AntonToo

Diamond Member

- Jun 13, 2016

- 31,603

- 9,261

- 1,340

Bush would own the economic downturn in 2007 and 2008. Let's remember however that George W. Bush warned Congress that we had things going on in the housing markets that had the potential to be devastating to the economy and his concern was pooh poohed by the likes of Christopher Dodd and Barney Frank. Let's also remember that Bush is the one who set up TARP...arguably the thing that had the most positive influence on stabilizing the economy in 2008 and 2009.

How can we remember that which is a fabrication?

Bush administration NEVER recognized real estate bubble and denied problems until it became near comic.

Bush denies U.S. economy in recession

But yes, TARP was initiated under Bush, for which I give him full credit, but was also supported and administered by Obama once he was in office.

As for the ARRA? With all due respect, Antontoo...if the Obama Stimulus had worked as promised...the Obama Administration wouldn't have had to use "Jobs created and saved" to hide how few net new jobs their programs actually created.

I've asked Rshermr for weeks now to give me the economic formula that was used to determine "Jobs Saved" if it's REALLY a viable number and for weeks he's ducked answering that question. Why he's doing so is obvious...there is no such formula. They basically pulled that number out of their posteriors.

You don't understand macroeconomic limitations - there is no way to isolate ARRA effects from the rest of the economy. There is no "ACTUALLY CREATED" known because that's not something that is possible to track once you get into secondary and tertiary effects. Best we have are estimates by economists, estimates that show (unsurprisingly) that 800 billion did not simply vanish into thin air as conservatives laughably claim.

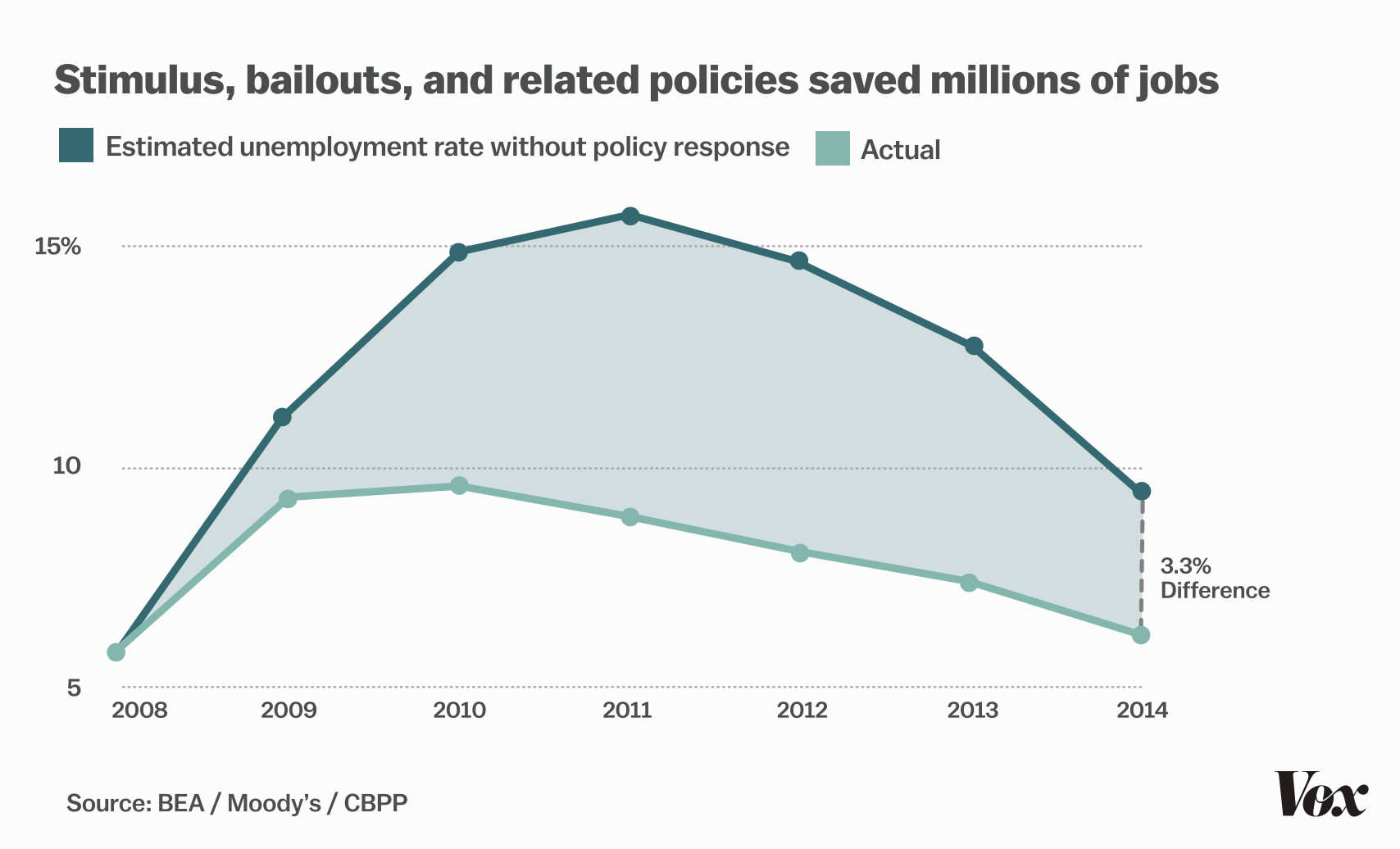

This is what unemployment would look like without ARRA TARP and QE according to some studies.

The Financial Crisis: Lessons for the Next One | Center on Budget and Policy Priorities

Setting the Record Straight: Six Years of Unheeded Warnings for GSE Reform

When

Over the past six years, the President and his Administration have not only warned of the systemic consequences of failure to reform GSEs but also put forward thoughtful plans to reduce the risk that either Fannie Mae or Freddie Mac would encounter such difficulties. In fact, it was Congress that flatly rejected President Bush's call more than five years ago to reform the GSEs. Over the years, the President's repeated attempts to reform the supervision of these entities were thwarted by the legislative maneuvering of those who emphatically denied there were problems with the GSEs.

2001

2002

- April: The Administration's FY02 budget declares that the size of Fannie Mae and Freddie Mac is "a potential problem," because "financial trouble of a large GSE could cause strong repercussions in financial markets, affecting Federally insured entities and economic activity." (2002 Budget Analytic Perspectives, pg. 142)

2003

- May: The Office of Management and Budget (OMB) calls for the disclosure and corporate governance principles contained in the President's 10-point plan for corporate responsibility to apply to Fannie Mae and Freddie Mac. (OMB Prompt Letter to OFHEO, 5/29/02)

2004

- February: The Office of Federal Housing Enterprise Oversight (OFHEO) releases a report explaining that unexpected problems at a GSE could immediately spread into financial sectors beyond the housing market.

- September: Then-Treasury Secretary John Snow testifies before the House Financial Services Committee to recommend that Congress enact "legislation to create a new Federal agency to regulate and supervise the financial activities of our housing-related government sponsored enterprises" and set prudent and appropriate minimum capital adequacy requirements.

- September: Then-House Financial Services Committee Ranking Member Barney Frank (D-MA) strongly disagrees with the Administration's assessment, saying "these two entities – Fannie Mae and Freddie Mac – are not facing any kind of financial crisis … The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing." (Stephen Labaton, "New Agency Proposed To Oversee Freddie Mac And Fannie Mae," The New York Times, 9/11/03)

- October: Senator Thomas Carper (D-DE) refuses to acknowledge any necessity for GSE reforms, saying "if it ain't broke, don't fix it." (Sen. Carper, Hearing of Senate Committee on Banking, Housing, and Urban Affairs, 10/16/03)

- November: Then-Council of the Economic Advisers (CEA) Chairman Greg Mankiw explains that any "legislation to reform GSE regulation should empower the new regulator with sufficient strength and credibility to reduce systemic risk." To reduce the potential for systemic instability, the regulator would have "broad authority to set both risk-based and minimum capital standards" and "receivership powers necessary to wind down the affairs of a troubled GSE." (N. Gregory Mankiw, Remarks At The Conference Of State Bank Supervisors State Banking Summit And Leadership, 11/6/03)

2005

- February: The President's FY05 Budget again highlights the risk posed by the explosive growth of the GSEs and their low levels of required capital and calls for creation of a new, world-class regulator: "The Administration has determined that the safety and soundness regulators of the housing GSEs lack sufficient power and stature to meet their responsibilities, and therefore … should be replaced with a new strengthened regulator." (2005 Budget Analytic Perspectives, pg. 83)

- February: Then-CEA Chairman Mankiw cautions Congress to "not take [the financial market's] strength for granted." Again, the call from the Administration was to reduce this risk by "ensuring that the housing GSEs are overseen by an effective regulator." (N. Gregory Mankiw, Op-Ed, "Keeping Fannie And Freddie's House In Order," Financial Times, 2/24/04)

- April: Rep. Frank ignores the warnings, accusing the Administration of creating an "artificial issue." At a speech to the Mortgage Bankers Association conference, Rep. Frank said "people tend to pay their mortgages. I don't think we are in any remote danger here. This focus on receivership, I think, is intended to create fears that aren't there." ("Frank: GSE Failure A Phony Issue," American Banker, 4/21/04)

- June: Then-Treasury Deputy Secretary Samuel Bodman spotlights the risk posed by the GSEs and calls for reform, saying "We do not have a world-class system of supervision of the housing government sponsored enterprises (GSEs), even though the importance of the housing financial system that the GSEs serve demands the best in supervision to ensure the long-term vitality of that system. Therefore, the Administration has called for a new, first class, regulatory supervisor for the three housing GSEs: Fannie Mae, Freddie Mac, and the Federal Home Loan Banking System." (Samuel Bodman, House Financial Services Subcommittee on Oversight and Investigations Testimony, 6/16/04)

2007

- April: Then-Secretary Snow repeats his call for GSE reform, saying "Events that have transpired since I testified before this Committee in 2003 reinforce concerns over the systemic risks posed by the GSEs and further highlight the need for real GSE reform to ensure that our housing finance system remains a strong and vibrant source of funding for expanding homeownership opportunities in America … Half-measures will only exacerbate the risks to our financial system." (Secretary John W. Snow, "Testimony Before The U.S. House Financial Services Committee," 4/13/05)

- July: Then-Minority Leader Harry Reid rejects legislation reforming GSEs, "while I favor improving oversight by our federal housing regulators to ensure safety and soundness, we cannot pass legislation that could limit Americans from owning homes and potentially harm our economy in the process." ("Dems Rip New Fannie Mae Regulatory Measure," United Press International, 7/28/05)

2008

- August: President Bush emphatically calls on Congress to pass a reform package for Fannie Mae and Freddie Mac, saying "first things first when it comes to those two institutions. Congress needs to get them reformed, get them streamlined, get them focused, and then I will consider other options." (President George W. Bush, Press Conference, the White House, 8/9/07)

- August: Senate Committee on Banking, Housing and Urban Affairs Chairman Christopher Dodd ignores the President's warnings and calls on him to "immediately reconsider his ill-advised" position. (Eric Dash, "Fannie Mae's Offer To Help Ease Credit Squeeze Is Rejected, As Critics Complain Of Opportunism," The New York Times, 8/11/07)

- December: President Bush again warns Congress of the need to pass legislation reforming GSEs, saying "These institutions provide liquidity in the mortgage market that benefits millions of homeowners, and it is vital they operate safely and operate soundly. So I've called on Congress to pass legislation that strengthens independent regulation of the GSEs – and ensures they focus on their important housing mission. The GSE reform bill passed by the House earlier this year is a good start. But the Senate has not acted. And the United States Senate needs to pass this legislation soon." (President George W. Bush, Discusses Housing, the White House, 12/6/07)

- February: Assistant Treasury Secretary David Nason reiterates the urgency of reforms, saying "A new regulatory structure for the housing GSEs is essential if these entities are to continue to perform their public mission successfully." (David Nason, Testimony On Reforming GSE Regulation, Senate Committee On Banking, Housing And Urban Affairs, 2/7/08)

- March: President Bush calls on Congress to take action and "move forward with reforms on Fannie Mae and Freddie Mac. They need to continue to modernize the FHA, as well as allow State housing agencies to issue tax-free bonds to homeowners to refinance their mortgages." (President George W. Bush, Remarks To The Economic Club Of New York, New York, NY, 3/14/08)

- April: President Bush urges Congress to pass the much needed legislation and "modernize Fannie Mae and Freddie Mac. [There are] constructive things Congress can do that will encourage the housing market to correct quickly by … helping people stay in their homes." (President George W. Bush, Meeting With Cabinet, the White House, 4/14/08)

- May: President Bush issues several pleas to Congress to pass legislation reforming Fannie Mae and Freddie Mac before the situation deteriorates further.

- "Americans are concerned about making their mortgage payments and keeping their homes. Yet Congress has failed to pass legislation I have repeatedly requested to modernize the Federal Housing Administration that will help more families stay in their homes, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow state housing agencies to issue tax-free bonds to refinance sub-prime loans." (President George W. Bush, Radio Address, 5/3/08)

- "[T]he government ought to be helping creditworthy people stay in their homes. And one way we can do that – and Congress is making progress on this – is the reform of Fannie Mae and Freddie Mac. That reform will come with a strong, independent regulator." (President George W. Bush, Meeting With The Secretary Of The Treasury, the White House, 5/19/08)

- "Congress needs to pass legislation to modernize the Federal Housing Administration, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance subprime loans." (President George W. Bush, Radio Address, 5/31/08)

- June: As foreclosure rates continued to rise in the first quarter, the President once again asks Congress to take the necessary measures to address this challenge, saying "we need to pass legislation to reform Fannie Mae and Freddie Mac." (President George W. Bush, Remarks At Swearing In Ceremony For Secretary Of Housing And Urban Development, Washington, D.C., 6/6/08)

- July: Congress heeds the President's call for action and passes reform legislation for Fannie Mae and Freddie Mac as it becomes clear that the institutions are failing.

- September: Democrats in Congress forget their previous objections to GSE reforms, as Senator Dodd questions "why weren't we doing more, why did we wait almost a year before there were any significant steps taken to try to deal with this problem? … I have a lot of questions about where was the administration over the last eight years." (Dawn Kopecki, "Fannie Mae, Freddie 'House Of Cards' Prompts Takeover," Bloomberg, 9/9/08)

Copy-pasted rightwing bullshit that has little to do with general market failures the lead to Great Recession. (No it wasn't the GSEs that "spread risk to rest of market")

Why else would his administration be talking about how they got "broadsided" by real estate collapse instead of talking about how right they were all along?

Bush administration oversaw vast loosening of banking leveraging regulations, urged GSEs in 2003 to "keep up with private market" in buying up sub-prime-backed securities, pushed "Ownership society" initiatives and advocated exotic mortgages with variable interest rates to consumers.

I'm not going to be blaming recesion on Bush, but a claim that his administration has foreseen the finance and real estate collapse and tried to do something about it, this with six years of Republican majority is a ridiculous right winger fantasy.

Last edited: