AntonToo

Diamond Member

- Jun 13, 2016

- 31,644

- 9,285

- 1,340

Tarp was put into play by George bush administration. Obama had nothing to do with it. More rewriting of history

Hey dummy!

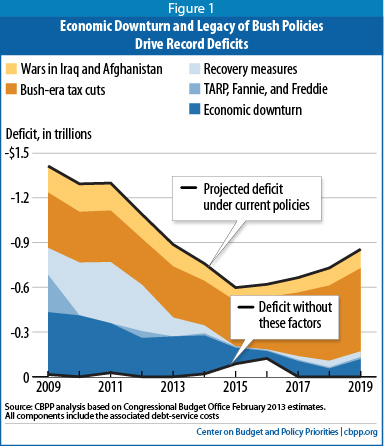

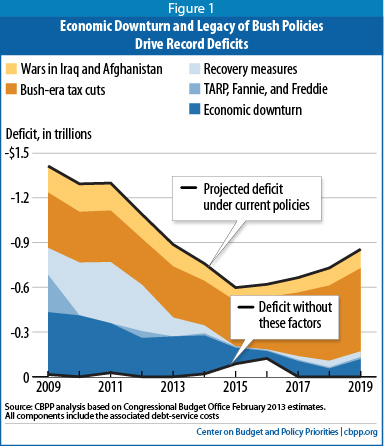

TARP's $626.4B outlay was part of GWB deficit for SURE. NO one disputes that!

BUT DUMMY Per the below.. TARP was PAID BACK WITH A $87B PROFIT TO BOOT AND IT WAS CONSIDERED REVENUE FOR OBAMA!

But did that stop Obama from running up $9 Trillion in additional debt and for WHAT???

Hey dummy! What did Obama spend 9 Trillion on?

I keep asking this simple question and there is NEVER any answer.

Why do you think that is?

Because you are full of shit