I agree that inflation is a lagging indicator, but I think Biden as well as Trump are responsible for it.Biden had nothing to do with inflation.

"unnecessary Govt spending"? You mean Trump's $8 trillion of debt.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump calls for politicians to control interest rates and inflation

- Thread starter bendog

- Start date

Toddsterpatriot

Diamond Member

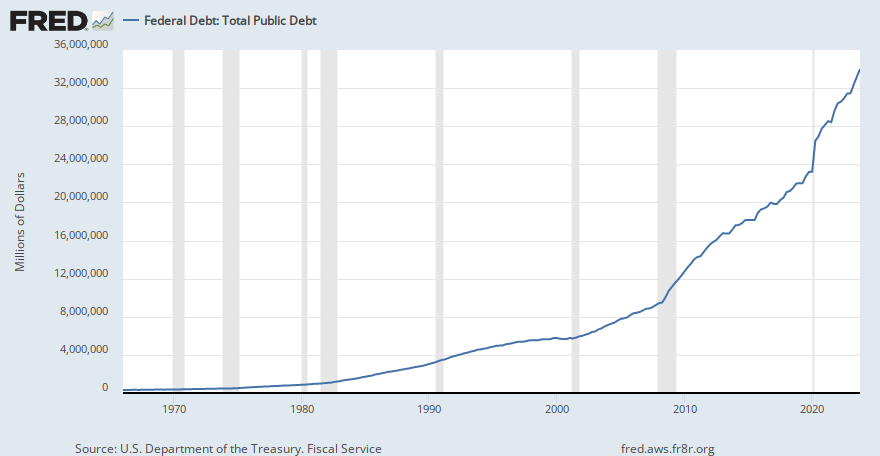

Total federal debt was $28 trillion in Q1 2021.

For Q1 2024, it stood at $34.5 trillion.

Federal Debt: Total Public Debt

Graph and download economic data for Federal Debt: Total Public Debt (GFDEBTN) from Q1 1966 to Q1 2024 about public, debt, federal, government, and USA.fred.stlouisfed.org

Debt is $35.1 trillion today.

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

I think Biden may have exacerbated it, but I put most of the exacerbation blame on the Fed for waiting to long to raise interest rates.I agree that inflation is a lagging indicator, but I think Biden as well as Trump are responsible for it.

I believe Powell even blames himself for ignoring the signals.

Lesh

Diamond Member

- Dec 21, 2016

- 70,889

- 35,497

- 2,615

Sure. Both caused it. By necessarily dumping trillions onto the economy due to Covid.I agree that inflation is a lagging indicator, but I think Biden as well as Trump are responsible for it.

It is declining nicely now

Toddsterpatriot

Diamond Member

A distinction without much difference.

The difference being most commercial paper is not backed by collateral.

CMBS, on the other hand, which is what JohnDB's chart was showing, are backed by collateral.

In any case, neither term has anything to do with homes.

The difference between weeks or months and a decade or more is kind of a big deal.

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

Yes it is. But it is not monetized. Not all of it. I think about $9 trillion is monetized the last time I looked.Debt is $35.1 trillion today.

There are some maniacs who want us to print that $35 million to pay off the debt.

kyzr

Diamond Member

Trump's Operation Warp Speed got vaccine shots in arms in 10-months, after the "experts" said it would take 4-years "if then".Of course Trump did not cause the pandemic.

He exacerbated it with his colossal stupidity.

You're welcome.

Toddsterpatriot

Diamond Member

Yes it is. But it is not monetized. Not all of it. I think about $9 trillion is monetized the last time I looked.

There are some maniacs who want us to print that $35 million to pay off the debt.

Monetized debt doesn't count as debt?

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

True. I let myself get sucked into conflating the two since JohnDB had. I should have immediately corrected him, but I was busy correcting his misapprehension about home mortgages.The difference between weeks or months and a decade or more is kind of a big deal.

Thanks for jumping in.

Toddsterpatriot

Diamond Member

True. I let myself get sucked into conflating the two since JohnDB had. I should have immediately corrected him, but I was busy correcting his misapprehension about home mortgages.

Thanks for jumping in.

Happy to correct a mistake when I see one.

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

The Fed monetizes our debt, not anyone else.Monetized debt doesn't count as debt?

And they do it during financial crises to increase liquidity.

They later demonetize it, except now our crises are coming more and more frequently.

They were at $4.5 trillion after the 2008 crash, then they demonetized down to $3.75 trillion (which is still too high IMO), and then really went crazy during Covid and increased their balance sheet to (I just looked it up) $ 9 trillion, just as I mentioned earlier.

They have since demonetized to $8 trillion.

I think where the Fed started to lose it's mind is when they began putting MBS and other Wall Street products on their balance sheet.

That was a huge bailout of our financial institutions which I have grave reservations about.

Nonetheless, not all of their monetization was federal debt.

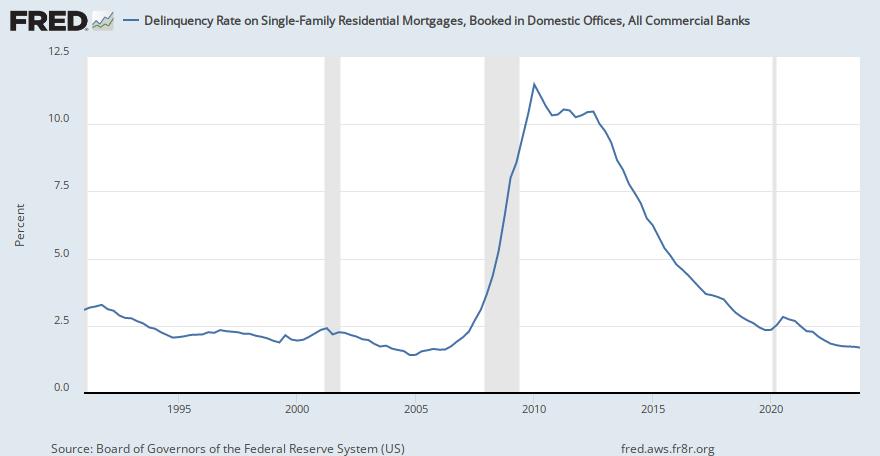

I have some bad news for you since most Trumpers want to see America fail.

Home mortgage delinquencies have been steadily declining for Biden's entire term.

Delinquency Rate on Single-Family Residential Mortgages, Booked in Domestic Offices, All Commercial Banks

Graph and download economic data for Delinquency Rate on Single-Family Residential Mortgages, Booked in Domestic Offices, All Commercial Banks (DRSFRMACBS) from Q1 1991 to Q1 2024 about domestic offices, delinquencies, 1-unit structures, mortgage, family, residential, commercial, domestic...fred.stlouisfed.org

Of course it's declining, fewer and fewer people have mortgages. The ones that do, like me are more financially stable.

.

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

Here's a chart of the Fed's balance sheet:

Recent balance sheet trends

The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov

Debt does not cause hyperinflation. It can cause inflation, but not hyperinflation.

Take a class in economics.

Mind you, no one has talked about our debt on this forum than me.

It is sickening to watch the right wing hacks convince themselves the GOP is fiscally responsible.

Well that just not true, in fact there is another thread on this very topic that was started before yours.

Search results for query: inflation

www.usmessageboard.com

www.usmessageboard.com

.

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

Wrong.Of course it's declining, fewer and fewer people have mortgages.

The home ownership rate has remained steady since the pandemic. In fact, it has been higher during Biden's term than during Trump's administration, with the exception of the pandemic spike when interest rates were the lowest in decades.

That's when I refinanced my mortgage. I have a ridiculously low rate.

See for yourself:

Homeownership Rate in the United States

Graph and download economic data for Homeownership Rate in the United States (RHORUSQ156N) from Q1 1965 to Q2 2024 about homeownership, housing, rate, and USA.

fred.stlouisfed.org

Toddsterpatriot

Diamond Member

The Fed monetizes our debt, not anyone else.

And they do it during financial crises to increase liquidity.

They later demonetize it, except now our crises are coming more and more frequently.

They were at $4.5 trillion after the 2008 crash, then they demonetized down to $3.75 trillion (which is still too high IMO), and then really went crazy during Covid and increased their balance sheet to (I just looked it up) $ 9 trillion, just as I mentioned earlier.

They have since demonetized to $8 trillion.

I think where the Fed started to lose it's mind is when they began putting MBS and other Wall Street products on their balance sheet.

That was a huge bailout of our financial institutions which I have grave reservations about.

Nonetheless, not all of their monetization was federal debt.

Monetized debt is still debt. For this topic, debt added by president, it doesn't matter.

No one knows what the future will bring BUT you can almost bet for sure no matter who wins we will have more inflation. The degree largely depends on how the world situation improves or worsens. I am concerned it's going to worsen. No one is addressing the primary problems as of yet.No, Trump doesnt want inflation, but if Kamala wins youll have your fill of it.

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

People have been buying houses all during this period of inflation. They know they can refinance when inflation goes back down.

That's exactly what my son did. Like Fed Chairman Powell, though, he waited too long despite my warnings to him to hurry.

That's exactly what my son did. Like Fed Chairman Powell, though, he waited too long despite my warnings to him to hurry.

g5000

Diamond Member

- Nov 26, 2011

- 126,122

- 69,877

- 2,605

Again, not all $35 trillion of our debt has been monetized.Monetized debt is still debt. For this topic, debt added by president, it doesn't matter.

That's why we don't have hyperinflation.

$9 trillion of debt has been monetized, but not all of it is federal debt. Some of it is Wall Street debt, but I have no idea what the ratio is. I could probably look it up somewhere.

Similar threads

- Replies

- 12

- Views

- 87

- Replies

- 28

- Views

- 348

- Replies

- 61

- Views

- 479

Latest Discussions

- Replies

- 73

- Views

- 283

- Replies

- 214

- Views

- 1K

- Replies

- 15

- Views

- 115

Forum List

-

-

-

-

-

Political Satire 8637

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 485

-

-

-

-

-

-

-

-

-

-