- Jun 12, 2010

- 103,062

- 25,524

no thanks collectivism advances underachievers (lazy ass pieces of shit) to an equal statushe poor pay less overall and the rich pay more overall and so eventually creating a smaller gap between the two in my opinion but still allowing for a relatively high standard of living for all.

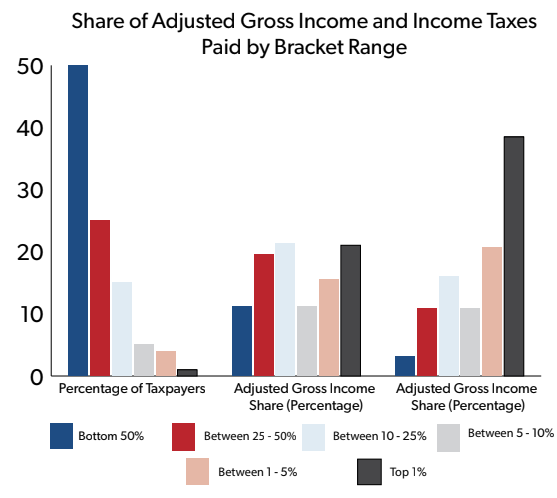

We're already there... The top 5% of wage earners pay about 65% of ALL income tax.. The bottom 50% of wage earners pay next to nothing.. How much MORE "progressive" can you get???

Who Pays Income Taxes?

The new data shows that the top 1 percent of earners (with incomes over $515,371) paid nearly 39 percent of all income taxes, up slightly from the previous tax year’s 37 percent share. The amount of taxes paid in this percentile is nearly twice as much their adjusted gross income (AGI) load.

The top 10 percent of earners bore responsibility for 70 percent of all income taxes paid – up slightly from 2016 – while half of all tax filers paid 97 percent of all income tax revenue. Indicating the degree of progressivity in the code, the bottom 50 percent of earners took home 11 percent of total nationwide income while owing 3 percent of all income taxes.

Now -- if you're saying your saying the MIDDLE class need to contribute more (and even at 25% most of them WOULD be) -- you're probably right.. Because there's 30 times MORE of them than the 1% at the top and that makes a BIGGER difference than hiking taxes on the 1%....

In the chart above,

Yes I am saying that the middle class would need to contribute more. Upwards to 25% or so. Like I said above in my previous post, all people who earn an income would pay a flat tax rate along with an addition step/progressive tax % in addition to that based on the income bracket.

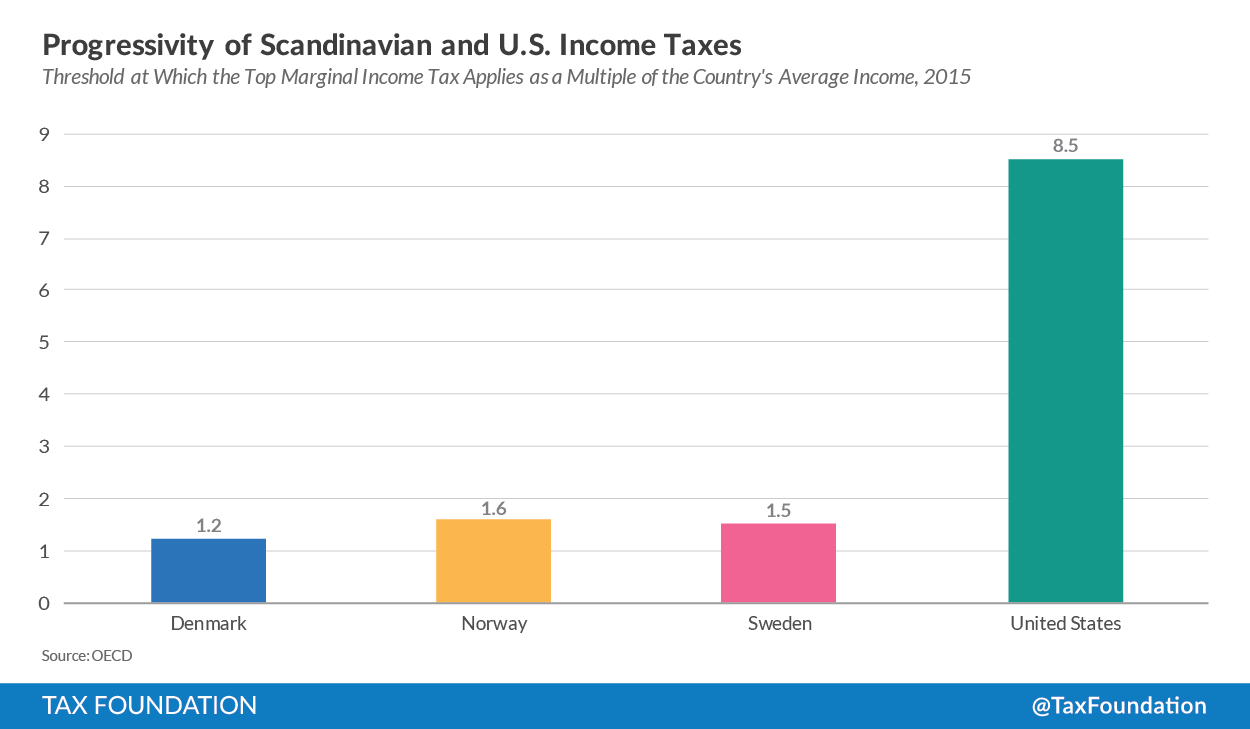

Well they'd pretty HAVE TO with all the free stuff you want to guarantee.. In even MODERATELY socialist countries the taxes on middle class, their middle class is carrying the BULK of the taxes.. Because of all the free stuff and benefits... Norway Sweden top rate is in the 50 to 60% range.. But the BIG DIFF is this.....

This chart shows WHERE that highest tax rate kicks in as a MULTIPLE of the "average income"... Folks in those moderate socialist countries get hit with the WORST BRACKET for being just 50% more than the average..

THAT better bring some REALLY REALLY REALLY good services to the middle class in return... Or there would be revolts.. Doesn't even cover their high VAT taxes..

But STILL -- you're not changing "the income gap"... Which is what you set out to do... You've just created monstrous, unfriendly, uncompassionate, one size fits all "programs" for healthcare for everyone.. But the POOR still are poor...

The only other country that I have experience living in and being part of it's culture is Norway. I can't adapt Norway's welfare state to the US exactly because of different variables but there are ways to utilize our collective wealth as a nation and create social programs that can benefit all citizens. It does work in Norway and people are generally very happy with the services for what they pay in taxation but again, the culture is different and the mindset is different which is another point I am trying to make here. We have the collective wealth generated in this country's capitalistic system to create social programs that are "free", but the American mindset is not one of doing what's best for all it's doing what's best for me, and that is the biggest barrier to any collective investment project in my opinion.

And some have to fail.. But the WINNERS all have a history of being losers.. But most eventually hit on a good or service that makes them LOTS of money.

And some have to fail.. But the WINNERS all have a history of being losers.. But most eventually hit on a good or service that makes them LOTS of money.