The Derp

Gold Member

- Apr 12, 2017

- 9,620

- 661

- 205

- Banned

- #141

We're not talking about growth rates.

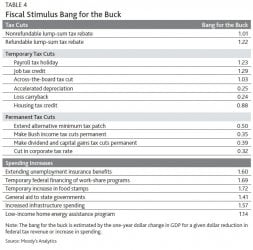

Growth rates are intrinsic to the conversation because you are making the claim that growth will happen if the wealthy are given a tax cut. That's what you are claiming when you say that tax cuts increase revenue. The theory you are pushing is that the wealthy will take the tax cut money they got and spend it in the economy. Only, that doesn't happen. As we saw in the Bush Tax Cuts, when the rate for the wealthy was cut from 39.6% to 35%, the wealthy increased their savings, not their consumption. So that undermines your argument that cutting taxes for the wealthy leads to increased spending by the wealthy.