Avorysuds

Gold Member

What do you markets guys think of this story?

Price to earnings ratios suggest that stock markets are overvalued and in need of price adjustment, say GMO's Jeremy Grantham and James Montier.

I'm not big on the stock market. I feel I understand the FED's role in creating bubbles but past that I don't do anything in stocks.

I'm not ready for another recession =( If that's what happens...

Price to earnings ratios suggest that stock markets are overvalued and in need of price adjustment, say GMO's Jeremy Grantham and James Montier.

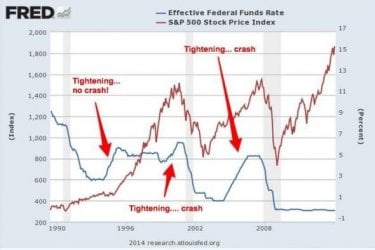

I'm not big on the stock market. I feel I understand the FED's role in creating bubbles but past that I don't do anything in stocks.

I'm not ready for another recession =( If that's what happens...