Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

More economic GOOD News...DOW hits new record..on track to hit 17K.

- Thread starter Sallow

- Start date

Sallow

The Big Bad Wolf.

- Thread starter

- #1,902

A subprime loan in itself is not necessarily a problem, but the vast majority of the toxic loans were subprime. And we suffered the perfect storm ... 1% adjustable loans ... with no down payment ... and backed by the government with insufficient oversight. Once the rates went up, which was inevitable, droves of folks who had little invested in their home and now struggled to pay the adjusted rates, simply walked away from them.

Even if you want to go down that route and blame subprimes? You still have financial outfits in the mix like Goldman, who were thirsting for them, backed them and encouraged predatory lending.

Additionally, many of these loans were taken to open small businesses.

And the predatory lenders? Lied like crazy to get the numbers.

But they weren't the problem.

The securities and AIG insuring them were..

Andylusion

Platinum Member

The CRA had zero to do with the Bush cataclysm. Neither did minimum wage.The bubble created BY US initially during the Clinton administration and subsequently continued during the Bush administration, was gonna pop no matter what. That's what bubbles do. Additionally each time Bush tried to do something about it the democrats blocked him because the way it was working benefited democrats. This including the time in 2007 when Frank blocked him, Frank who was Chair of the House Financial Services Committee, the committee in charge of this issue, Frank that guy reporting to congress that the bill pushed by Bush was not necessary because everything was fine. This just months before the crash.Yes or no NIMROD Bush was POTUS in 2007 and the democrats were in charge of congress. What makes you think I was talking about pre 2007. The bubble popped while the democrats were in charge of congress ya dumb ass.Ya gotta be a "special" kind of stupid to think Frank, a member of the minority party until 2007, was in charge. Learn how our government functions and learn whether it's the majority party or the minority party which is in charge each respective chamber of the Congress so you can understand why that comment of yours is so asinine.Bush's "massive stimulus bills" came in the form of tax cuts for the rich, under the notion that the rich are some how altruistic angels will to spend their windfalls on investment into their companies or innovation.

Nothing could be further from the truth. The rich, spend, on themselves. They buy massive mansions, boats and other big boy toys. One trip to Monaco will confirm that for you.

Bush didn't spend on infrastructure. There weren't many big federal builds during his time in office. Heck, they didn't even start rebuilding the Freedom Tower, until he was out of office. You would figure that, would at least, be completed.

Bush's notion, that somehow giving rich folks everything they wanted, was a dismal failure, as evidenced by the financial cataclysm he left for Obama.

Bush's tax cuts were larger for the middle class and poor than they were for the rich. In fact, it is because of Bush's moronic tax cuts that we now have half the country not paying any income taxes, ya moron.

"Bush didn't spend on infrastructure." Yeah cause all the money going to the infrastructure in NYC and NO that doesn't count. FT wasn't delayed by Bush dumb ass.

Bush warned about the realestate bubble, Frank was in charge and stonewalled republican reforms in congress.

But yes by and large Bush was a socialist POS aka moderate republican RINO, PNAC republican.

I'm not defending Bush, I'm just pointing out your lies.

The Bubble didn't pop as a result of the Democrats winning the election. The bubble popped as a result of actions taken by the Bush administration to create the bubble in the first place.

The CRA had everything to do with the bubble, and the evidence shows as much.

Andylusion

Platinum Member

Interesting Article.

The True Story Of How One Man Shut Down American Commerce To Avoid Paying His Workers A Fair Wage ThinkProgress

And yet, for all its beauty, the town was still a mechanism to ensure his dominion over his workers. Though Pullman employees were technically under no obligation to reside in the company town, promotions were often only available to workers residing in company housing, and workers who lived elsewhere were the first to be laid off in difficult economic times. Every square inch of land in Pullman was owned by the company — workers had no option to buy their own homes — and leases permitted the company to evict a resident on just ten days notice. Thus, a worker who displeased their bosses could wind up homeless almost as quickly as they were rendered jobless.

Pullman, Illinois’ layout also reinforced a rigid hierarchy. The residential portion began at Florence Boulevard, named for Pullman’s daughter, where a dozen and a half homes housed corporate executives. Beyond the town’s most expensive residences laid hundreds of two to five family row houses for skilled workers. At the outskirts, Pullman built tenements for unskilled laborers. And overlooking all of this was the Florence Hotel, built at the beginning of Florence Boulevard, where Pullman himself could watch over his domain from a suite built for his use.

It was the closest thing that has ever existed to an American barony, with George Mortimer Pullman ensconced as its lord and master. As Harper’s warned,

the idea of Pullman is un-American. It is a nearer approach than anything the writer has seen to what appears to be the ideal of the great German Chancellor. It is not the American ideal. It is benevolent, well-wishing feudalism, which desires the happiness of the people, but in such way as shall please the authorities. One can not avoid thinking of the late Czar of Russia, Alexander II., to whom the welfare of his subjects was truly a matter of concern. He wanted them to be happy, but desired their happiness to proceed from him, in whom everything should centre.

This is a bedrock of modern conservatism.

No, you are an idiot as always. This is as valid as pointing to Stalin, and the millions he killed and saying "this is the bedrock of modern leftism", but ironically my statement would be closer to the truth than yours.

Andylusion

Platinum Member

umm, the subprime loans started flying in 2003....They now think the recession didn't start till after Oblama was president? To add to the fact they at first they only said Bush was a rino, and Bush had to go into hiding from his own party to hide from their hostility and embarrassment....

When Bush was first elected, he was more conservative, than he ended up.

He was in favor of privatizing social security, which was my biggest pro-Bush issue. I'd vote for him NOW, if he ran again with that as his goal.

As for when the Recession, no it started during his presidency.

But unlike the ignorant, mindless leftards.... I'm too intelligent to simply think

"Dur Recession started when Bush was president... therefore Bush must have caused recession, because I'm leftard that thinks correlation equals causation! Dur"

We've had that phrase "correlation does not equal causation" for almost 100 years, and yet morons leftists, still think that is how the world works.

Bush was president when the economy crashed. But the cause of the recession, is rooted back in the 90s. That's when the price bubble started, and that's when sub-prime loans starting flying. But of course leftists are too dumb to look at data before per-determining their conclusions.

... next lie ... ?

That's ratio. Who cares about ratio? How about when did the sub-prime mortages start being used period? 1994. When did they first become a significant part of the market? 1997. Your cherry picked graph, doesn't even go back far enough.

Here, how about a source from inside the mortgage market?

Between 1994 and 1997, the sub-prime market was a niche market with almost no growth at all. Before 1994, it practically didn't exist as a market. There were only a few isolated areas that had them.

In 1997, the market increased dramatically. That was the start.

"Well I'm a dumb leftard, and clear evidence isn't enough for me!"

Ok ok ok...... When did the price bubble start? When did housing prices, due to the drastic increase in sub-prime loans, start raising from the additional demand?

Looky there.... 1997. Can't see that? Let me blow it up for you.

Look at that.... 1997.

So the sub-prime mortgage market shoots off in 1997, and we see clearly that housing prices began their march up into oblivion, in 1997. Both of these are established facts.

You want to debate Yale economist Robert Shiller, go for it. But until you have some counter evidence to his, I'm going with the Yale economist over doofus on the internet with an opinion.

So then we have to ask... what the crap happened in 1997 to 1998? Because clearly something did happen, and I highly doubt it was 'greed'. You are telling me that before 1997, all the bankers were altruistic, and then magically 'poof' became greedy in 1997? And I don't buy the idea they were all sitting around one night after too many beers, and all spontaneously said "Hey, lets engage in super risky loans, and ask the government to bail us out when we crash!" "yeah yeah! that's a good plan!".

So what could have happened. My theory.... carrot and stick.

First the stick.

Andrew Cuomo, Secretary of HUD, announces a successful lawsuit against a bank, for BILLIONS, to be used in CRA loans. Cuomo openly admits these loans will go to unqualified borrowers. Openly admits the default rates will be higher.

So the government is beating banks with a stick to make exactly the kind of loans that caused the crash.

Now the carrot.

First Union Capital Markets Corp. Bear Stearns Co. Price Securities Offering... -- re CHARLOTTE N.C. Oct. 20 PRNewswire --

First Union Capital Markets Corp.

and Bear, Stearns & Co. Inc. have priced a $384.6 million offering of

securities backed by Community Reinvestment Act (CRA) loans - marking the

industry's first public securitization of CRA loans.

The $384.6 million in senior certificates are guaranteed by Freddie Mac

and have an implied "AAA" rating. First Union Capital Markets Corp. is the

investment banking subsidiary of First Union Corporation (NYSE: FTU).

Let's review. First Union became Wachovia. So Wachovia and Bear Stearns, two of the biggest early crashes during the bubble burst, agreed in 1997, to have Freddie Mac, guarantee, with a AAA rating, CRA loans.

You think that might motivate banks to make bad loans, when the Federal Government is guaranteeing them?

This is what crashed the economy in 2008.

The boost to the housing market in '97, that you're referring to, came from CRA loans after Clinton modified the law. It is well documented that CRA loans comprised just a small percentage of the toxic loans which crashed the real estate market and was not the problem. The problem began in the early 2000's after the federal fund rate was lowered to 2%, and then to 1%, and Bush guaranteed any loans given to folks who now qualified for a loan because of the super low interest rates and the waiving of a down payment. That's why the chart I showed demonstrates at that point, the vast majority of loans were subprime mortgages.

But again... before this happened in 1997, there was no sub-prime market. Look at the data. Very clearly you can see that prior to 1997, the sub-prime, which included all CRA and non-CRA sub-prime loans, was a tiny tiny niche market.

Then after 1997, the market shot off.

And as much as you want to claim that the "the problem began in the early 2000", that doesn't jive with the data. The housing bubble CLEARLY started in 1997.

Now until you can come up with some rational explanation of how a policy change in 2004, created a price bubble that started in 1997, you really don't have an argument.... if you are honest.

Andylusion

Platinum Member

umm, the subprime loans started flying in 2003....They now think the recession didn't start till after Oblama was president? To add to the fact they at first they only said Bush was a rino, and Bush had to go into hiding from his own party to hide from their hostility and embarrassment....

When Bush was first elected, he was more conservative, than he ended up.

He was in favor of privatizing social security, which was my biggest pro-Bush issue. I'd vote for him NOW, if he ran again with that as his goal.

As for when the Recession, no it started during his presidency.

But unlike the ignorant, mindless leftards.... I'm too intelligent to simply think

"Dur Recession started when Bush was president... therefore Bush must have caused recession, because I'm leftard that thinks correlation equals causation! Dur"

We've had that phrase "correlation does not equal causation" for almost 100 years, and yet morons leftists, still think that is how the world works.

Bush was president when the economy crashed. But the cause of the recession, is rooted back in the 90s. That's when the price bubble started, and that's when sub-prime loans starting flying. But of course leftists are too dumb to look at data before per-determining their conclusions.

... next lie ... ?

That's ratio. Who cares about ratio? How about when did the sub-prime mortages start being used period? 1994. When did they first become a significant part of the market? 1997. Your cherry picked graph, doesn't even go back far enough.

Here, how about a source from inside the mortgage market?

Between 1994 and 1997, the sub-prime market was a niche market with almost no growth at all. Before 1994, it practically didn't exist as a market. There were only a few isolated areas that had them.

In 1997, the market increased dramatically. That was the start.

"Well I'm a dumb leftard, and clear evidence isn't enough for me!"

Ok ok ok...... When did the price bubble start? When did housing prices, due to the drastic increase in sub-prime loans, start raising from the additional demand?

Looky there.... 1997. Can't see that? Let me blow it up for you.

Look at that.... 1997.

So the sub-prime mortgage market shoots off in 1997, and we see clearly that housing prices began their march up into oblivion, in 1997. Both of these are established facts.

You want to debate Yale economist Robert Shiller, go for it. But until you have some counter evidence to his, I'm going with the Yale economist over doofus on the internet with an opinion.

So then we have to ask... what the crap happened in 1997 to 1998? Because clearly something did happen, and I highly doubt it was 'greed'. You are telling me that before 1997, all the bankers were altruistic, and then magically 'poof' became greedy in 1997? And I don't buy the idea they were all sitting around one night after too many beers, and all spontaneously said "Hey, lets engage in super risky loans, and ask the government to bail us out when we crash!" "yeah yeah! that's a good plan!".

So what could have happened. My theory.... carrot and stick.

First the stick.

Andrew Cuomo, Secretary of HUD, announces a successful lawsuit against a bank, for BILLIONS, to be used in CRA loans. Cuomo openly admits these loans will go to unqualified borrowers. Openly admits the default rates will be higher.

So the government is beating banks with a stick to make exactly the kind of loans that caused the crash.

Now the carrot.

First Union Capital Markets Corp. Bear Stearns Co. Price Securities Offering... -- re CHARLOTTE N.C. Oct. 20 PRNewswire --

First Union Capital Markets Corp.

and Bear, Stearns & Co. Inc. have priced a $384.6 million offering of

securities backed by Community Reinvestment Act (CRA) loans - marking the

industry's first public securitization of CRA loans.

The $384.6 million in senior certificates are guaranteed by Freddie Mac

and have an implied "AAA" rating. First Union Capital Markets Corp. is the

investment banking subsidiary of First Union Corporation (NYSE: FTU).

Let's review. First Union became Wachovia. So Wachovia and Bear Stearns, two of the biggest early crashes during the bubble burst, agreed in 1997, to have Freddie Mac, guarantee, with a AAA rating, CRA loans.

You think that might motivate banks to make bad loans, when the Federal Government is guaranteeing them?

This is what crashed the economy in 2008.

The boost to the housing market in '97, that you're referring to, came from CRA loans after Clinton modified the law. It is well documented that CRA loans comprised just a small percentage of the toxic loans which crashed the real estate market and was not the problem. The problem began in the early 2000's after the federal fund rate was lowered to 2%, and then to 1%, and Bush guaranteed any loans given to folks who now qualified for a loan because of the super low interest rates and the waiving of a down payment. That's why the chart I showed demonstrates at that point, the vast majority of loans were subprime mortgages.

Subprimes weren't even the problem.

The problem, mainly, was mortgage backed securities, which, no one outside the sharpies that put them together, really understood. That, and the same sharpies insured them.

It's funny that no matter how many times you go over it, conservatives will never blame the guys that put this scheme in action.

A subprime loan in itself is not necessarily a problem, but the vast majority of the toxic loans were subprime. And we suffered the perfect storm ... 1% adjustable loans ... with no down payment ... and backed by the government with insufficient oversight. Once the rates went up, which was inevitable, droves of folks who had little invested in their home and now struggled to pay the adjusted rates, simply walked away from them.

Again... there is ZERO evidence of "insufficient oversight". Where do you even come up with that? Have you look at how many regulations there are on banks? What bank anywhere, didn't have oversight? We have more controls and regulations on our banks than anywhere else in the world.

Faun

Diamond Member

- Nov 14, 2011

- 124,337

- 80,982

- 2,635

CRA loans required lenders to provide a certain number of loans to minorities. The vast majority of toxic loans, some 94%, we're not CRA loans. They were loans given voluntarily by lenders because they knew the loans were guaranteed even if the borrower couldn't pay them back. Time and time again, it's been shown that the CRA, while some of those loans did go bad, was not the cause of the crash. Greed, opportunity, and the perfect conditions to allow it to happen were the cause.The CRA had zero to do with the Bush cataclysm. Neither did minimum wage.The bubble created BY US initially during the Clinton administration and subsequently continued during the Bush administration, was gonna pop no matter what. That's what bubbles do. Additionally each time Bush tried to do something about it the democrats blocked him because the way it was working benefited democrats. This including the time in 2007 when Frank blocked him, Frank who was Chair of the House Financial Services Committee, the committee in charge of this issue, Frank that guy reporting to congress that the bill pushed by Bush was not necessary because everything was fine. This just months before the crash.Yes or no NIMROD Bush was POTUS in 2007 and the democrats were in charge of congress. What makes you think I was talking about pre 2007. The bubble popped while the democrats were in charge of congress ya dumb ass.Ya gotta be a "special" kind of stupid to think Frank, a member of the minority party until 2007, was in charge. Learn how our government functions and learn whether it's the majority party or the minority party which is in charge each respective chamber of the Congress so you can understand why that comment of yours is so asinine.Bush's "massive stimulus bills" came in the form of tax cuts for the rich, under the notion that the rich are some how altruistic angels will to spend their windfalls on investment into their companies or innovation.

Nothing could be further from the truth. The rich, spend, on themselves. They buy massive mansions, boats and other big boy toys. One trip to Monaco will confirm that for you.

Bush didn't spend on infrastructure. There weren't many big federal builds during his time in office. Heck, they didn't even start rebuilding the Freedom Tower, until he was out of office. You would figure that, would at least, be completed.

Bush's notion, that somehow giving rich folks everything they wanted, was a dismal failure, as evidenced by the financial cataclysm he left for Obama.

Bush's tax cuts were larger for the middle class and poor than they were for the rich. In fact, it is because of Bush's moronic tax cuts that we now have half the country not paying any income taxes, ya moron.

"Bush didn't spend on infrastructure." Yeah cause all the money going to the infrastructure in NYC and NO that doesn't count. FT wasn't delayed by Bush dumb ass.

Bush warned about the realestate bubble, Frank was in charge and stonewalled republican reforms in congress.

But yes by and large Bush was a socialist POS aka moderate republican RINO, PNAC republican.

I'm not defending Bush, I'm just pointing out your lies.

The Bubble didn't pop as a result of the Democrats winning the election. The bubble popped as a result of actions taken by the Bush administration to create the bubble in the first place.

The CRA had everything to do with the bubble, and the evidence shows as much.

Faun

Diamond Member

- Nov 14, 2011

- 124,337

- 80,982

- 2,635

umm, the subprime loans started flying in 2003....They now think the recession didn't start till after Oblama was president? To add to the fact they at first they only said Bush was a rino, and Bush had to go into hiding from his own party to hide from their hostility and embarrassment....

When Bush was first elected, he was more conservative, than he ended up.

He was in favor of privatizing social security, which was my biggest pro-Bush issue. I'd vote for him NOW, if he ran again with that as his goal.

As for when the Recession, no it started during his presidency.

But unlike the ignorant, mindless leftards.... I'm too intelligent to simply think

"Dur Recession started when Bush was president... therefore Bush must have caused recession, because I'm leftard that thinks correlation equals causation! Dur"

We've had that phrase "correlation does not equal causation" for almost 100 years, and yet morons leftists, still think that is how the world works.

Bush was president when the economy crashed. But the cause of the recession, is rooted back in the 90s. That's when the price bubble started, and that's when sub-prime loans starting flying. But of course leftists are too dumb to look at data before per-determining their conclusions.

... next lie ... ?

That's ratio. Who cares about ratio? How about when did the sub-prime mortages start being used period? 1994. When did they first become a significant part of the market? 1997. Your cherry picked graph, doesn't even go back far enough.

Here, how about a source from inside the mortgage market?

Between 1994 and 1997, the sub-prime market was a niche market with almost no growth at all. Before 1994, it practically didn't exist as a market. There were only a few isolated areas that had them.

In 1997, the market increased dramatically. That was the start.

"Well I'm a dumb leftard, and clear evidence isn't enough for me!"

Ok ok ok...... When did the price bubble start? When did housing prices, due to the drastic increase in sub-prime loans, start raising from the additional demand?

Looky there.... 1997. Can't see that? Let me blow it up for you.

Look at that.... 1997.

So the sub-prime mortgage market shoots off in 1997, and we see clearly that housing prices began their march up into oblivion, in 1997. Both of these are established facts.

You want to debate Yale economist Robert Shiller, go for it. But until you have some counter evidence to his, I'm going with the Yale economist over doofus on the internet with an opinion.

So then we have to ask... what the crap happened in 1997 to 1998? Because clearly something did happen, and I highly doubt it was 'greed'. You are telling me that before 1997, all the bankers were altruistic, and then magically 'poof' became greedy in 1997? And I don't buy the idea they were all sitting around one night after too many beers, and all spontaneously said "Hey, lets engage in super risky loans, and ask the government to bail us out when we crash!" "yeah yeah! that's a good plan!".

So what could have happened. My theory.... carrot and stick.

First the stick.

Andrew Cuomo, Secretary of HUD, announces a successful lawsuit against a bank, for BILLIONS, to be used in CRA loans. Cuomo openly admits these loans will go to unqualified borrowers. Openly admits the default rates will be higher.

So the government is beating banks with a stick to make exactly the kind of loans that caused the crash.

Now the carrot.

First Union Capital Markets Corp. Bear Stearns Co. Price Securities Offering... -- re CHARLOTTE N.C. Oct. 20 PRNewswire --

First Union Capital Markets Corp.

and Bear, Stearns & Co. Inc. have priced a $384.6 million offering of

securities backed by Community Reinvestment Act (CRA) loans - marking the

industry's first public securitization of CRA loans.

The $384.6 million in senior certificates are guaranteed by Freddie Mac

and have an implied "AAA" rating. First Union Capital Markets Corp. is the

investment banking subsidiary of First Union Corporation (NYSE: FTU).

Let's review. First Union became Wachovia. So Wachovia and Bear Stearns, two of the biggest early crashes during the bubble burst, agreed in 1997, to have Freddie Mac, guarantee, with a AAA rating, CRA loans.

You think that might motivate banks to make bad loans, when the Federal Government is guaranteeing them?

This is what crashed the economy in 2008.

The boost to the housing market in '97, that you're referring to, came from CRA loans after Clinton modified the law. It is well documented that CRA loans comprised just a small percentage of the toxic loans which crashed the real estate market and was not the problem. The problem began in the early 2000's after the federal fund rate was lowered to 2%, and then to 1%, and Bush guaranteed any loans given to folks who now qualified for a loan because of the super low interest rates and the waiving of a down payment. That's why the chart I showed demonstrates at that point, the vast majority of loans were subprime mortgages.

But again... before this happened in 1997, there was no sub-prime market. Look at the data. Very clearly you can see that prior to 1997, the sub-prime, which included all CRA and non-CRA sub-prime loans, was a tiny tiny niche market.

Then after 1997, the market shot off.

And as much as you want to claim that the "the problem began in the early 2000", that doesn't jive with the data. The housing bubble CLEARLY started in 1997.

Now until you can come up with some rational explanation of how a policy change in 2004, created a price bubble that started in 1997, you really don't have an argument.... if you are honest.

http://www.americanbanker.com/bankthink/stop-spreading-myths-about-cra-al-1055901-1.html

Multiple studies have shown that CRA did not drive the risky lending that led to the subprime crisis. Studies by researchers at the San Francisco Federal Reserve Bank and UNC Center for Community Capital have demonstrated that CRA encouraged safe and sustainable lending that expanded homeownership without incurring the high default levels experienced by the unregulated, non-CRA-covered loans.Federal Reserve economists have demonstrated that only 6% of the high-cost, high-risk mortgages made at the height of the subprime boom were made by banks in their CRA-eligible markets.

Faun

Diamond Member

- Nov 14, 2011

- 124,337

- 80,982

- 2,635

umm, the subprime loans started flying in 2003....They now think the recession didn't start till after Oblama was president? To add to the fact they at first they only said Bush was a rino, and Bush had to go into hiding from his own party to hide from their hostility and embarrassment....

When Bush was first elected, he was more conservative, than he ended up.

He was in favor of privatizing social security, which was my biggest pro-Bush issue. I'd vote for him NOW, if he ran again with that as his goal.

As for when the Recession, no it started during his presidency.

But unlike the ignorant, mindless leftards.... I'm too intelligent to simply think

"Dur Recession started when Bush was president... therefore Bush must have caused recession, because I'm leftard that thinks correlation equals causation! Dur"

We've had that phrase "correlation does not equal causation" for almost 100 years, and yet morons leftists, still think that is how the world works.

Bush was president when the economy crashed. But the cause of the recession, is rooted back in the 90s. That's when the price bubble started, and that's when sub-prime loans starting flying. But of course leftists are too dumb to look at data before per-determining their conclusions.

... next lie ... ?

That's ratio. Who cares about ratio? How about when did the sub-prime mortages start being used period? 1994. When did they first become a significant part of the market? 1997. Your cherry picked graph, doesn't even go back far enough.

Here, how about a source from inside the mortgage market?

Between 1994 and 1997, the sub-prime market was a niche market with almost no growth at all. Before 1994, it practically didn't exist as a market. There were only a few isolated areas that had them.

In 1997, the market increased dramatically. That was the start.

"Well I'm a dumb leftard, and clear evidence isn't enough for me!"

Ok ok ok...... When did the price bubble start? When did housing prices, due to the drastic increase in sub-prime loans, start raising from the additional demand?

Looky there.... 1997. Can't see that? Let me blow it up for you.

Look at that.... 1997.

So the sub-prime mortgage market shoots off in 1997, and we see clearly that housing prices began their march up into oblivion, in 1997. Both of these are established facts.

You want to debate Yale economist Robert Shiller, go for it. But until you have some counter evidence to his, I'm going with the Yale economist over doofus on the internet with an opinion.

So then we have to ask... what the crap happened in 1997 to 1998? Because clearly something did happen, and I highly doubt it was 'greed'. You are telling me that before 1997, all the bankers were altruistic, and then magically 'poof' became greedy in 1997? And I don't buy the idea they were all sitting around one night after too many beers, and all spontaneously said "Hey, lets engage in super risky loans, and ask the government to bail us out when we crash!" "yeah yeah! that's a good plan!".

So what could have happened. My theory.... carrot and stick.

First the stick.

Andrew Cuomo, Secretary of HUD, announces a successful lawsuit against a bank, for BILLIONS, to be used in CRA loans. Cuomo openly admits these loans will go to unqualified borrowers. Openly admits the default rates will be higher.

So the government is beating banks with a stick to make exactly the kind of loans that caused the crash.

Now the carrot.

First Union Capital Markets Corp. Bear Stearns Co. Price Securities Offering... -- re CHARLOTTE N.C. Oct. 20 PRNewswire --

First Union Capital Markets Corp.

and Bear, Stearns & Co. Inc. have priced a $384.6 million offering of

securities backed by Community Reinvestment Act (CRA) loans - marking the

industry's first public securitization of CRA loans.

The $384.6 million in senior certificates are guaranteed by Freddie Mac

and have an implied "AAA" rating. First Union Capital Markets Corp. is the

investment banking subsidiary of First Union Corporation (NYSE: FTU).

Let's review. First Union became Wachovia. So Wachovia and Bear Stearns, two of the biggest early crashes during the bubble burst, agreed in 1997, to have Freddie Mac, guarantee, with a AAA rating, CRA loans.

You think that might motivate banks to make bad loans, when the Federal Government is guaranteeing them?

This is what crashed the economy in 2008.

The boost to the housing market in '97, that you're referring to, came from CRA loans after Clinton modified the law. It is well documented that CRA loans comprised just a small percentage of the toxic loans which crashed the real estate market and was not the problem. The problem began in the early 2000's after the federal fund rate was lowered to 2%, and then to 1%, and Bush guaranteed any loans given to folks who now qualified for a loan because of the super low interest rates and the waiving of a down payment. That's why the chart I showed demonstrates at that point, the vast majority of loans were subprime mortgages.

Subprimes weren't even the problem.

The problem, mainly, was mortgage backed securities, which, no one outside the sharpies that put them together, really understood. That, and the same sharpies insured them.

It's funny that no matter how many times you go over it, conservatives will never blame the guys that put this scheme in action.

A subprime loan in itself is not necessarily a problem, but the vast majority of the toxic loans were subprime. And we suffered the perfect storm ... 1% adjustable loans ... with no down payment ... and backed by the government with insufficient oversight. Once the rates went up, which was inevitable, droves of folks who had little invested in their home and now struggled to pay the adjusted rates, simply walked away from them.

Again... there is ZERO evidence of "insufficient oversight". Where do you even come up with that? Have you look at how many regulations there are on banks? What bank anywhere, didn't have oversight? We have more controls and regulations on our banks than anywhere else in the world.

It comes from Bush, for one, who started asking Congress around 2003 to add oversight of the GSEs to prevent the meltdown we incurred by not having such oversight.

New Agency Proposed to Oversee Freddie Mac and Fannie Mae

The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.

Under the plan, disclosed at a Congressional hearing today, a new agency would be created within the Treasury Department to assume supervision of Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry.

You are a lying POS.Interesting Article.

The True Story Of How One Man Shut Down American Commerce To Avoid Paying His Workers A Fair Wage ThinkProgress

And yet, for all its beauty, the town was still a mechanism to ensure his dominion over his workers. Though Pullman employees were technically under no obligation to reside in the company town, promotions were often only available to workers residing in company housing, and workers who lived elsewhere were the first to be laid off in difficult economic times. Every square inch of land in Pullman was owned by the company — workers had no option to buy their own homes — and leases permitted the company to evict a resident on just ten days notice. Thus, a worker who displeased their bosses could wind up homeless almost as quickly as they were rendered jobless.

Pullman, Illinois’ layout also reinforced a rigid hierarchy. The residential portion began at Florence Boulevard, named for Pullman’s daughter, where a dozen and a half homes housed corporate executives. Beyond the town’s most expensive residences laid hundreds of two to five family row houses for skilled workers. At the outskirts, Pullman built tenements for unskilled laborers. And overlooking all of this was the Florence Hotel, built at the beginning of Florence Boulevard, where Pullman himself could watch over his domain from a suite built for his use.

It was the closest thing that has ever existed to an American barony, with George Mortimer Pullman ensconced as its lord and master. As Harper’s warned,

the idea of Pullman is un-American. It is a nearer approach than anything the writer has seen to what appears to be the ideal of the great German Chancellor. It is not the American ideal. It is benevolent, well-wishing feudalism, which desires the happiness of the people, but in such way as shall please the authorities. One can not avoid thinking of the late Czar of Russia, Alexander II., to whom the welfare of his subjects was truly a matter of concern. He wanted them to be happy, but desired their happiness to proceed from him, in whom everything should centre.

This is a bedrock of modern conservatism.

umm, the subprime loans started flying in 2003....They now think the recession didn't start till after Oblama was president? To add to the fact they at first they only said Bush was a rino, and Bush had to go into hiding from his own party to hide from their hostility and embarrassment....

When Bush was first elected, he was more conservative, than he ended up.

He was in favor of privatizing social security, which was my biggest pro-Bush issue. I'd vote for him NOW, if he ran again with that as his goal.

As for when the Recession, no it started during his presidency.

But unlike the ignorant, mindless leftards.... I'm too intelligent to simply think

"Dur Recession started when Bush was president... therefore Bush must have caused recession, because I'm leftard that thinks correlation equals causation! Dur"

We've had that phrase "correlation does not equal causation" for almost 100 years, and yet morons leftists, still think that is how the world works.

Bush was president when the economy crashed. But the cause of the recession, is rooted back in the 90s. That's when the price bubble started, and that's when sub-prime loans starting flying. But of course leftists are too dumb to look at data before per-determining their conclusions.

... next lie ... ?

That's ratio. Who cares about ratio? How about when did the sub-prime mortages start being used period? 1994. When did they first become a significant part of the market? 1997. Your cherry picked graph, doesn't even go back far enough.

Here, how about a source from inside the mortgage market?

Between 1994 and 1997, the sub-prime market was a niche market with almost no growth at all. Before 1994, it practically didn't exist as a market. There were only a few isolated areas that had them.

In 1997, the market increased dramatically. That was the start.

"Well I'm a dumb leftard, and clear evidence isn't enough for me!"

Ok ok ok...... When did the price bubble start? When did housing prices, due to the drastic increase in sub-prime loans, start raising from the additional demand?

Looky there.... 1997. Can't see that? Let me blow it up for you.

Look at that.... 1997.

So the sub-prime mortgage market shoots off in 1997, and we see clearly that housing prices began their march up into oblivion, in 1997. Both of these are established facts.

You want to debate Yale economist Robert Shiller, go for it. But until you have some counter evidence to his, I'm going with the Yale economist over doofus on the internet with an opinion.

So then we have to ask... what the crap happened in 1997 to 1998? Because clearly something did happen, and I highly doubt it was 'greed'. You are telling me that before 1997, all the bankers were altruistic, and then magically 'poof' became greedy in 1997? And I don't buy the idea they were all sitting around one night after too many beers, and all spontaneously said "Hey, lets engage in super risky loans, and ask the government to bail us out when we crash!" "yeah yeah! that's a good plan!".

So what could have happened. My theory.... carrot and stick.

First the stick.

Andrew Cuomo, Secretary of HUD, announces a successful lawsuit against a bank, for BILLIONS, to be used in CRA loans. Cuomo openly admits these loans will go to unqualified borrowers. Openly admits the default rates will be higher.

So the government is beating banks with a stick to make exactly the kind of loans that caused the crash.

Now the carrot.

First Union Capital Markets Corp. Bear Stearns Co. Price Securities Offering... -- re CHARLOTTE N.C. Oct. 20 PRNewswire --

First Union Capital Markets Corp.

and Bear, Stearns & Co. Inc. have priced a $384.6 million offering of

securities backed by Community Reinvestment Act (CRA) loans - marking the

industry's first public securitization of CRA loans.

The $384.6 million in senior certificates are guaranteed by Freddie Mac

and have an implied "AAA" rating. First Union Capital Markets Corp. is the

investment banking subsidiary of First Union Corporation (NYSE: FTU).

Let's review. First Union became Wachovia. So Wachovia and Bear Stearns, two of the biggest early crashes during the bubble burst, agreed in 1997, to have Freddie Mac, guarantee, with a AAA rating, CRA loans.

You think that might motivate banks to make bad loans, when the Federal Government is guaranteeing them?

This is what crashed the economy in 2008.

The boost to the housing market in '97, that you're referring to, came from CRA loans after Clinton modified the law. It is well documented that CRA loans comprised just a small percentage of the toxic loans which crashed the real estate market and was not the problem. The problem began in the early 2000's after the federal fund rate was lowered to 2%, and then to 1%, and Bush guaranteed any loans given to folks who now qualified for a loan because of the super low interest rates and the waiving of a down payment. That's why the chart I showed demonstrates at that point, the vast majority of loans were subprime mortgages.

But again... before this happened in 1997, there was no sub-prime market. Look at the data. Very clearly you can see that prior to 1997, the sub-prime, which included all CRA and non-CRA sub-prime loans, was a tiny tiny niche market.

Then after 1997, the market shot off.

And as much as you want to claim that the "the problem began in the early 2000", that doesn't jive with the data. The housing bubble CLEARLY started in 1997.

Now until you can come up with some rational explanation of how a policy change in 2004, created a price bubble that started in 1997, you really don't have an argument.... if you are honest.

Let's not forget the bubble inside the bubble aka. the dot com boom.

Andylusion

Platinum Member

CRA loans required lenders to provide a certain number of loans to minorities. The vast majority of toxic loans, some 94%, we're not CRA loans. They were loans given voluntarily by lenders because they knew the loans were guaranteed even if the borrower couldn't pay them back. Time and time again, it's been shown that the CRA, while some of those loans did go bad, was not the cause of the crash. Greed, opportunity, and the perfect conditions to allow it to happen were the cause.The CRA had everything to do with the bubble, and the evidence shows as much.

But here's the problem.... At the *END* of the bubble, yes the vast majority of sub-prime loans were not CRA loans. That's true. You have the aspect correct.

But, at the start... at the very beginning, nearly ALL sub-primes were CRA loans. Go look it up.

What happened?

Sub-prime loans have existed for decades. They existed in the 70s. They existed in the 80s. They existed in the 90s.

There is absolute zero explanation for why sub-prime loans didn't explode the market in the 1970-90s, and yet did after 1997.

Was there no greed in the 1970-90s? Did martian men with greed guns come down and zap all the bankers?

Was there no opportunity? Of course there was. There was zero legal restriction on making sub-prime loans, and bundling them in MBS, and selling them.

And I have read reports by the rating agencies, (don't remember which agency wrote it), saying the reason they never rated sub-prime loans before 1997, was because they were too risky.

Now your theory is, that all of a sudden in ONE YEAR... all the bankers and mortgage brokers, and lender, and rating agencies, all together at the exact same time, after saying for decades sub-prime mortgages were far too risky, magically decided that Sub-prime was not risky, and everyone together throughout the entire country, started making them, bundling them in MBS, rating them as safe, and selling them, and buy them on the market.

Really? Think about what you are suggesting. You telling me that for no reason, no rational explanation, the entire industry which I guess had been running altruistically for decades, caught the greed virus, and all of them in one swoop starting making sub-prime loans.

To me that is not a supportable, or logical position. Something had to cause the market to shift. That something, had to have happened in 1997, and that something had to be large enough, and with enough authority to cause the market to move.

Bubba Joe's Mortgage Shack, would never have the pull to make that move in the market. They'd be laughed at and ignored.

Only the government, and only the GSEs, Fannie and Freddie have that kind of pull and authority in the market.

And again... we know that in 1997 Freddie Mac guaranteed sub-prime loans.

I believe that is the only logical, and conicidentally time frame accurate event to cause the change.

If you have another credible theory, I'd love to see your evidence.

Now back to CRA loans.

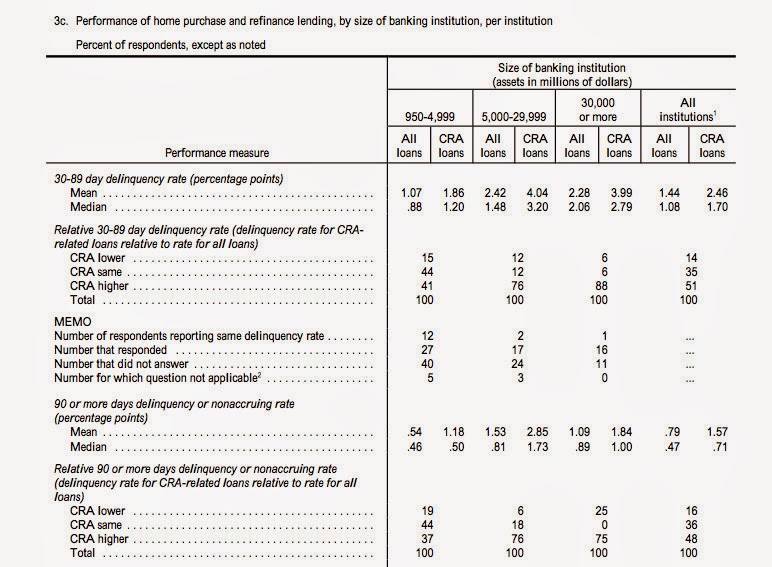

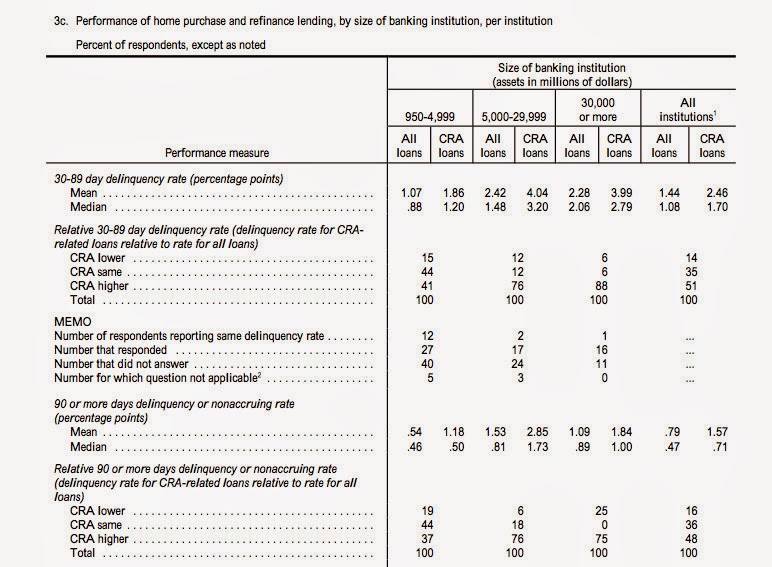

Regardless of what percentage of the total of all bad loans, were CRA loans.... the fact is, CRA loans were terrible. They were bad sub-prime loans. All the data shows this.

In every single category, in every single institution, CRA loans had nearly double the delinquency rate, and default rate of Prime-Rate loans.

Defending the Community Reinvestment Act, is like saying the poison from this particular source is ok, because some other source gave a larger dose of poison.

No, that's a fail. You are wrong if that's the position you are taking. It's still poison, those loans were still bad, and they directly contributed to the crash of the system.

Andylusion

Platinum Member

It comes from Bush, for one, who started asking Congress around 2003 to add oversight of the GSEs to prevent the meltdown we incurred by not having such oversight.Again... there is ZERO evidence of "insufficient oversight". Where do you even come up with that? Have you look at how many regulations there are on banks? What bank anywhere, didn't have oversight? We have more controls and regulations on our banks than anywhere else in the world.

New Agency Proposed to Oversee Freddie Mac and Fannie Mae

The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.

Under the plan, disclosed at a Congressional hearing today, a new agency would be created within the Treasury Department to assume supervision of Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry.

You appear to me, to be contradicting your previous post. Maybe I'm misunderstanding.

In this one you seem to be saying we need more control over GSEs to prevent a future crash... implication... the GSEs caused the prior crash (which I agree with).

Yet in the prior post, you indicated that the GSEs were not the cause. That it was 'greed' that caused the problem.

Perhaps you should clarify your position.

That said, the problem the Bush proposal was designed to deal with, had nothing to do with sub-prime mortgages, or a melt down, and nor could it anyway.

Once a bubble is created, there is no other outcome, but a crash. There is no way to 'deflate' the bubble and prevent a 'pop'.

As the data from the Yale Economist shows, the Bubble started in 1997. By 2003, it was way way way way too late to do anything about it. It was going to grow, and pop, and crash. There is no policy, or alternative regulation that could be created at that point to stop the inevitable.

The problem that the 2003 Bush proposal was supposed to deal with, was something far simpler. Fannie and Freddie were fudging their accounting numbers to trigger bonuses for their management. OFHEO, is the regulatory agency that was designed to do oversight on Freddie and Fannie.

Now there is a question as to whether (depending on what source you believe), the accounting scandal was discovered by the SEC or OFHEO. Regardless the scandal was in fact caught. Suggesting again, that there in fact WAS regulation over the GSEs.

The issue was that OFHEO couldn't do anything without congressional help, which wasn't fourth coming until the congressional investigation of 2004. And the reason of course, was that Franklin Raines, was appointed by Clinton over Fannie, and the Democrats were avid supporters (and profit takers from Fannie), and defended Fannie until the bitter end. To that end, they hindered OFHEO at every turn.

Bush wanted a more powerful oversight on the GSEs. But the key there is, this oversight wasn't over the rest of the entire banking system, just as OFHEO wasn't over the rest of the banks either. It was just a regulatory agency over only the two GSEs, Freddie and Fannie.

My point to you is this... More regulations, more oversight, would not have stopped anything, and nor will it in the future.

Why? Because Freddie and Fannie were specifically directed to promote more home ownership, by lowering their standards. The scandal, and congressional investigation of 2004, didn't even mention the increase in defaulting loans, or the sub-prime loans, or the Alt-A loans, or the AAA rated bad loans. Their issue was the accounting errors and cooked numbers, that gave Raines and other executives big bonuses.

Again, if there was a lack of oversight, then how did they find those cooked books and bad accounting? Because there was oversight. There was always oversight.

Faun

Diamond Member

- Nov 14, 2011

- 124,337

- 80,982

- 2,635

Your analogy is completely off. A more accurate analogy would be the first poison didn't hurt but the second poison killed and here you are blaming the first poison for the death.CRA loans required lenders to provide a certain number of loans to minorities. The vast majority of toxic loans, some 94%, we're not CRA loans. They were loans given voluntarily by lenders because they knew the loans were guaranteed even if the borrower couldn't pay them back. Time and time again, it's been shown that the CRA, while some of those loans did go bad, was not the cause of the crash. Greed, opportunity, and the perfect conditions to allow it to happen were the cause.The CRA had everything to do with the bubble, and the evidence shows as much.

But here's the problem.... At the *END* of the bubble, yes the vast majority of sub-prime loans were not CRA loans. That's true. You have the aspect correct.

But, at the start... at the very beginning, nearly ALL sub-primes were CRA loans. Go look it up.

What happened?

Sub-prime loans have existed for decades. They existed in the 70s. They existed in the 80s. They existed in the 90s.

There is absolute zero explanation for why sub-prime loans didn't explode the market in the 1970-90s, and yet did after 1997.

Was there no greed in the 1970-90s? Did martian men with greed guns come down and zap all the bankers?

Was there no opportunity? Of course there was. There was zero legal restriction on making sub-prime loans, and bundling them in MBS, and selling them.

And I have read reports by the rating agencies, (don't remember which agency wrote it), saying the reason they never rated sub-prime loans before 1997, was because they were too risky.

Now your theory is, that all of a sudden in ONE YEAR... all the bankers and mortgage brokers, and lender, and rating agencies, all together at the exact same time, after saying for decades sub-prime mortgages were far too risky, magically decided that Sub-prime was not risky, and everyone together throughout the entire country, started making them, bundling them in MBS, rating them as safe, and selling them, and buy them on the market.

Really? Think about what you are suggesting. You telling me that for no reason, no rational explanation, the entire industry which I guess had been running altruistically for decades, caught the greed virus, and all of them in one swoop starting making sub-prime loans.

To me that is not a supportable, or logical position. Something had to cause the market to shift. That something, had to have happened in 1997, and that something had to be large enough, and with enough authority to cause the market to move.

Bubba Joe's Mortgage Shack, would never have the pull to make that move in the market. They'd be laughed at and ignored.

Only the government, and only the GSEs, Fannie and Freddie have that kind of pull and authority in the market.

And again... we know that in 1997 Freddie Mac guaranteed sub-prime loans.

I believe that is the only logical, and conicidentally time frame accurate event to cause the change.

If you have another credible theory, I'd love to see your evidence.

Now back to CRA loans.

Regardless of what percentage of the total of all bad loans, were CRA loans.... the fact is, CRA loans were terrible. They were bad sub-prime loans. All the data shows this.

In every single category, in every single institution, CRA loans had nearly double the delinquency rate, and default rate of Prime-Rate loans.

Defending the Community Reinvestment Act, is like saying the poison from this particular source is ok, because some other source gave a larger dose of poison.

No, that's a fail. You are wrong if that's the position you are taking. It's still poison, those loans were still bad, and they directly contributed to the crash of the system.

CRA loans were only 6% of the toxic loans which crashed the economy. It doesn't matter how many were written in comparison with the rest since no matter how you slice it and dice it, CRA loans will forever remain just 6% of the total bad loans. CRA loans did not crash the economy. Had we not had the other 94% of toxic loans written, the markets could have easily absorbed that 6% and barely felt it. It was the 94% of toxic loans which crashed the economy. And that started in the early 2000's when the federal fund rate dropped to 2% and then 1%.

Faun

Diamond Member

- Nov 14, 2011

- 124,337

- 80,982

- 2,635

You're completely off base again. I included GSEs as part of the equation for why the system crashed. And yes, more oversight was absolutely needed. That's why, as indicated above, Bush was asking Congress for more.It comes from Bush, for one, who started asking Congress around 2003 to add oversight of the GSEs to prevent the meltdown we incurred by not having such oversight.Again... there is ZERO evidence of "insufficient oversight". Where do you even come up with that? Have you look at how many regulations there are on banks? What bank anywhere, didn't have oversight? We have more controls and regulations on our banks than anywhere else in the world.

New Agency Proposed to Oversee Freddie Mac and Fannie Mae

The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.

Under the plan, disclosed at a Congressional hearing today, a new agency would be created within the Treasury Department to assume supervision of Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry.

You appear to me, to be contradicting your previous post. Maybe I'm misunderstanding.

In this one you seem to be saying we need more control over GSEs to prevent a future crash... implication... the GSEs caused the prior crash (which I agree with).

Yet in the prior post, you indicated that the GSEs were not the cause. That it was 'greed' that caused the problem.

Perhaps you should clarify your position.

That said, the problem the Bush proposal was designed to deal with, had nothing to do with sub-prime mortgages, or a melt down, and nor could it anyway.

Once a bubble is created, there is no other outcome, but a crash. There is no way to 'deflate' the bubble and prevent a 'pop'.

As the data from the Yale Economist shows, the Bubble started in 1997. By 2003, it was way way way way too late to do anything about it. It was going to grow, and pop, and crash. There is no policy, or alternative regulation that could be created at that point to stop the inevitable.

The problem that the 2003 Bush proposal was supposed to deal with, was something far simpler. Fannie and Freddie were fudging their accounting numbers to trigger bonuses for their management. OFHEO, is the regulatory agency that was designed to do oversight on Freddie and Fannie.

Now there is a question as to whether (depending on what source you believe), the accounting scandal was discovered by the SEC or OFHEO. Regardless the scandal was in fact caught. Suggesting again, that there in fact WAS regulation over the GSEs.

The issue was that OFHEO couldn't do anything without congressional help, which wasn't fourth coming until the congressional investigation of 2004. And the reason of course, was that Franklin Raines, was appointed by Clinton over Fannie, and the Democrats were avid supporters (and profit takers from Fannie), and defended Fannie until the bitter end. To that end, they hindered OFHEO at every turn.

Bush wanted a more powerful oversight on the GSEs. But the key there is, this oversight wasn't over the rest of the entire banking system, just as OFHEO wasn't over the rest of the banks either. It was just a regulatory agency over only the two GSEs, Freddie and Fannie.

My point to you is this... More regulations, more oversight, would not have stopped anything, and nor will it in the future.

Why? Because Freddie and Fannie were specifically directed to promote more home ownership, by lowering their standards. The scandal, and congressional investigation of 2004, didn't even mention the increase in defaulting loans, or the sub-prime loans, or the Alt-A loans, or the AAA rated bad loans. Their issue was the accounting errors and cooked numbers, that gave Raines and other executives big bonuses.

Again, if there was a lack of oversight, then how did they find those cooked books and bad accounting? Because there was oversight. There was always oversight.

Andylusion

Platinum Member

Your analogy is completely off. A more accurate analogy would be the first poison didn't hurt but the second poison killed and here you are blaming the first poison for the death.

CRA loans were only 6% of the toxic loans which crashed the economy. It doesn't matter how many were written in comparison with the rest since no matter how you slice it and dice it, CRA loans will forever remain just 6% of the total bad loans. CRA loans did not crash the economy. Had we not had the other 94% of toxic loans written, the markets could have easily absorbed that 6% and barely felt it. It was the 94% of toxic loans which crashed the economy. And that started in the early 2000's when the federal fund rate dropped to 2% and then 1%.

But my argument doesn't require that CRA loans be more than 6% or any percent of the market.

You are missing the point.

I don't care what the % of CRA loans were. Doesn't matter to my argument.

Yes, I already said the vast majority, or 94% of the toxic loans were not CRA loans. Still doesn't matter to my argument.

This lady over here, died in her house, because the house fell in on her. And you are saying 'well we need to build better houses'.

I'm saying, no, it was because a train crashed into it. And you say "well we need better trains".

I'm saying no, it was because the train derailed. And you say "well we need better tracks".

I'm saying no, it was because that guy who pulled the pins from the track, which caused the train to derail, which caused it to hit the house, which caused the house to fell in and kill the lady. We need to stop that guy who pulled the pins from the tracks.

And you say "No no no! There were no track pins in the house where the lady died. clearly that's not the problem. That guy is not at fault!".

You are looking at the crash, only the crash... and trying to determine what happened from only the evidence of the crash.

I'm trying to determine the ORIGINS of the crash. What was the beginning of all this, not the end.

Clearly, before 1997, do you see a huge, or even significant sub-prime market of any type? No.

So something happened in 1997, which legitimized sub-prime loans to the market.

I say, it was the CRA. Freddie Mac in 1997, guaranteed sub-prime loans, under the goals of the CRA.

Now once the Federal Government through Freddie Mac, stamped their seal of approval on sub-prime loans.... even if only a few under the direction of the CRA, the rest of the market followed.

See, what you don't seem to grasp... is that one mortgage doesn't look any different from any other mortgage. Well this is a CRA mortgage..... what's the difference? Nothing. It's loan.... for a single family home. Yeah but *THIS* loan is a CRA loan... and that loan is not. How do you tell the difference?

There is no difference. This is a mortgage, that's mortgage, they are both mortgages.

So when the government securitized a sub-prime mortgage... to the rest of the market, there was no difference. There might have been a difference to Fannie and Freddie, but the rest of the market said "Sub-prime is safe!". Freddie Mac Guaranteed a sub-prime loan, so they must be profitable.

And.... they were profitable. As the sub-prime loans drastically increased the 'qualified' buyers of homes, home values started going up in 1997, and because the values were increasing, even if the sub-prime loan defaulted, they ended up with a house worth more than the original loan.

So the market shot off. Yes, again, at the *END* of the bubble, CRA loans were a tiny fraction of all toxic loans. Doesn't matter.

What started the whole thing? CRA loans in 1997.

Sallow

The Big Bad Wolf.

- Thread starter

- #1,917

You are a lying POS.Interesting Article.

The True Story Of How One Man Shut Down American Commerce To Avoid Paying His Workers A Fair Wage ThinkProgress

And yet, for all its beauty, the town was still a mechanism to ensure his dominion over his workers. Though Pullman employees were technically under no obligation to reside in the company town, promotions were often only available to workers residing in company housing, and workers who lived elsewhere were the first to be laid off in difficult economic times. Every square inch of land in Pullman was owned by the company — workers had no option to buy their own homes — and leases permitted the company to evict a resident on just ten days notice. Thus, a worker who displeased their bosses could wind up homeless almost as quickly as they were rendered jobless.

Pullman, Illinois’ layout also reinforced a rigid hierarchy. The residential portion began at Florence Boulevard, named for Pullman’s daughter, where a dozen and a half homes housed corporate executives. Beyond the town’s most expensive residences laid hundreds of two to five family row houses for skilled workers. At the outskirts, Pullman built tenements for unskilled laborers. And overlooking all of this was the Florence Hotel, built at the beginning of Florence Boulevard, where Pullman himself could watch over his domain from a suite built for his use.

It was the closest thing that has ever existed to an American barony, with George Mortimer Pullman ensconced as its lord and master. As Harper’s warned,

the idea of Pullman is un-American. It is a nearer approach than anything the writer has seen to what appears to be the ideal of the great German Chancellor. It is not the American ideal. It is benevolent, well-wishing feudalism, which desires the happiness of the people, but in such way as shall please the authorities. One can not avoid thinking of the late Czar of Russia, Alexander II., to whom the welfare of his subjects was truly a matter of concern. He wanted them to be happy, but desired their happiness to proceed from him, in whom everything should centre.

This is a bedrock of modern conservatism.

Lying about what?

No need to soil your undies over this, either, old man.

Sallow

The Big Bad Wolf.

- Thread starter

- #1,918

S&P 500

1,998.98

+14.85 (0.75%)

Dow

17,131.97

+100.83 (0.59%)

Nasdaq

4,552.76

+33.86 (0.75%)

Crude Oil 94.82 +2.04% Gold 1,238.80 +0.03% EUR/USD 1.2959 +0.15% 10-Yr Bond 2.59 -0.08% Corn 344.00 +0.29% Copper 3.16 +2.40% Silver 18.72 +0.51% Natural Gas 4.06 +1.60% Russell 2000 1,151.19 +0.41% VIX 12.86 -8.92% BATS 1000 22,146.12 -0.17% GBP/USD 1.6272 +0.25% USD/JPY 107.1350 -0.05%

Today's numbers.

Sure looks "dismal".

1,998.98

+14.85 (0.75%)

Dow

17,131.97

+100.83 (0.59%)

Nasdaq

4,552.76

+33.86 (0.75%)

Crude Oil 94.82 +2.04% Gold 1,238.80 +0.03% EUR/USD 1.2959 +0.15% 10-Yr Bond 2.59 -0.08% Corn 344.00 +0.29% Copper 3.16 +2.40% Silver 18.72 +0.51% Natural Gas 4.06 +1.60% Russell 2000 1,151.19 +0.41% VIX 12.86 -8.92% BATS 1000 22,146.12 -0.17% GBP/USD 1.6272 +0.25% USD/JPY 107.1350 -0.05%

Today's numbers.

Sure looks "dismal".

Sallow

The Big Bad Wolf.

- Thread starter

- #1,919

Your analogy is completely off. A more accurate analogy would be the first poison didn't hurt but the second poison killed and here you are blaming the first poison for the death.

CRA loans were only 6% of the toxic loans which crashed the economy. It doesn't matter how many were written in comparison with the rest since no matter how you slice it and dice it, CRA loans will forever remain just 6% of the total bad loans. CRA loans did not crash the economy. Had we not had the other 94% of toxic loans written, the markets could have easily absorbed that 6% and barely felt it. It was the 94% of toxic loans which crashed the economy. And that started in the early 2000's when the federal fund rate dropped to 2% and then 1%.

But my argument doesn't require that CRA loans be more than 6% or any percent of the market.

You are missing the point.

I don't care what the % of CRA loans were. Doesn't matter to my argument.

Yes, I already said the vast majority, or 94% of the toxic loans were not CRA loans. Still doesn't matter to my argument.

This lady over here, died in her house, because the house fell in on her. And you are saying 'well we need to build better houses'.

I'm saying, no, it was because a train crashed into it. And you say "well we need better trains".

I'm saying no, it was because the train derailed. And you say "well we need better tracks".

I'm saying no, it was because that guy who pulled the pins from the track, which caused the train to derail, which caused it to hit the house, which caused the house to fell in and kill the lady. We need to stop that guy who pulled the pins from the tracks.

And you say "No no no! There were no track pins in the house where the lady died. clearly that's not the problem. That guy is not at fault!".

You are looking at the crash, only the crash... and trying to determine what happened from only the evidence of the crash.

I'm trying to determine the ORIGINS of the crash. What was the beginning of all this, not the end.

Clearly, before 1997, do you see a huge, or even significant sub-prime market of any type? No.

So something happened in 1997, which legitimized sub-prime loans to the market.

I say, it was the CRA. Freddie Mac in 1997, guaranteed sub-prime loans, under the goals of the CRA.

Now once the Federal Government through Freddie Mac, stamped their seal of approval on sub-prime loans.... even if only a few under the direction of the CRA, the rest of the market followed.

See, what you don't seem to grasp... is that one mortgage doesn't look any different from any other mortgage. Well this is a CRA mortgage..... what's the difference? Nothing. It's loan.... for a single family home. Yeah but *THIS* loan is a CRA loan... and that loan is not. How do you tell the difference?

There is no difference. This is a mortgage, that's mortgage, they are both mortgages.

So when the government securitized a sub-prime mortgage... to the rest of the market, there was no difference. There might have been a difference to Fannie and Freddie, but the rest of the market said "Sub-prime is safe!". Freddie Mac Guaranteed a sub-prime loan, so they must be profitable.

And.... they were profitable. As the sub-prime loans drastically increased the 'qualified' buyers of homes, home values started going up in 1997, and because the values were increasing, even if the sub-prime loan defaulted, they ended up with a house worth more than the original loan.

So the market shot off. Yes, again, at the *END* of the bubble, CRA loans were a tiny fraction of all toxic loans. Doesn't matter.

What started the whole thing? CRA loans in 1997.

This is quite possibly the most ridiculous bit of trite in this thread.

But thanks..because it was hilarious.

Similar threads

- Replies

- 16

- Views

- 1K

- Replies

- 66

- Views

- 4K

- Replies

- 203

- Views

- 15K

- Replies

- 171

- Views

- 3K

Latest Discussions

- Replies

- 2

- Views

- 3

- Replies

- 7

- Views

- 8

- Replies

- 110

- Views

- 452

Forum List

-

-

-

-

-

Political Satire 8487

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 481

-

-

-

-

-

-

-

-

-

-