.

Would you like to add a VAT tax in the US and lower the corporate income tax?

In most Countries, their VAT is a substitute for our State Sales Taxes.

Where it exceeds our States Sales taxes, it also funds their Universal Health Care Systems. In some cases, their Income taxes AND their VAT is lower but the people get free Health Care as well

Of particular note is Switzerland where their VAT is quite low compared to other Countries.

The reason for that is because they have a sane Health Insurance program.

Your beloved Denmark has a 0% VAT rate

Swing and a miss. Strike 2

I'm not going to doubt your word for it, yet.

"Denmark has a non-deductible value added tax (VAT) of 25%,[8] - MOMS (Danish: merværdiafgift, formerlymeromsætningsafgift). The tax is subject to the European Union value added tax Directives.

In Denmark, VAT is generally applied at one rate, and with few exceptions is not split into two or more rates as in other countries (e.g. Germany), where reduced rates apply to essential goods such as foodstuffs. The current standard rate of VAT in Denmark is 25%. VAT in Denmark is one of the highest rates, alongside Norway and Sweden. A number of services have reduced VAT, for instance public transportation of private persons, health care services, publishing newspapers, rent of premises (the lessor can, though, voluntarily register as VAT payer, except for residential premises), and travel agency operations."

Taxation in Denmark - Wikipedia the free encyclopedia

So, maybe the above is wrong...is it?

Edgetho

Platinum Member

- Mar 27, 2012

- 15,797

- 7,039

- 390

- Thread starter

- #24

I'm not going to doubt your word for it, yet.

"Denmark has a non-deductible value added tax (VAT) of 25%,[8] - MOMS (Danish: merværdiafgift, formerlymeromsætningsafgift). The tax is subject to the European Union value added tax Directives.

In Denmark, VAT is generally applied at one rate, and with few exceptions is not split into two or more rates as in other countries (e.g. Germany), where reduced rates apply to essential goods such as foodstuffs. The current standard rate of VAT in Denmark is 25%. VAT in Denmark is one of the highest rates, alongside Norway and Sweden. A number of services have reduced VAT, for instance public transportation of private persons, health care services, publishing newspapers, rent of premises (the lessor can, though, voluntarily register as VAT payer, except for residential premises), and travel agency operations."

Taxation in Denmark - Wikipedia the free encyclopedia

So, maybe the above is wrong...is it?

oopsie. I read the Bible for Community Colleges, Wiki, wrong. (And I don't see an excuse for it) My bad

Still beside the point

If Corporations owned our Politicians, wouldn't they make The People pay more in taxes while they paid less? Like in Denmark? Your socialist wonderland?

This isn't about taxes, this is about the FALLACY of Corporations owning politicians in this Country.

Maybe they do in Denmark, but not here.

It's just a lie.

Edgetho

Platinum Member

- Mar 27, 2012

- 15,797

- 7,039

- 390

- Thread starter

- #25

So.......

I guess all this horse shit we hear about Corporations controlling American Politics and Politicians is just that -- Horse shit.

the dimocrap masters play the tune and their idiot followers dance to the music..

Pathetic that dimocraps think of themselves as independent thinkers. They're anything but.

And you liberturdians that spout the same juvenile bullshit?

You're stupid

I guess all this horse shit we hear about Corporations controlling American Politics and Politicians is just that -- Horse shit.

the dimocrap masters play the tune and their idiot followers dance to the music..

Pathetic that dimocraps think of themselves as independent thinkers. They're anything but.

And you liberturdians that spout the same juvenile bullshit?

You're stupid

The problem is you've shown it here conclusively. But the very next thread that opens some liberal dope, or some brain dead narco-libertarian, will repeat the same bullshit. It never ends.So.......

I guess all this horse shit we hear about Corporations controlling American Politics and Politicians is just that -- Horse shit.

the dimocrap masters play the tune and their idiot followers dance to the music..

Pathetic that dimocraps think of themselves as independent thinkers. They're anything but.

And you liberturdians that spout the same juvenile bullshit?

You're stupid

Kosh

Quick Look Over There!

Corporations are only evil if they support republicans not Democrats (aka the far left)..

NYcarbineer

Diamond Member

So.......

I guess all this horse shit we hear about Corporations controlling American Politics and Politicians is just that -- Horse shit.

the dimocrap masters play the tune and their idiot followers dance to the music..

Pathetic that dimocraps think of themselves as independent thinkers. They're anything but.

And you liberturdians that spout the same juvenile bullshit?

You're stupid

Do you have any idea how many deductions, subsidies, loopholes, credits and other provisions there are in the corporate tax system that results in almost no companies paying the marginal rates?

Kosh

Quick Look Over There!

So.......

I guess all this horse shit we hear about Corporations controlling American Politics and Politicians is just that -- Horse shit.

the dimocrap masters play the tune and their idiot followers dance to the music..

Pathetic that dimocraps think of themselves as independent thinkers. They're anything but.

And you liberturdians that spout the same juvenile bullshit?

You're stupid

Do you have any idea how many deductions, subsidies, loopholes, credits and other provisions there are in the corporate tax system that results in almost no companies paying the marginal rates?

Sure all the far left corporations use them instead of paying their fair share.

Your point far left drone?

Dragonlady

Designing Woman

This thread wasn't intended to open a conversation with dimocrap scum.

Nothing could be more tedious to my mind.

This thread is aimed at liberturdians who still might have a brain cell or two left to them.

If we are SO dominated by Corporations, how come we have the highest Corporate Income Tax on Planet Earth?

Well, next to Chad and the UAE.

And how come we are the ONLY Country that taxes it's domestic companies on profits made OUTSIDE its borders?

And how come our Capital Gains taxes FAR exceed those of other civilized Countries?

As to dimocrap scum and economics?

Here's a primer for you to get started down the path of understanding.....

If Dick has one Apple and Jane has two, and they put them all in the same basket. How many Apples do Dick and Jane have?

Stop by later, dimocrap scum, for the answer.

If you get it right (doubtful) then we'll move on to more advanced theory like, "What happens if Jane's Dog, Spot, takes one of the Apples out of the basket?"

Try looking at effective tax rates. For large U.S. Corporations it's around 11%, giving the U.S. one of the lowest corporate tax rates in the world.

Kosh

Quick Look Over There!

This thread wasn't intended to open a conversation with dimocrap scum.

Nothing could be more tedious to my mind.

This thread is aimed at liberturdians who still might have a brain cell or two left to them.

If we are SO dominated by Corporations, how come we have the highest Corporate Income Tax on Planet Earth?

Well, next to Chad and the UAE.

And how come we are the ONLY Country that taxes it's domestic companies on profits made OUTSIDE its borders?

And how come our Capital Gains taxes FAR exceed those of other civilized Countries?

As to dimocrap scum and economics?

Here's a primer for you to get started down the path of understanding.....

If Dick has one Apple and Jane has two, and they put them all in the same basket. How many Apples do Dick and Jane have?

Stop by later, dimocrap scum, for the answer.

If you get it right (doubtful) then we'll move on to more advanced theory like, "What happens if Jane's Dog, Spot, takes one of the Apples out of the basket?"

Try looking at effective tax rates. For large U.S. Corporations it's around 11%, giving the U.S. one of the lowest corporate tax rates in the world.

And the far left loves to make up numbers to support their religious cause..

IsaacNewton

Gold Member

- Jun 20, 2015

- 17,308

- 3,697

- 290

Yes, the tax rate for large corporations is what most of the 300 million people in the country think about most of the time.

A better question, why are wealthy people always whining about money. Its because they like to whine.

A better question, why are wealthy people always whining about money. Its because they like to whine.

Edgetho

Platinum Member

- Mar 27, 2012

- 15,797

- 7,039

- 390

- Thread starter

- #33

Do you have any idea how many deductions, subsidies, loopholes, credits and other provisions there are in the corporate tax system that results in almost no companies paying the marginal rates?

That has been debunked.

The U.S. Corporate Effective Tax Rate Myth and the Fact Tax Foundation

The bottom line is that US Corporations pay the highest effective Tax Rates on the highest Nominal Tax Rates in the Civilized World.

Period

US Corporations also pay the highest combined Capital Gains Taxes of any Country in the OECD.

And they also pay a repatriation tax THAT NO OTHER OECD COUNTRIES CHARGE!!

Think we could use 2.5 TRILLION DOLLARS pumped into the economy?

Evidently, the Lying Cocksucker in Chief doesn't. He's trying to find a way to tax it even though it's out of the Country.

Oh, yes he is.

So stop with the lies.

We're sick of them. But you won't. Lies are your stock and trade. It's what dimocraps do. It's what you've always done

liberturdians? Maybe. They're not actually 'bad' people, they're just kinda stupid

Edgetho

Platinum Member

- Mar 27, 2012

- 15,797

- 7,039

- 390

- Thread starter

- #34

Yes, the tax rate for large corporations is what most of the 300 million people in the country think about most of the time.

A better question, why are wealthy people always whining about money. Its because they like to whine.

Not the point, Einstein

The point of the thread is that dimocrap scum and liberturdian morons are always bitching about how the government is controlled by Corporations.

Any moron can look at our Tax System and see that it isn't. Even you.

If Corporations controlled Government, every day people would be paying MUCH higher Income Taxes and a VAT of up to 30% while Corporations payed half what they currently do -- Like in Europe.

Corporate Taxes are another topic. This thread is about the FUCKING LIE that US Corporations have an inordinate amount of influence on our government.

I think I've proven that they don't.

Unless you're a moron. Or a dimocrap. Same thing, actually

rightwinger

Award Winning USMB Paid Messageboard Poster

- Aug 4, 2009

- 285,010

- 157,745

- 2,615

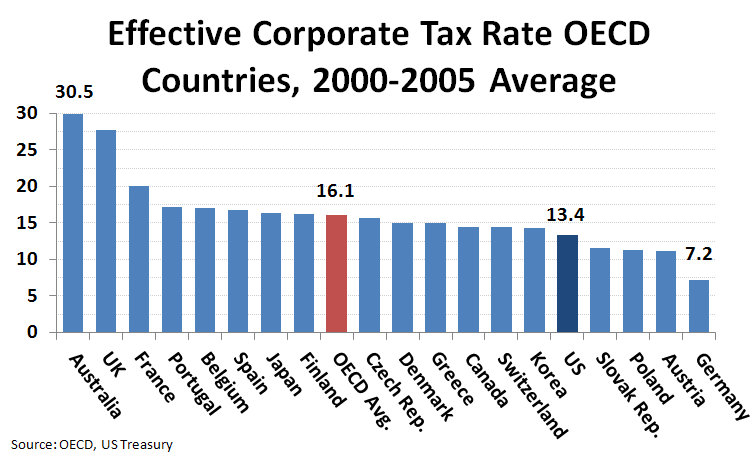

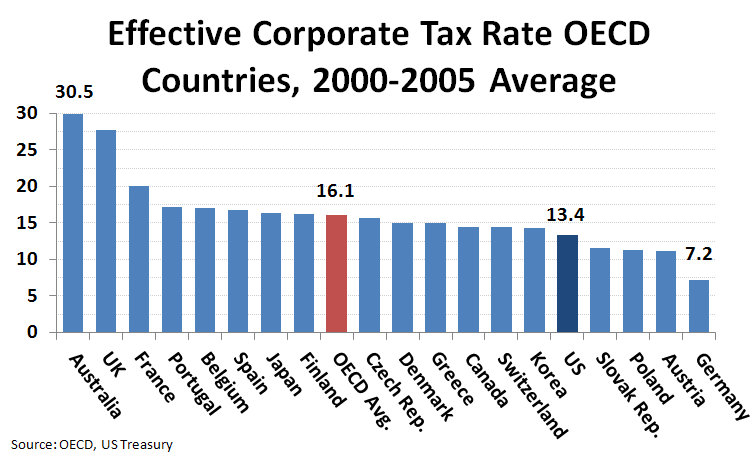

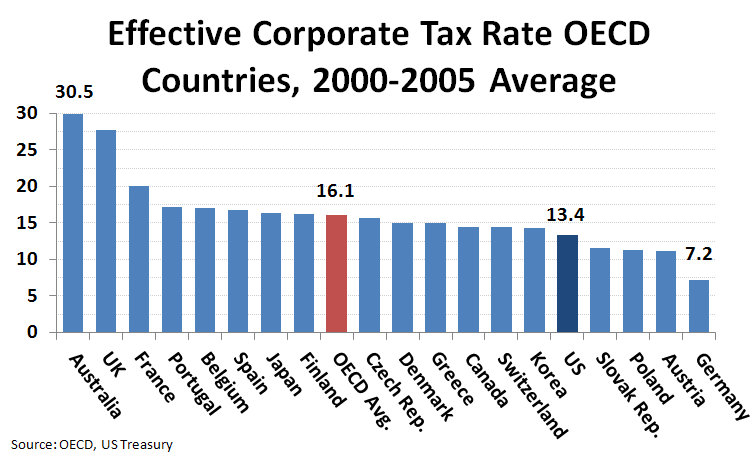

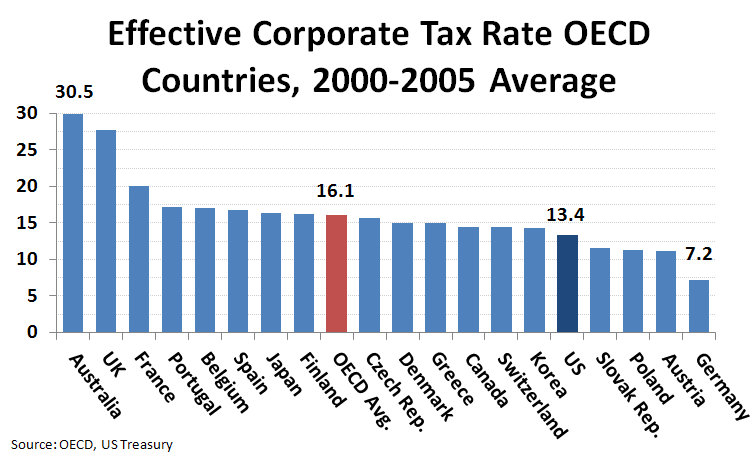

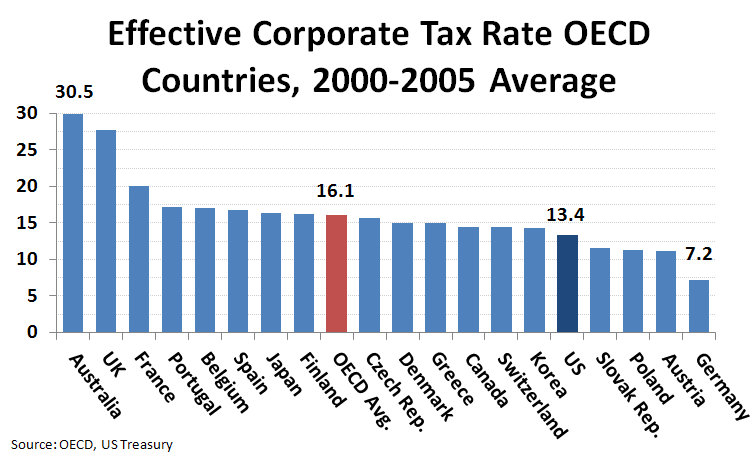

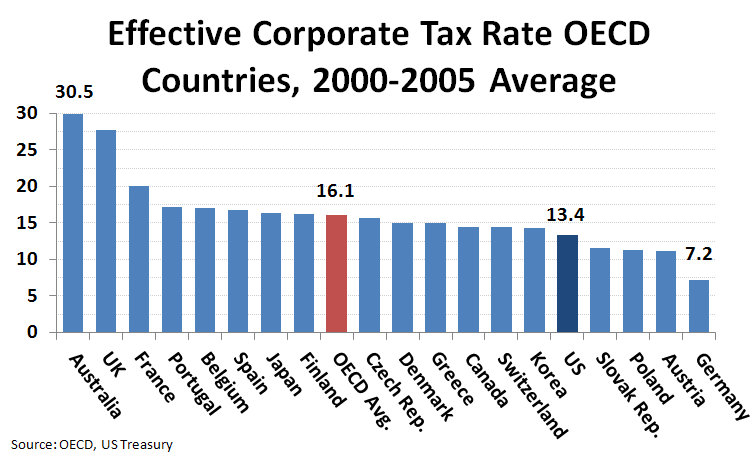

Now, lets see what US corporations ACTUALLY pay in taxes

gipper

Diamond Member

- Jan 8, 2011

- 67,185

- 35,787

- 2,605

The basis for your conclusion is incorrect.We have the highest Corporate Income Tax of the 34 Country member OECD?

39.1%

And the 3rd highest on the Planet behind only Chad and the UAE. Which is laughable

And how come we have the highest Capital Gains tax rates FAR above the average of Countries in the OECD??

The US has both high corporate and capital gains tax rates vs. other advanced economies - AEI Pethokoukis Blog AEIdeas

Currently, the United States’ top marginal tax rate on long-term capital gains income is 23.8 percent. In addition, taxpayers face state-level capital gains tax rates as low as zero and as high as 13.3 percent. As a result, the average combined top marginal rate in the United States is 28.7 percent. This rate exceeds the average top capital gains tax rate of 18.2 percent faced by taxpayers throughout the industrialized world. Even more, taxpayers in some U.S. states face top rates on capital gains over 30 percent, which is higher than most industrialized countries. In fact, California’s top marginal capital gains tax rate of 33 percent is the third highest in the industrialized world.

And when you look at the combined tax rate on capital, you find a huge gap. The US integrated rate is 67.8% versus 43.7% for OECD economies.

And how come, if we are SO owned by Corporatists, we are the ONLY Country in the OECD that charges Income Tax on repatriated money....?????

Let me explain.

If Sony, a multinational company, makes a TV in Mexico, where they pay taxes on it, and sells it in Germany, where they also pay taxes on it, they owe nothing to the Japanese Government.

They can bring the money home and reinvest it in people, machinery and technology -- No Japanese taxes.

But if Apple makes an iPhone in China, where they pay taxes on it, and they sell it in the UK, where they pay taxes on it.......

The US Government wants Apple to pay taxes on it........!!!!

Why?

Nobody else does it. Nobody in the OECD does that. Nobody.

Apples has to pay taxes on the iPhone they make in China, then they have to pay taxes on the same phone they sell in the UK and even though the iPhone never sees the USA, dimocrap scum still want their pound of flesh.

Why?

This might help explain why Companies have in the neighborhood of 2.5 TRILLION DOLLARS sitting offshore that they won't repatriate. But, what the hell? What do we need with 2.5 TRILLION Dollars, right?

You people that think we're run by 'Corporatists.?

You're stupid. There's just simply no other way to put it.

You are mouth breathing, drool cup stupid.

Get a freaking life

Most Fortune 500 companies have legions of tax attorneys in-house all working diligently to avoid federal and state taxation. They then get their lobbyists and owned politicians to write special tax rules exempting them from taxation. So your argument that corporate profits are highly taxed in the USA, is total bunk and purely propaganda.

I suggest you read David Cay Johnston and Hunter Lewis. It is clearly outlined in their books.

Crony capitalism rules the day. Our central government is nearly completely captured.

JoeB131

Diamond Member

We have the highest Corporate Income Tax of the 34 Country member OECD?

39.1%

And the 3rd highest on the Planet behind only Chad and the UAE. Which is laughable

We don't. Our EFFECTIVE Tax rate is only 13.4%.

JoeB131

Diamond Member

Now, lets see what US corporations ACTUALLY pay in taxes

Dude, you found the same chart I did!!!

gipper

Diamond Member

- Jan 8, 2011

- 67,185

- 35,787

- 2,605

Hey Lil' Joe and Leftnutter is it true Rs are responsible for this and Ds are not?Now, lets see what US corporations ACTUALLY pay in taxes

Dude, you found the same chart I did!!!

rightwinger

Award Winning USMB Paid Messageboard Poster

- Aug 4, 2009

- 285,010

- 157,745

- 2,615

Hey Lil' Joe and Leftnutter is it true Rs are responsible for this and Ds are not?Now, lets see what US corporations ACTUALLY pay in taxes

Dude, you found the same chart I did!!!

Of course not

Both Democrats and Republicans understand the Golden Rule

He who has the gold, makes the rules

Similar threads

- Replies

- 1

- Views

- 58

- Replies

- 27

- Views

- 449

- Replies

- 517

- Views

- 6K

- Replies

- 47

- Views

- 948

- Replies

- 84

- Views

- 2K

Latest Discussions

- Replies

- 171

- Views

- 663

- Replies

- 123

- Views

- 605

- Replies

- 275

- Views

- 2K

- Replies

- 16

- Views

- 96

Forum List

-

-

-

-

-

Political Satire 8477

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 481

-

-

-

-

-

-

-

-

-

-