Independent thinker

Diamond Member

- Oct 15, 2015

- 22,821

- 18,746

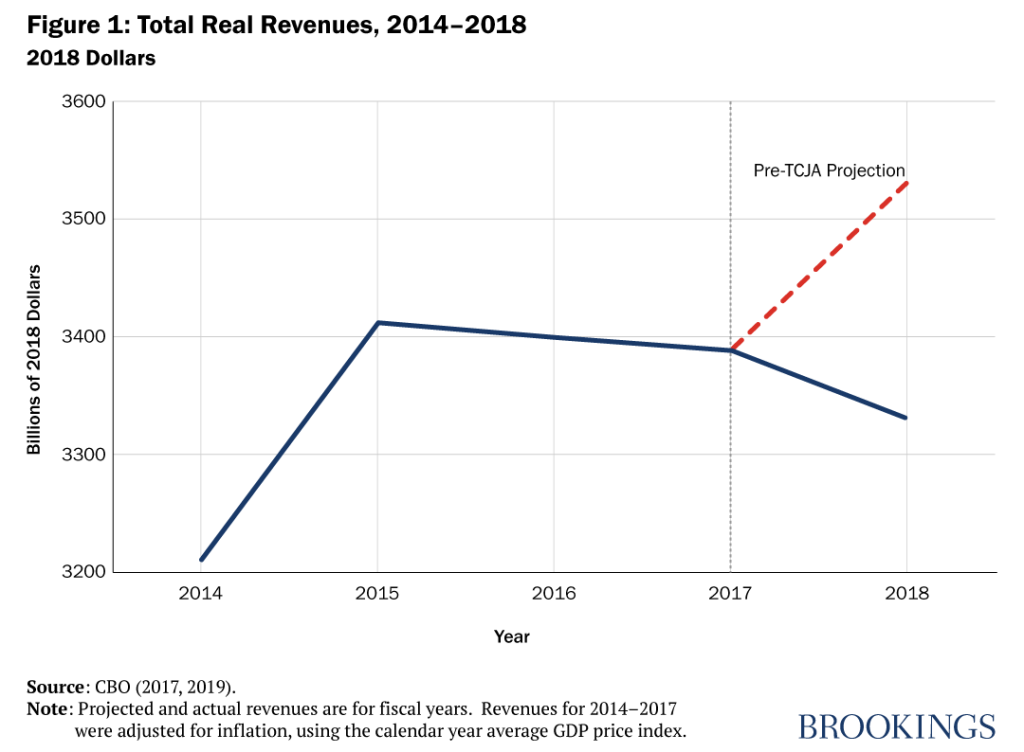

So, you're admitting that when tax cuts were done, tax receipts didn't go down and, in fact, went up. That took a real man to admit you were wrong.Tax receipts didn’t go down. That isn’t my point. My point is two fold: 1) tax receipts are going to up every year regardless of legislation unless we are in a recession. 2) tax receipts is not how you measure the value of revenue.