The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #181

Doesn't make sense. The rich not increasing spending with tax cuts means the tax base was not broadened? Odd that someone would argue against the economy in the Reagan years. Started my business then and saw things first hand. And with Obama. I don't need someone on the internet to redefine reality.

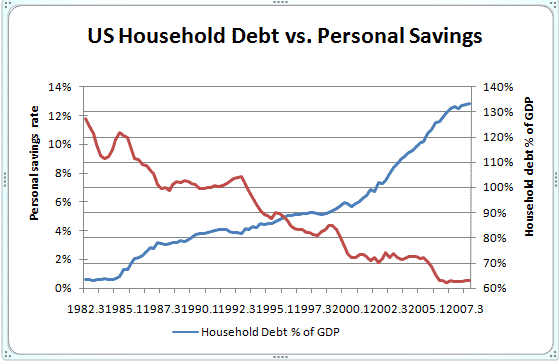

No, the rich not spending money means that cutting taxes doesn't lead to increased consumption by the wealthy. Which means the tax cuts do not pay for themselves, which is (was) the claim Conservatives (used to) make. So if you're now saying that tax cuts do not result in increased consumption to make up for the revenue gap, then they are not economic multipliers. The same thing always happens; taxes are cut, household debt skyrockets, deficits explode, debt grows. It's what happened during the Bush Tax Cuts, it's what happened in Kansas under the Brownback Tax Cuts, and it's what would happen if we tried them again.

As for your anecdote, if you are at the point in the debate where you have to submit unverifiable personal anecdotes in place of facts, then you've already lost. You wouldn't believe me if I said I was Tom Brady, so why should I believe anything you say about yourself that cannot be verified? Isn't it possible you're just saying this for the sake of your argument, even if it isn't true?