Toddsterpatriot

Diamond Member

Yep.

The responses here really are an indictment of our public education system.

Leftist teachers unions are ruining the country.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Yep.

The responses here really are an indictment of our public education system.

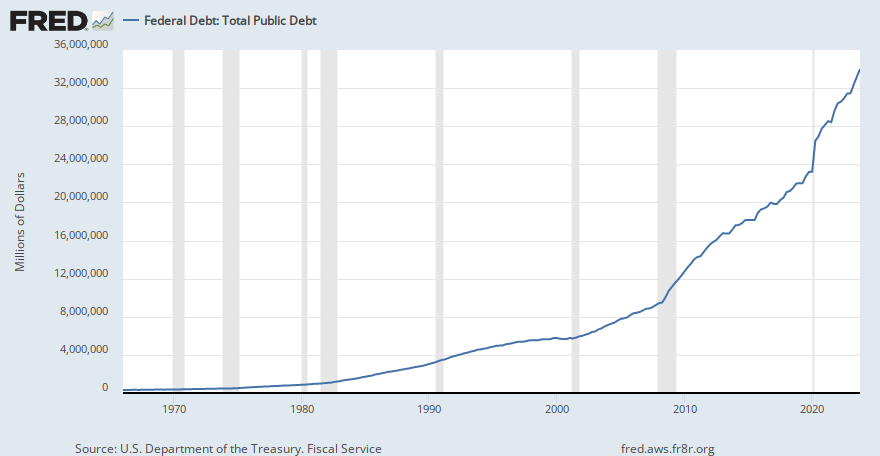

Biden is at about $6 trillion, not $8 trillion.Or Biden's $8 trillion of debt.

Each president outspends the one before. Biden will take our debt to outer space.

One of the key factors behind the recent inflation was that the Federal Reserve kept interest rates too low for too long.

In 2021, they hesitated at a crucial time, believing inflation was not a danger. They realized only after it was too late and inflation had taken off.

Fed will not raise rates on inflation fears alone, Powell says

Federal Reserve Chair Jerome Powell on Tuesday reaffirmed the U.S. central bank's intent to encourage a "broad and inclusive" recovery of the job market, and not to raise interest rates too quickly based only on the fear of coming inflation.

"We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances," Powell said in a hearing before a U.S. House of Representatives panel.

Powell fucked up. Bigly.

Now let's roll back to 2019 during a period when Trump was failing to grow the economy his promised 4 to 6 percent, despite spending like a madman to artificially juice GDP.

His solution? NEGATIVE interest rates!

Trump Calls for Fed’s ‘Boneheads’ to Slash Interest Rates Below Zero

The real bonehead in the picture was Donald Trump.

Trump railed that other countries were doing it, and so should we.

So how did that work out for those other countries?

They have worse inflation than we do.

This is exactly why we don't want populists anywhere near the monetary printing press.

Fast forward to today:

Donald Trump wants a 'say' in setting interest rates

Former President Donald Trump said Thursday that he would like a "say" in setting interest rates if he is reelected, further raising the prospect that the Republican nominee could seek to reduce the independence of the Federal Reserve if he wins in November.

"I feel the president should have at least say in there, yeah, I feel that strongly," the presidential candidate said in response to a question about the US central bank interest rate policy and the prospects of a soft landing for the US economy.

Donald Trump is once again demonstrating his ignorance and stupidity.

Ok....That's because technology has allowed more and more people to work from home, driving up office space vacancies.

Defaults are also being caused by the fact money was borrowed when interest rates were low, and refinancing is taking place in a higher interest environment.

And another factor is shopping malls and other retail spaces are imploding because of Amazon and other online retail sites.

Blaming a president for this is stupid.

Yup.

But the rubes only know what they're told.

Allowing economically ignorant populists in Congress to operate the monetary money machine would be colossally stupid.The Constitution tasks congress with setting monetary not private for profit banks.

.

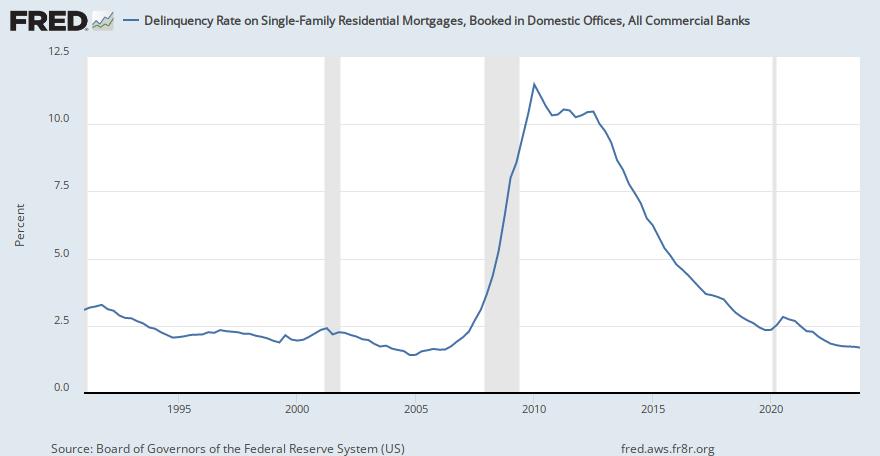

Commercial paper is not created from home mortgages.Ok....

This is a banking crisis surrounding mortgage backed securities. Commercial paper ....which is created from home mortgages.

This isn't commercial property delinquencies/defaults/repossessions which also are climbing.

Some people still believe trump is a successful businessman , he isn't. His economics professor at Wharton School ( business college , a subdivision of the U. Of Pa. ) Frank DePrima said of him , " Donald Trump was the dumbest. goddamn student I ever had. " Economics ! And he still doesn't know anything about it. FYI : He falsely gained entry into that college. He paid another student to take his entry test for him. Plus when trump says he graduated number one in his class. Another lie. He didn't even make the dean's list ( top 56 out of 366 students in the graduating class. ) One comment simply said , he was " a less than stellar student. " Half a dozen professors at Wharton recently signed a petition to investigate Trump's admittance and graduation from Wharton. The college higher ups said no ,tooi much time has passed. Wonder how much they were paid off to do that.One of the key factors behind the recent inflation was that the Federal Reserve kept interest rates too low for too long.

In 2021, they hesitated at a crucial time, believing inflation was not a danger. They realized only after it was too late and inflation had taken off.

Fed will not raise rates on inflation fears alone, Powell says

Federal Reserve Chair Jerome Powell on Tuesday reaffirmed the U.S. central bank's intent to encourage a "broad and inclusive" recovery of the job market, and not to raise interest rates too quickly based only on the fear of coming inflation.

"We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances," Powell said in a hearing before a U.S. House of Representatives panel.

Powell fucked up. Bigly.

Now let's roll back to 2019 during a period when Trump was failing to grow the economy his promised 4 to 6 percent, despite spending like a madman to artificially juice GDP.

His solution? NEGATIVE interest rates!

Trump Calls for Fed’s ‘Boneheads’ to Slash Interest Rates Below Zero

The real bonehead in the picture was Donald Trump.

Trump railed that other countries were doing it, and so should we.

So how did that work out for those other countries?

They have worse inflation than we do.

This is exactly why we don't want populists anywhere near the monetary printing press.

Fast forward to today:

Donald Trump wants a 'say' in setting interest rates

Former President Donald Trump said Thursday that he would like a "say" in setting interest rates if he is reelected, further raising the prospect that the Republican nominee could seek to reduce the independence of the Federal Reserve if he wins in November.

"I feel the president should have at least say in there, yeah, I feel that strongly," the presidential candidate said in response to a question about the US central bank interest rate policy and the prospects of a soft landing for the US economy.

Donald Trump is once again demonstrating his ignorance and stupidity.

Your chart clearly states it is for CMBS delinquencies.Ok....

This is a banking crisis surrounding mortgage backed securities. Commercial paper ....which is created from home mortgages.

This isn't commercial property delinquencies/defaults/repossessions which also are climbing.

Biden is at about $6 trillion, not $8 trillion.

I find this surprising since I expected Biden would add a lot more.

My prediction from his first year:

Trump was flat broke. The Apprentice game show saved him.Some people still believe trump is a successful businessman , he isn't. His economics professor at Wharton School ( business college , a subdivision of the U. Of Pa. ) Frank DePrima said of him , " Donald Trump was the dumbest. goddamn student I ever had. Economics ! And he still doesn't know anything about it. FYI : He falsely gained entry into that college. He paid another student to take his entry test for him. Plus when trump says he graduated number one in his class. Another lie. He didn't even make the dean's list ( top 56 out of 366 students in the graduating class. ) One comment simply said , he was " a less than stellar student. Half a dozen professors at Wharton recently signed a petition to investigate Trump's admittance and graduation from Wharton. The college higher ups said no ,tooi much time has passed. Wonder how much they were paid off to do that.

Commercial paper is not created from home mortgages.

Commercial paper are bonds issued by corporations.

Total federal debt was $28 trillion in Q1 2021.Biden is at $7.4 trillion.

Imagine how much higher he'd be without Mancin blocking him.

So the Hollywood he is always badmouthing is the Hollywood that saved his ass. Ironic.Trump was flat broke. The Apprentice game show saved him.

A distinction without much difference.Bills, not bonds.

I have some bad news for you since most Trumpers want to see America fail.Ok....

This is a banking crisis surrounding mortgage backed securities. Commercial paper ....which is created from home mortgages.

This isn't commercial property delinquencies/defaults/repossessions which also are climbing.

No, Trump doesnt want inflation, but if Kamala wins youll have your fill of it.One of the key factors behind the recent inflation was that the Federal Reserve kept interest rates too low for too long.

In 2021, they hesitated at a crucial time, believing inflation was not a danger. They realized only after it was too late and inflation had taken off.

Fed will not raise rates on inflation fears alone, Powell says

Federal Reserve Chair Jerome Powell on Tuesday reaffirmed the U.S. central bank's intent to encourage a "broad and inclusive" recovery of the job market, and not to raise interest rates too quickly based only on the fear of coming inflation.

"We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances," Powell said in a hearing before a U.S. House of Representatives panel.

Powell fucked up. Bigly.

Now let's roll back to 2019 during a period when Trump was failing to grow the economy his promised 4 to 6 percent, despite spending like a madman to artificially juice GDP.

His solution? NEGATIVE interest rates!

Trump Calls for Fed’s ‘Boneheads’ to Slash Interest Rates Below Zero

The real bonehead in the picture was Donald Trump.

Trump railed that other countries were doing it, and so should we.

So how did that work out for those other countries?

They have worse inflation than we do.

This is exactly why we don't want populists anywhere near the monetary printing press.

Fast forward to today:

Donald Trump wants a 'say' in setting interest rates

Former President Donald Trump said Thursday that he would like a "say" in setting interest rates if he is reelected, further raising the prospect that the Republican nominee could seek to reduce the independence of the Federal Reserve if he wins in November.

"I feel the president should have at least say in there, yeah, I feel that strongly," the presidential candidate said in response to a question about the US central bank interest rate policy and the prospects of a soft landing for the US economy.

Donald Trump is once again demonstrating his ignorance and stupidity.

Allowing economically ignorant populists in Congress to operate the monetary money machine would be colossally stupid.

We would have an additional hyperinflationary $30 trillion washing around our country. That's a solid guarantee.

Debt does not cause hyperinflation. It can cause inflation, but not hyperinflation.Oh, unlike what we have now? LMAO xiden is racking up 10 billion in new debt daily.

.