Toddsterpatriot

Diamond Member

- May 3, 2011

- 102,224

- 36,249

A contractual promise to pay is absolutely a debt.

No it isn't. I promise to give you $1 million in 10 years.

What interest rate am I paying on that "debt"?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

A contractual promise to pay is absolutely a debt.

The fed was created to prevent recessions - Bing

La recherche intelligente de Bing facilite la recherche rapide et vous récompense.www.bing.com

Crises Before and After the Creation of the Fed - San Francisco Fed

The Federal Reserve was created 100 years ago in response to the harsh recession associated with the Panic of 1907. Comparing that recession with the Great Recession of 2007–09 suggests the Fed can mitigate downturns to some extent. A statistical analysis suggests that if a central bank had...www.frbsf.org

Thanks for the links.

The Federal Reserve, the U.S. central bank, was created in 1913 to smooth out boom-and-bust cycles in the economy. It has developed a variety of methods to soften the pain of recessions,

Do you have any that back up your claim?

Look up Panic of '93.

Panics and Busts were much worse than what we go through now.

Before the Fed, booms and busts worked themselves out in less than 2 years and did not add to the national debt.

Think on that

I was an Economics Major at Queens College and I was lucky to have one of the last ever Chicago School Professors allowed to teach in NYC.

The Panic of 1893 was multiprong: US crop failures, foreign trade going sideways, currency deflation then massive silver influx, the ending of a 20 year boom cycle that caused companies to overextend, etc.

Was the Fed going to save the wheat crop?

Was the Fed going to save the wheat crop?

No. Does that mean they couldn't have shortened/lessened the '93 bust?

Not correct. It had a hell of a lot to do with pensions.And he lost $1.7 billion. Nothing to do with pensions.

I don’t care if it’s zero or, after you lose at trial, the court imposes interest on the debt Obligation. The interest rate isn’t the question. The question is whether a contractual obligation can be a debt or not. And it sure can.No it isn't. I promise to give you $1 million in 10 years.

What interest rate am I paying on that "debt"?

Before the Fed, booms and busts worked themselves out in less than 2 years

They were more frequent, deeper and lasted longer. On average.

and did not add to the national debt.

Well, shit! 110 years ago the government was a reasonable size.

Doesn't mean busts are longer and deeper today.

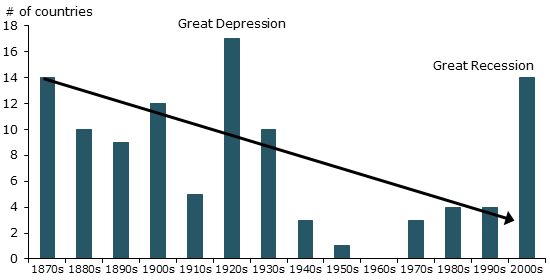

View attachment 715423

US Business Cycle Expansions and Contractions

www.nber.org

We had three in the 1860s. 58 months total.

One in the 1870s. 65 months.

Two in the 1880s. 51 months total.

FOUR!!!! in the 1890s. 63 months total.

Two in the 1900s. 36 months total.

Show me it was worse after the Fed was created.

And yeah, they fucked up big time by letting all the banks fail in the Great Depression.

| Year | Months (peak to Trough) |

1857 | 18 |

1860 | 8 |

1865 | 32 |

1869 | 18 |

1873 | 65 |

1882 | 38 |

1887 | 13 |

1890 | 10 |

1893 | 17 |

1895 | 18 |

1899 | 18 |

1902 | 23 |

1907 | 13 |

1910 | 24 |

1913 | 23 |

| AVG | 23 |

Not correct. It had a hell of a lot to do with pensions.

Twenty Years after OC Bankruptcy and $5 Billion in Pension Debt

December 6, 2014 marks the twenty-year anniversary of Orange County filing for bankruptcy. For 18 years, Orange County Treasurer Robert "Bob" Citron had |www.breitbart.com

I don’t care if it’s zero or, after you lose at trial, the court imposes interest on the debt Obligation. The interest rate isn’t the question. The question is whether a contractual obligation can be a debt or not. And it sure can.

Year Months (peak to Trough) AVG 23

Pre Fed Average peak to trough was under 2 years and national debt was a rounding error.

When were we better off??

Also, post Fed, Coolidge and Harding IGNORED Progressive dingbats and ended a bad recession in 18 months. Later, Reagan also ignore Progressive Dingbats and created a multi decade business boom adding TRILLIONS to the economy

That is pretty much the context of the links I posted.Thanks for the links.

The Federal Reserve, the U.S. central bank, was created in 1913 to smooth out boom-and-bust cycles in the economy. It has developed a variety of methods to soften the pain of recessions,

Do you have any that back up your claim?

That is pretty much the context of the links I posted.

:max_bytes(150000):strip_icc()/GettyImages-1064145406-88d3bab6a34444eaa76f4914540beae0.jpg)

Yes. It is."Smoothing out boom and bust cycles" isn't the same as "created to prevent recessions"

The booms, busts and bubbles of the business cycle are and have historically been caused by the Federal Reserve's actions.

Now we're on the verge of a crack-up boom. The stage is set for it. And it's why we're starting to see the BIS come out of the woodwork, whereas it usually prefers to keep a low profile. They know what's coming. They know that the Fed has effectively lost the ability to control the price of so-called ''money.'' And I've already mentioned previously in the thread about the underhanded reason for the sudden push by the Fed (and the BIS) to digital currency and the strategic assault on physical mediums of exchange.

:max_bytes(150000):strip_icc()/GettyImages-1064145406-88d3bab6a34444eaa76f4914540beae0.jpg)

What Is a Crack-Up Boom? Definition, History, Causes and Examples

A crack-up boom is the crash of the credit and monetary system due to continual credit expansion and price increases that cannot be sustained long-term.www.investopedia.com